📰 THE YEET —FLOW Backed Sector PARI Showdown

Looking at diferent sectors and which can heat up or cool down--and what flow plays best with those thesis'

🧮 What PARI & slope actually mean

PARI (Price Action Risk Indicator) is our 0–100 “momentum vs risk” score.

🔥 80–100: market is hot/overextended → pullbacks common

🙂 60–79: constructive → trend continuation likely

😐 40–59: neutral → needs confirmation

🥶 0–39: weak/oversold → bounce setups possible

Slope(10) is the trajectory of PARI over ~10 days.

📈 Positive slope: momentum is building, strength compounding

📉 Negative slope: momentum fading, pullback risk rising

➡️ Flat slope: chop/digestion likely

Think of PARI as the “fuel gauge” and slope as the “gas pedal.”

High PARI + +slope = 🔥 speeding uphill (exciting but risky)

High PARI + −slope = 🚨 overheating → stalls coming

Mid PARI + +slope = 🙂 quiet accumulation

Low PARI + +slope = 🟢 bottoming attempt

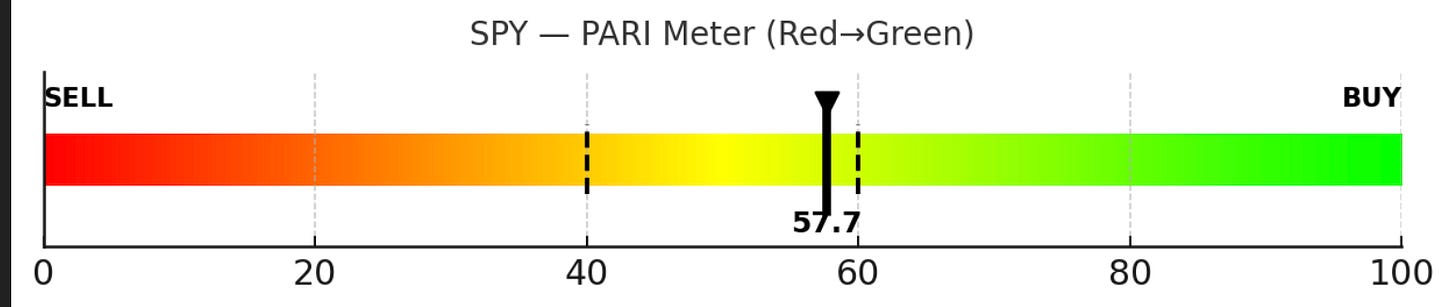

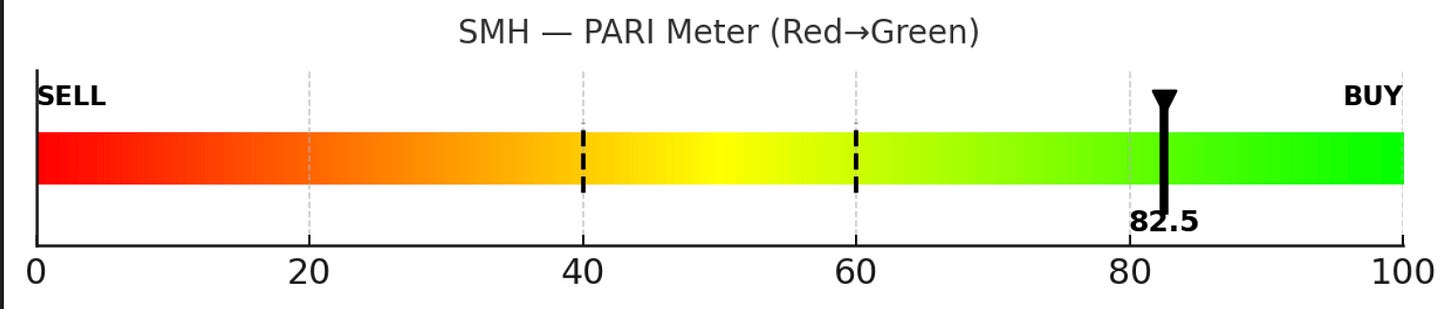

🧭 SPY — Market Compass (Baseline)

😐 Neutral regime: PARI 57.7, slope +1.1 → drifting up but not stretched

📊 10-day change: +9.1 points = constructive climb

🧰 Role: SPY is the baseline; sectors tell us where the juice is

Recommendation: 🟢 Hold / slight long — not overextended, follow leadership from chips/tech, hedge only if they crack.

