🐳 These Three Already ITM Signature Trades Have One UW Flow Factor in Common

How these gems were found is easier than you think on Unusual Whales

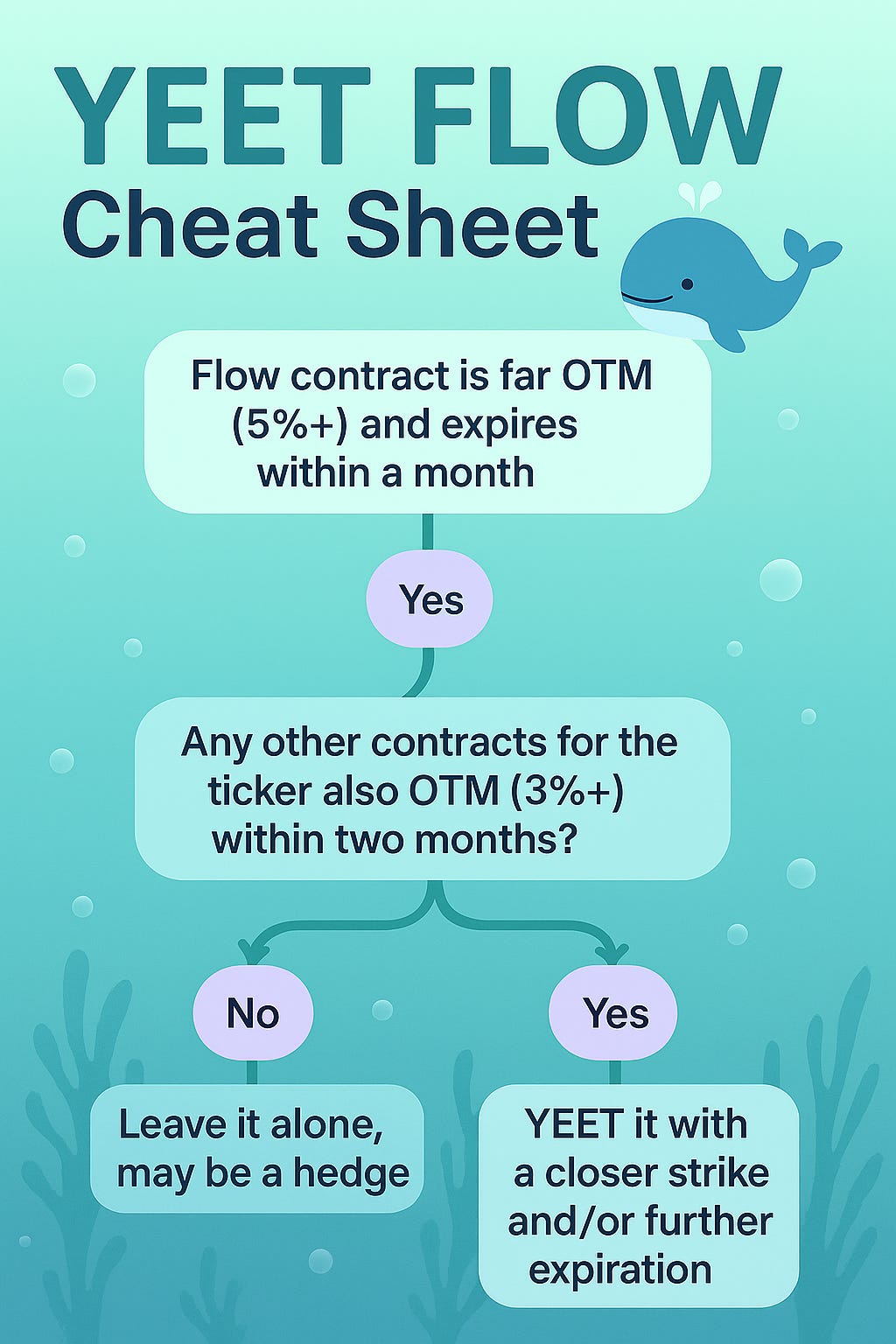

No AWS? No problem! Here’s a YEET reviewing how we hit ALL three ⭐️ trades last week for YEET Plus, AND a cheat sheet so you can start identifying these yourself.

