🪐 Tomorrowland No. 5: The Moves of Tomorrow Today (how we knew volatility would expand today)

volatility, pari, vise and how we got here

Tomorrowland No. 5

volatility, pari, vise and how we got here

Yesterday’s move was not magic, it was VISE doing its job.

For two sessions in a row VISE kept contracting, then basically sat on the floor. That is our “volatility constriction” signal. When VISE shrinks like that it tells you the market range is tightening, energy is getting bottled up, and the next move is more likely to be a bigger expansion in either direction.

Think accordion again:

📏 open accordion → wide ranges, easy movement

🫁 squeezed accordion → quiet tape, compressed energy

We walked into yesterday with the accordion fully squeezed. ES finally moved and volatility expanded off that floor. That is exactly what VISE is built to show: not “up or down,” but how ready the tape is to move at all.

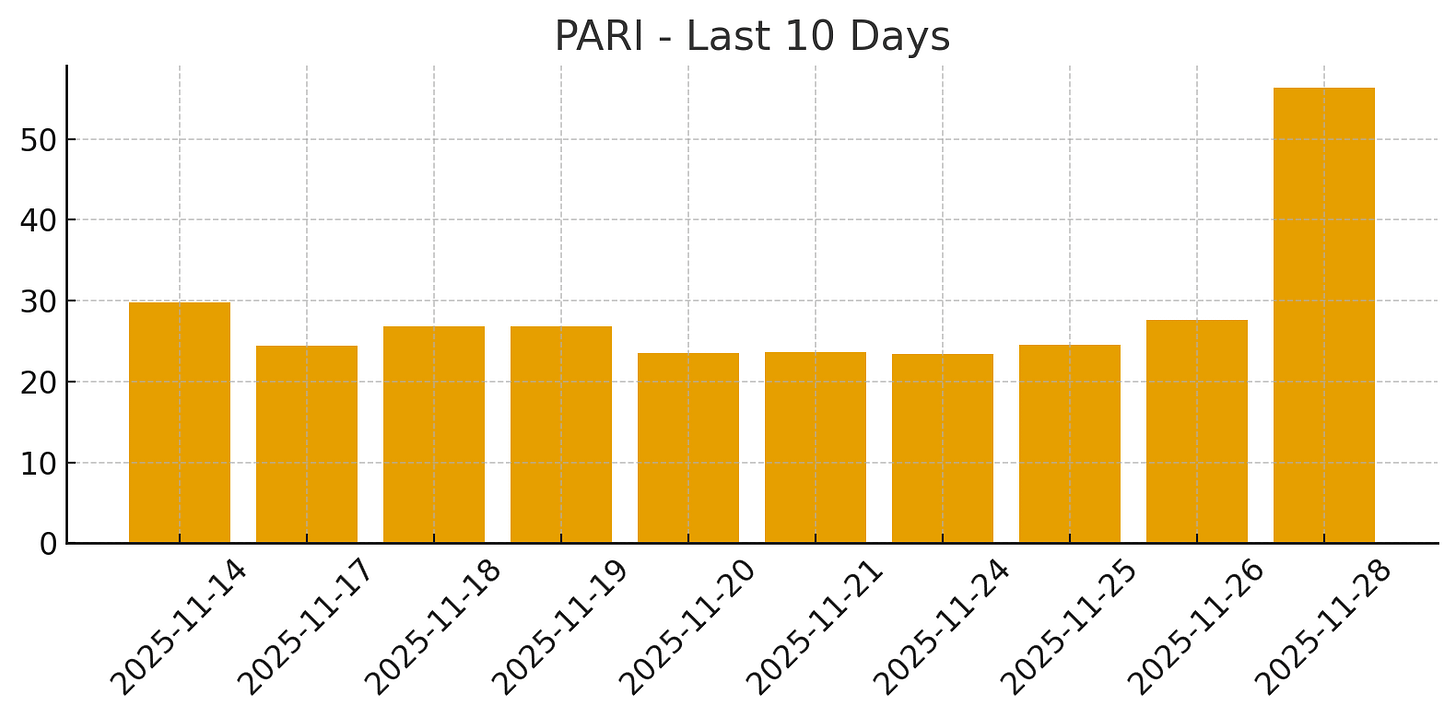

PARI fills in the other half of the picture. While VISE was collapsing, PARI never turned into a strong trend reading. It stayed on the softer side, which means the underlying trend was fragile even on green days. Weak PARI plus a compressed VISE is the setup where any fresh volatility can knock price around more than usual.

That is how we got to yesterday’s read:

low VISE, soft PARI, and a market that finally had room to exhale.