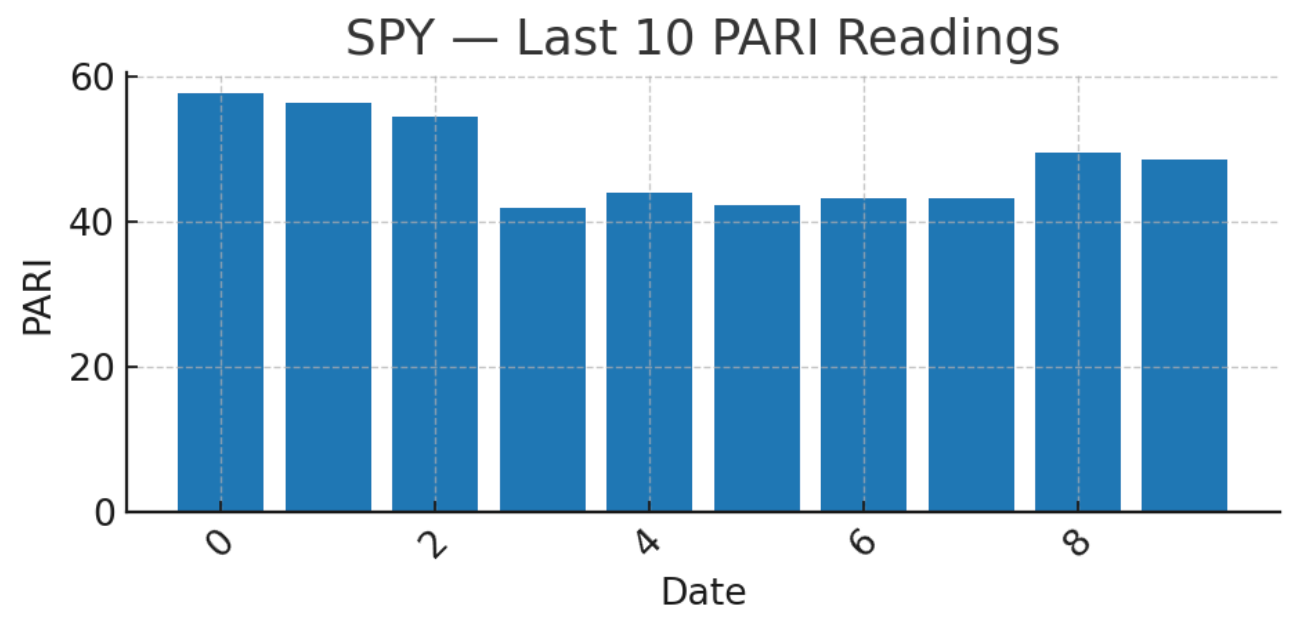

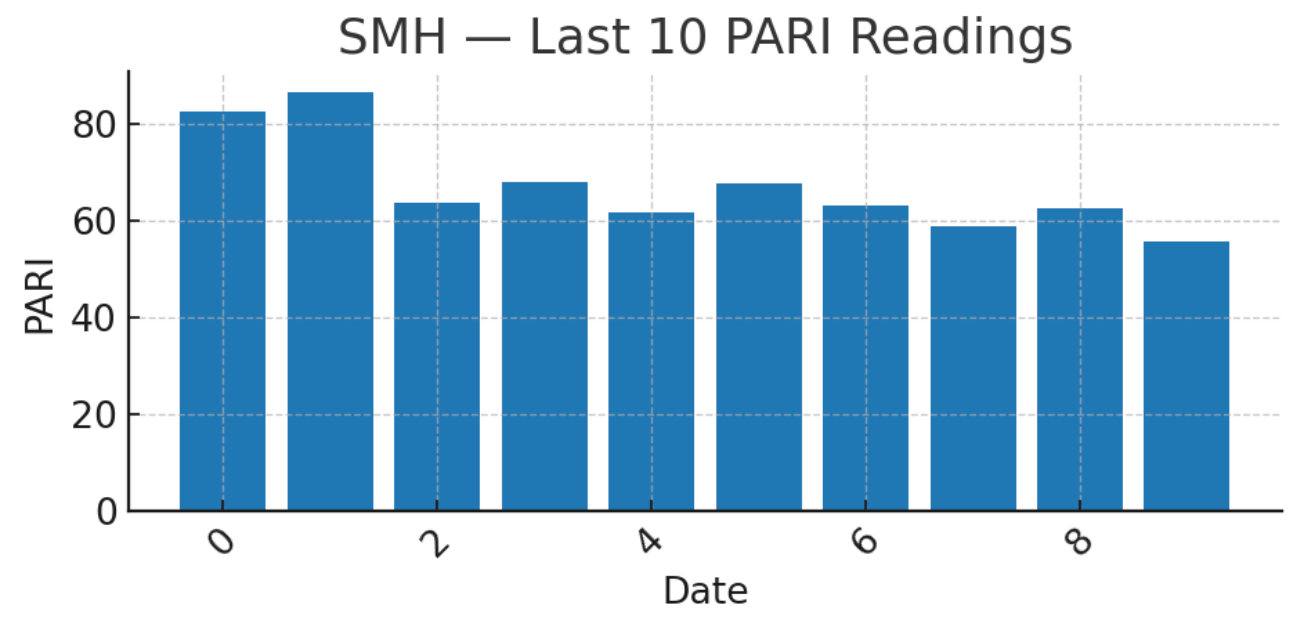

🔧 SMH — Semiconductors

🔥 Overheated: PARI 82.5, slope +2.7 = extended & crowded

📈 10-day change: +26.8 points → unsustainable pace

🚩 Overlay: big positive spread vs SPY — leaders this stretched usually snap back first

Recommendation: 🔴 Short / Trim hard — semis are too hot. Expect pullback toward mid-70s PARI. This is the most asymmetric sell opportunity in the set.