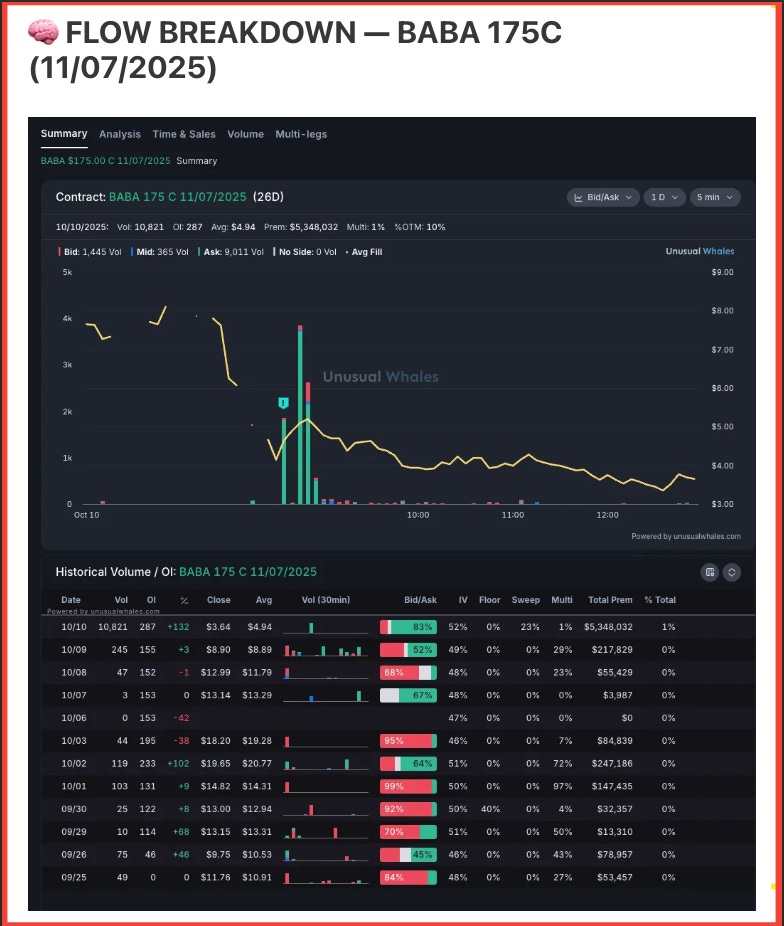

🐳 On Tuesday for YEET Plus, our second Bangers Only pick so far was BABA 170c 11/7

