🌌 TOMORROWLAND No. 4 (last day of Black Friday Sale!)

what do the data indicators of the YEET say is coming?

🌌 TOMORROWLAND No. 4

spy outlook • friday edition

🔥 LAST DAY OF THE YEET PLUS DISCOUNT — $99 FOR ONE YEAR

Upgrade today to lock in the lower annual rate before pricing resets.

YEET Plus gives you:

⚡ discord alerts: SPY Magic, Nautilus, Absolute YEET, Whale Consistency

📡 all YEET filters: People’s Screener Ultra, Nautilus, FarCry, Freelance Ultra, BAT Filter, Absolute YEET

🤖 automation: daily SPY engines, QQQ dashboards, flow clustering, detection models

📈 core signals: full PARI, full VISE, full Orange Swan, combined directional maps

🧠 briefings: Tomorrowland, volatility notes, after-hours flow, premarket reads

🚨 BIG SURPRISE NEXT WEEK ❗❗ (Plus-only. This one’s huge.)

Everything activates instantly the moment you join.

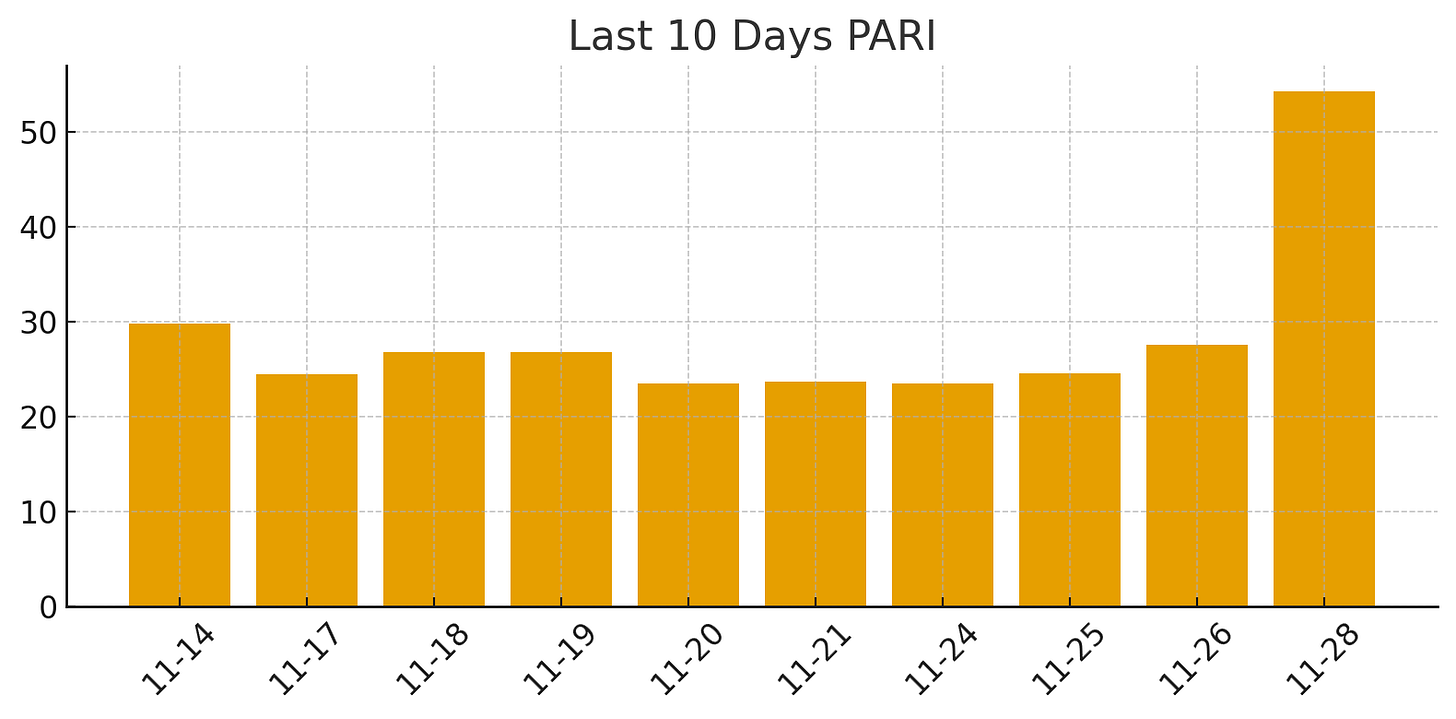

📈 PARI (daily): 54.26

PARI measures the balance between momentum and volatility—how hard price is pushing versus how much “real” volatility is underneath it. When PARI climbs, momentum is outrunning volatility, meaning the trend is strong but can become stretched. When PARI falls, volatility is overpowering momentum, signaling weakness, exhaustion, or the early stages of a reversal. It’s essentially your pressure gauge for trend strength and sustainability.

PARI spiked hard today — the strongest daily reading of the last 10 sessions.

This tells you:

the uptrend is strong

momentum is elevated

the move is stretched

buyers still dominate the daily tape

PARI measures how aggressively the trend is pushing relative to volatility. When it shoots into the 50s like today, it means the trend is running hotter than the volatility beneath it.

10-Day PARI

📉 Why VISE matters alongside PARI

PARI = trend pressure

VISE = volatility pressure

You need both to understand whether a move has fuel or is stretched.

Here’s the simple version:

When PARI is hot and VISE is also hot → trend has real power

When PARI is hot and VISE is cold → trend is stretched

When VISE hits extremely low levels → volatility must return

When volatility returns → the spark almost always comes from a fade, shakeout, or stall

Today’s VISE situation is critical — but the exact number stays behind the Plus paywall.

🔒 VISE + ORANGE SWAN ARE YEET PLUS ONLY (Plus YOLO of the Day whale contract)

Unlock below to see:

today’s real volatility compression

the full Orange Swan flow stance

the combined Tomorrowland direction map

Monday’s scenario probabilities

Whale half a million dollar FLOOR order