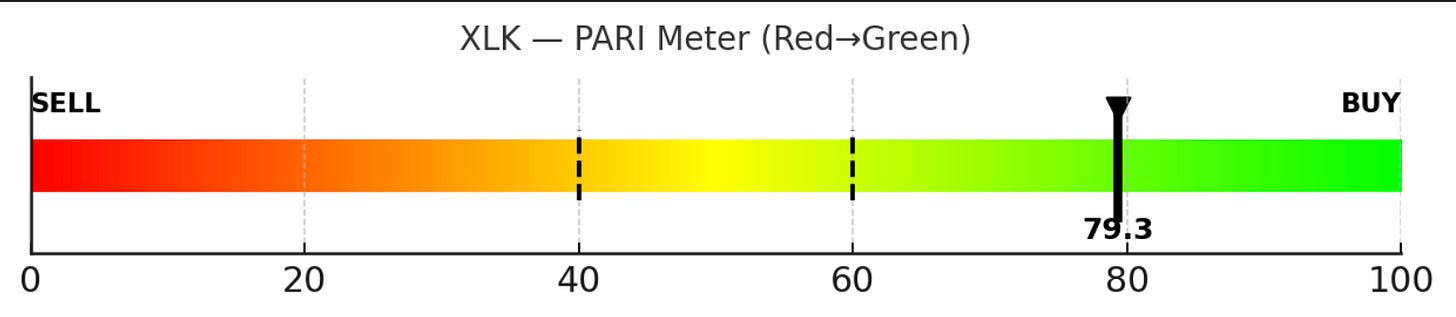

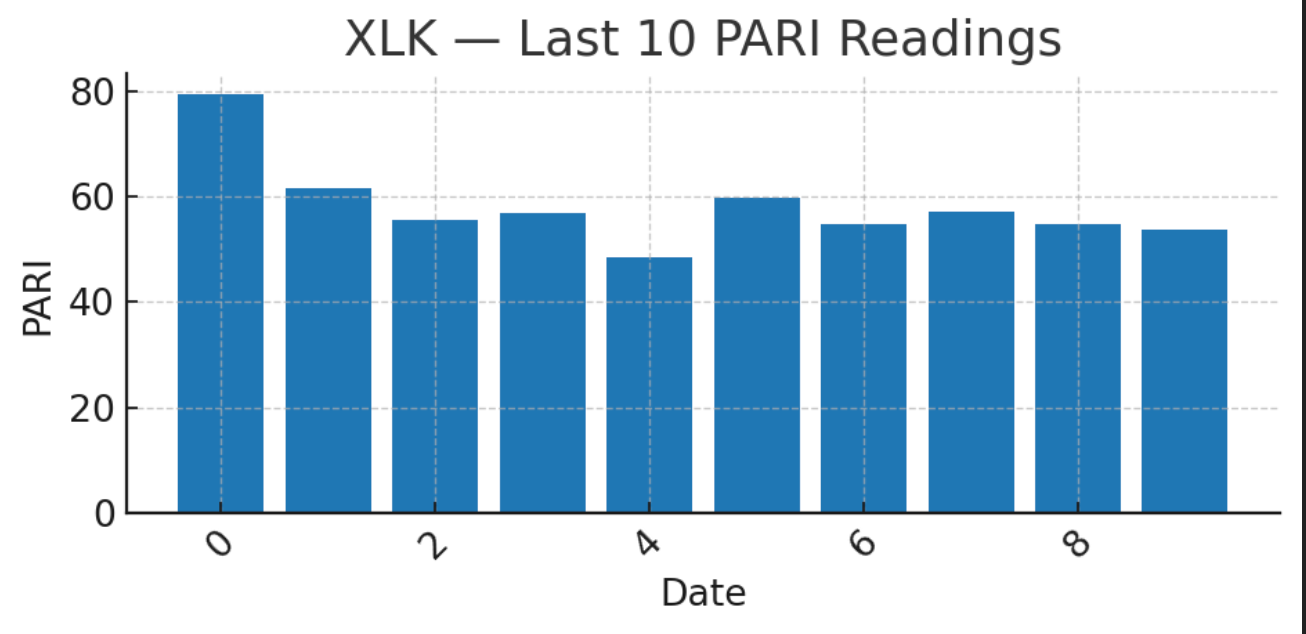

💻 XLK — Technology

🙂 Constructive (nearly hot): PARI 79.3, slope +1.6 → one step below overheated

📈 10-day change: +25.7 points → also running hard

⚠️ Overlay: leading SPY, but breadth is narrow (chip-heavy carry)

Recommendation: 🟠 Light short / Trim — less extreme than SMH, but still stretched. Expect digestion or shallow pullback before another push.