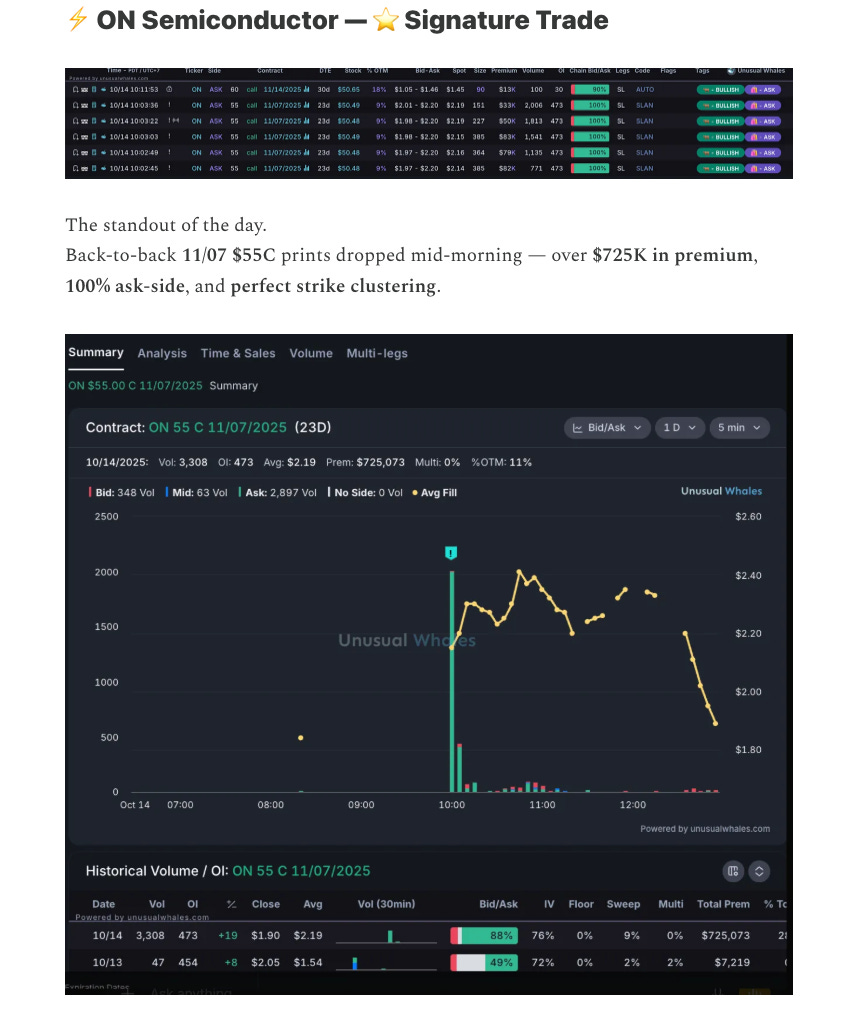

On Thursday we gave a Signature Trade: ON 55c

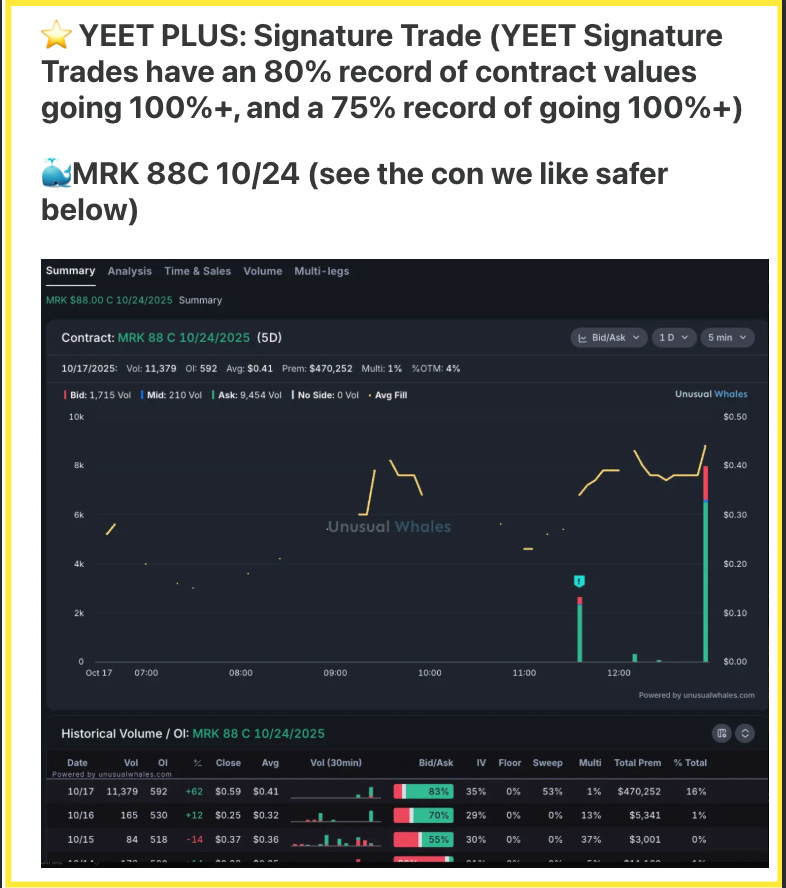

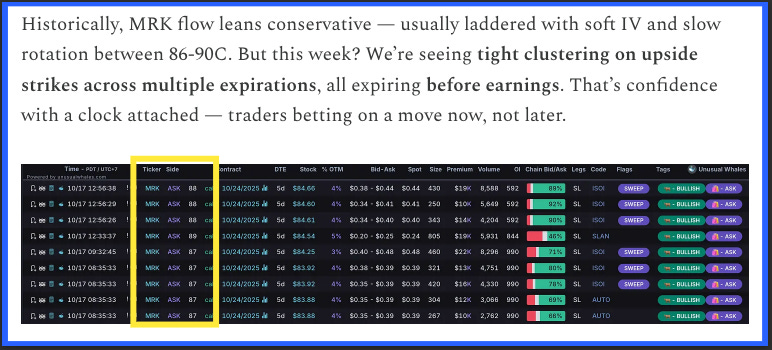

And on Friday another Signature Trade: MRK 87c 10/31

All these went in the money today, and all had one critical thing in common we keep stressing.

