🚀 TOMORROWLAND NO. 9 How the engines walked straight into the Fed rocket

We got our volatility expansion to the upside Tomorrowland has been calling for--what now?

🚀 TOMORROWLAND NO. 9 How the engines walked straight into the Fed rocket

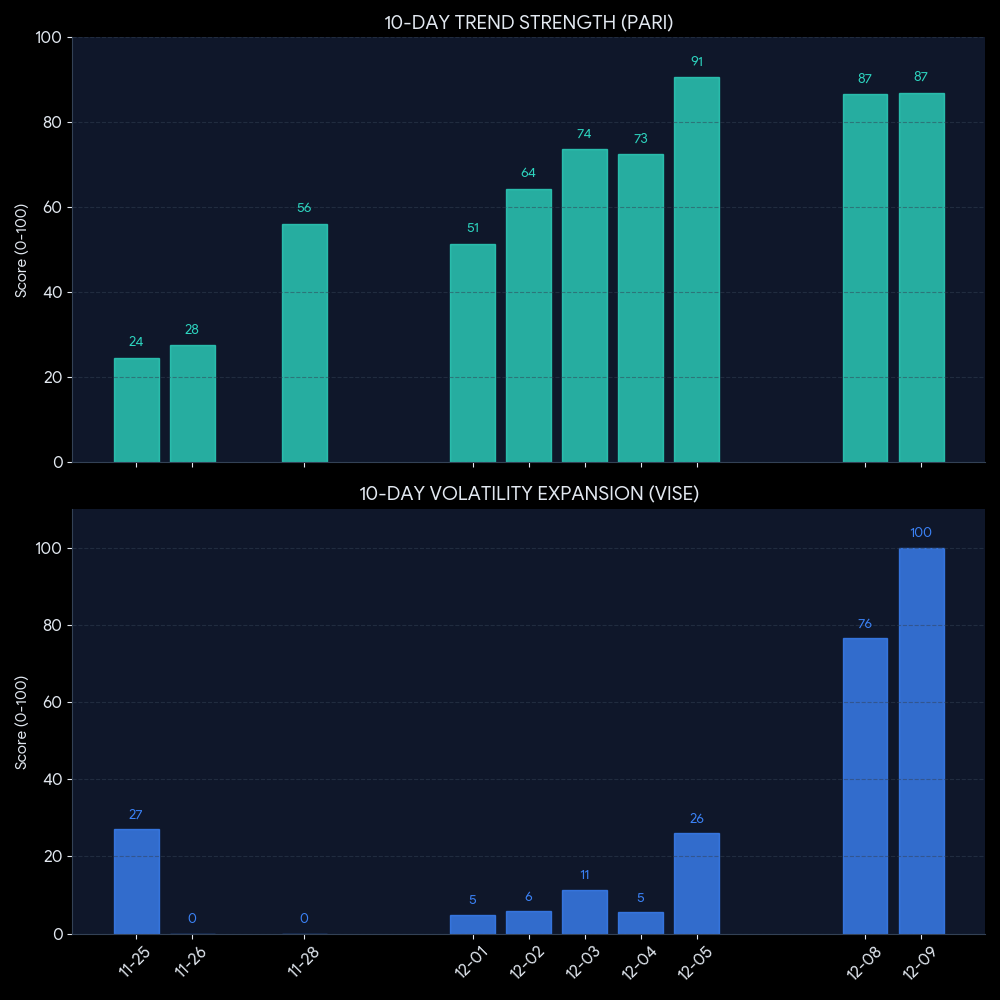

🧠 THE SETUP: PROGRESSIVE SCORES BEFORE THE BLAST

Today’s move did not appear out of nowhere. The engines have been stepping into this outcome for days.

Over the last couple of weeks:

PARI shifted from low, indecisive readings into firm trend strength.

VISE moved from deep compression into full expansion.

Orange Swan printed only the second neutral or constructive reading in months just before the event.