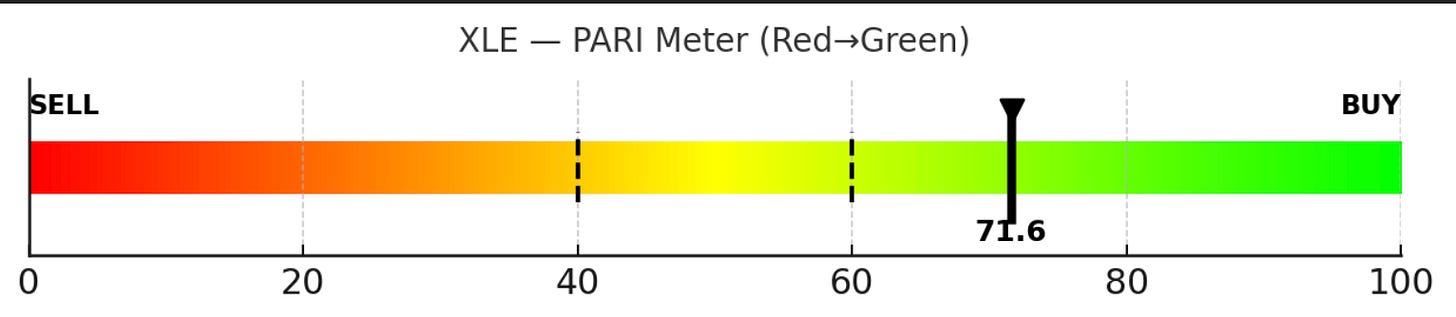

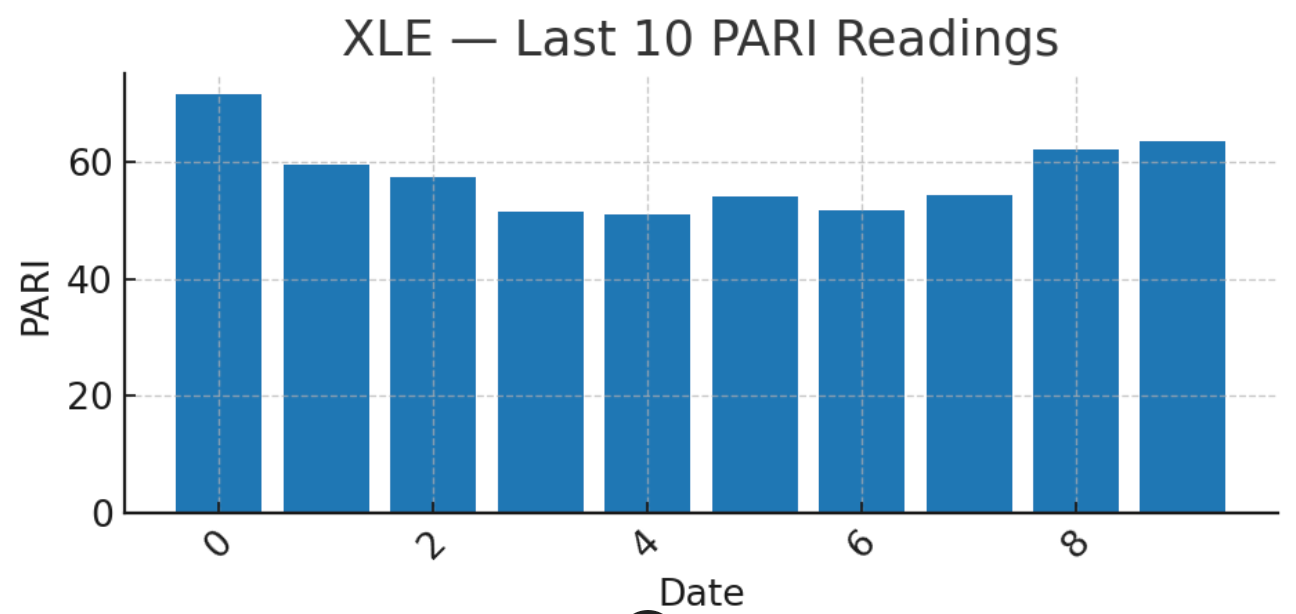

🛢️ XLE — Energy

🙂 Constructive: PARI 71.6, slope +0.4 → steady climb

📈 10-day change: +7.9 → slower, healthier pace

🟩 Overlay: near/above SPY, not euphoric → “participant, not driver”

Recommendation: 🟢 Long (buy dips) — steady trend, outperforms when growth cools. Prefer verticals/covered calls vs momentum lottos.