All three of these selections had the following:

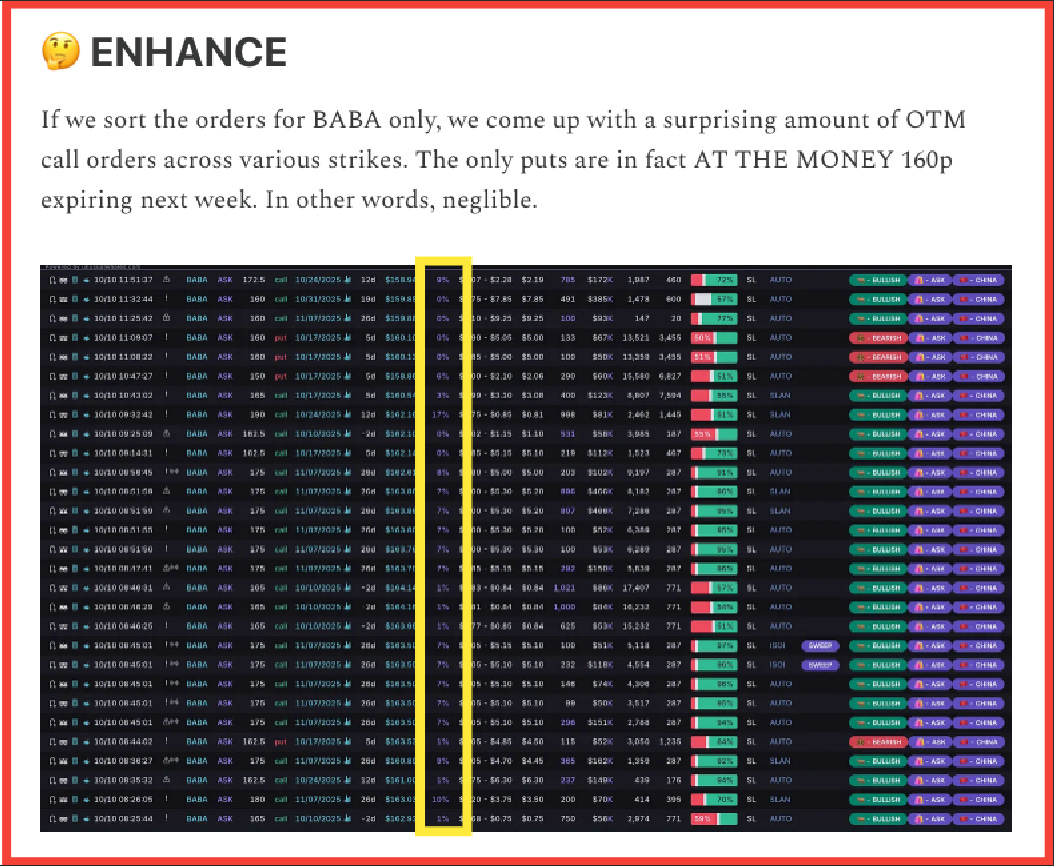

One: they hit the tape with orders we would refer to as far out the money

Two: they all had expirations not too far into the future

But those two commonalities represent the most important thing I’ve found in what seperates “interesting” flow that turns out to be a hedge from flow that makes it as a ⭐️ Signature Trade, Multibagger, Banger, whatever you want to call it…

💡They show multiple whale orders occuring within the same session or one or two days apart, on different strikes and expirations.

The reason why this is so important is that flow is, by definition, most hedges for large institutional holdings. That means 100kk green candle of orders you see for [whatever ticker it is] on its own is statistically likely to burn you. But when you see multiple orders it stops becoming a hedge, and starts looking more like confirmation.