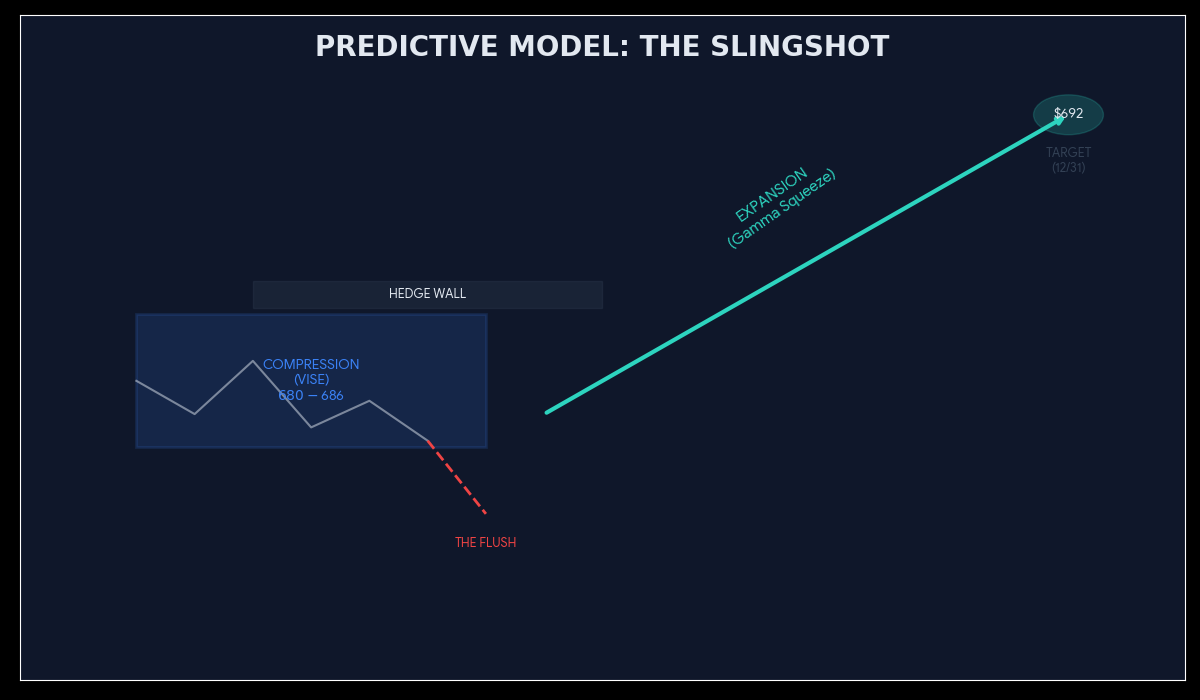

That rare Orange Swan flip is important. For most of the past two months, positioning sat in deep “Risk Off,” with heavy downside protection dominating the tape. The recent neutral/bullish print signaled that hedging pressure finally relaxed just as:

Trend strength was rising.

Volatility was still coiled.

A known catalyst sat on the calendar.

The Combination:

“If the catalyst leans even slightly positive, an upside squeeze is the path of least resistance.”

Today’s Fed rocket was the release of that stored structure, not a random surprise.

⚖️ PARI & VISE: THE COIL AND THE RELEASE

PARI (Price Action Risk Index) compares momentum against volatility. A high score means the trend is behaving in a way that matches strong, persistent historical advances.

VISE (Volatility Indicator for SPY Expansion) tracks the daily range relative to its average. A move to 100 marks “Full Expansion”—energy is being spent, not stored.

The Pattern into Today:

⭐ PLUS Gets

Automatic Flow Alerts (caught WRBY in real time)

All YEET Filters and access to the YEET Plus Filter Suite

Orange Swan Daily – whale stance & risk-off/on score

PARI Daily – trend reliability

VISE Daily – volatility mode

Predictive Model – tomorrow’s setup from all three engines

Whales to Watch – largest real-money footprints

Morning Levels – clean plan for the open

Contract Screens – top filters + high-probability setups