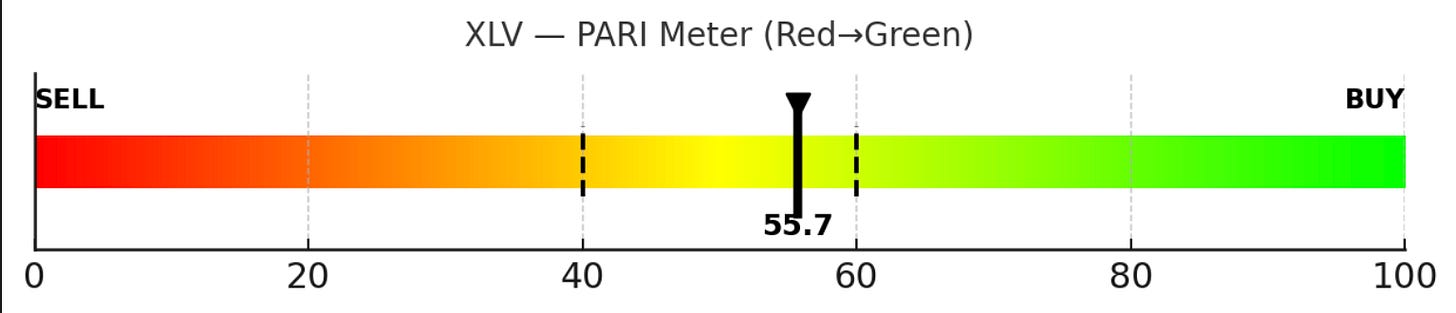

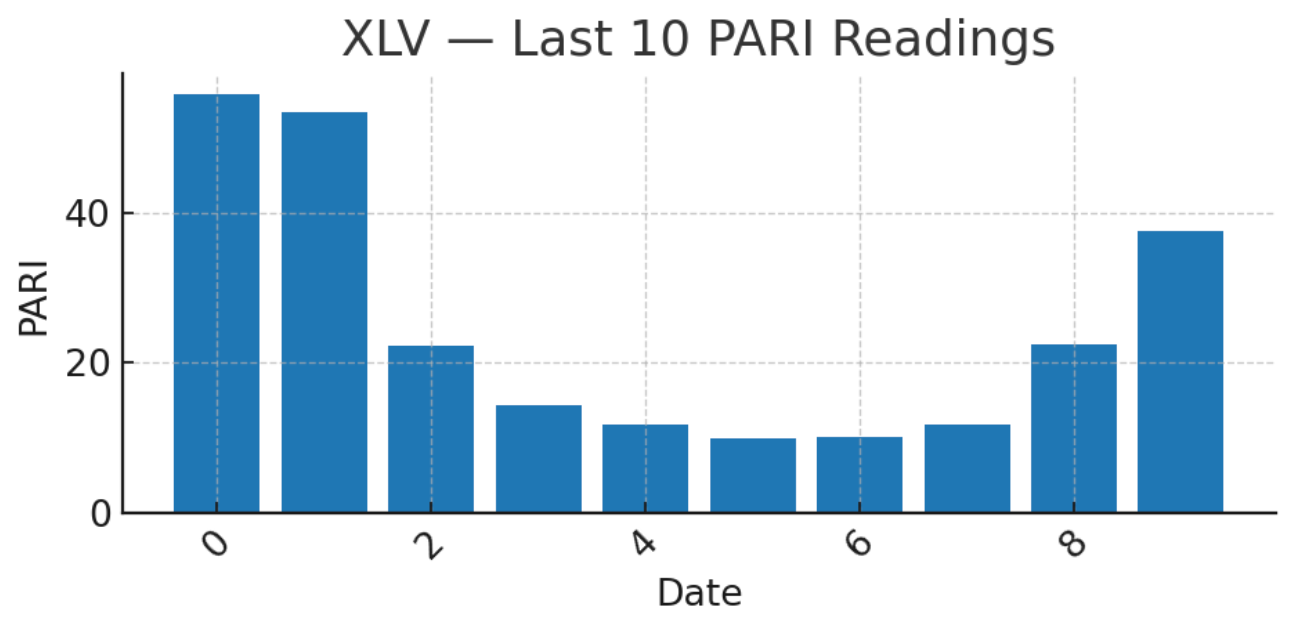

🏥 XLV — Healthcare

😐 Neutral improving: PARI 55.7, slope +2.7 → strong upward tilt from middle ground

📈 10-day change: +18.2 → big improvement off neutral base

🩹 Overlay: slightly under SPY, but with improving slope = rotation candidate

Recommendation: 🟢 Long (rotation hedge) — ideal as growth cools. Likely to outperform SPY quietly if semis/tech exhale.

📊 Bottom Line — Calls

🟢 SPY: Hold / slight long

🔴 SMH (Semis): Short / Trim hard → best near-term sell

🟠 XLK (Tech): Light short / Trim → stretched, expect digestion

🟢 XLE (Energy): Long → steady carry, dip-buy zone

🟢 XLV (Healthcare): Long → rotation play, hedge vs growth

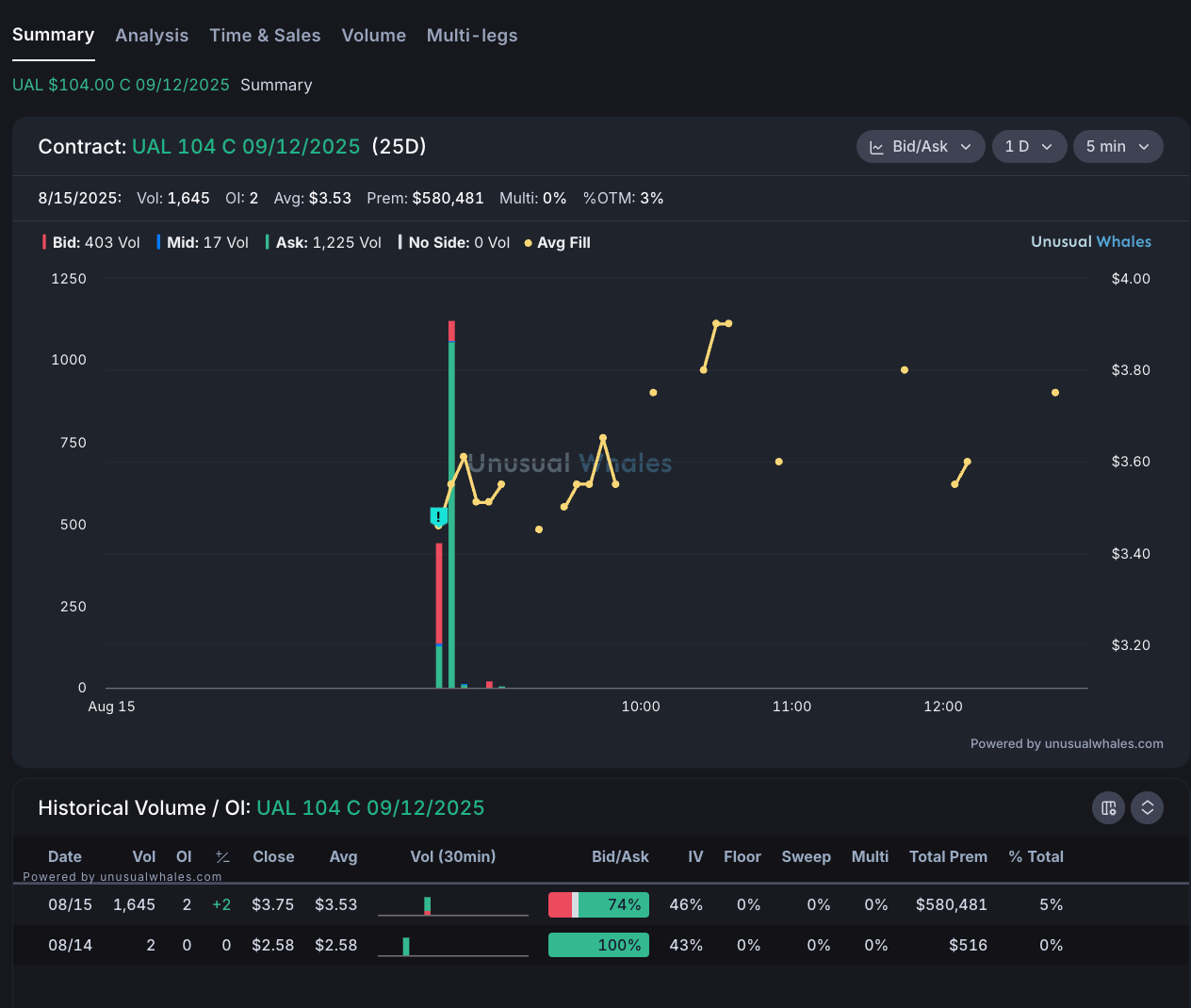

🐣Random Flow Easter Egg

UAL 104c 9/12 had over half a million in premium

🐳 PLUS: FLOW SECTION and SECTOR LEADERS

(5 Flow Selections)

AND

🔗 Overlays vs SPY — Who’s Actually Leading?

When we line each sector up against SPY’s own PARI, the spreads tell us who’s really pulling the market cart and who’s just along for the ride.