🏈 Training Camp Day 2: Special Teams with ELF Earnings and ER Flow Tips

Day 2 of Training Camp will focus on the ELF Special Teams Play

⛑️In this series Special Teams (well, let’s be real, anyone who chooses to trade options is already pretty special) will refer to the following high volatility events:

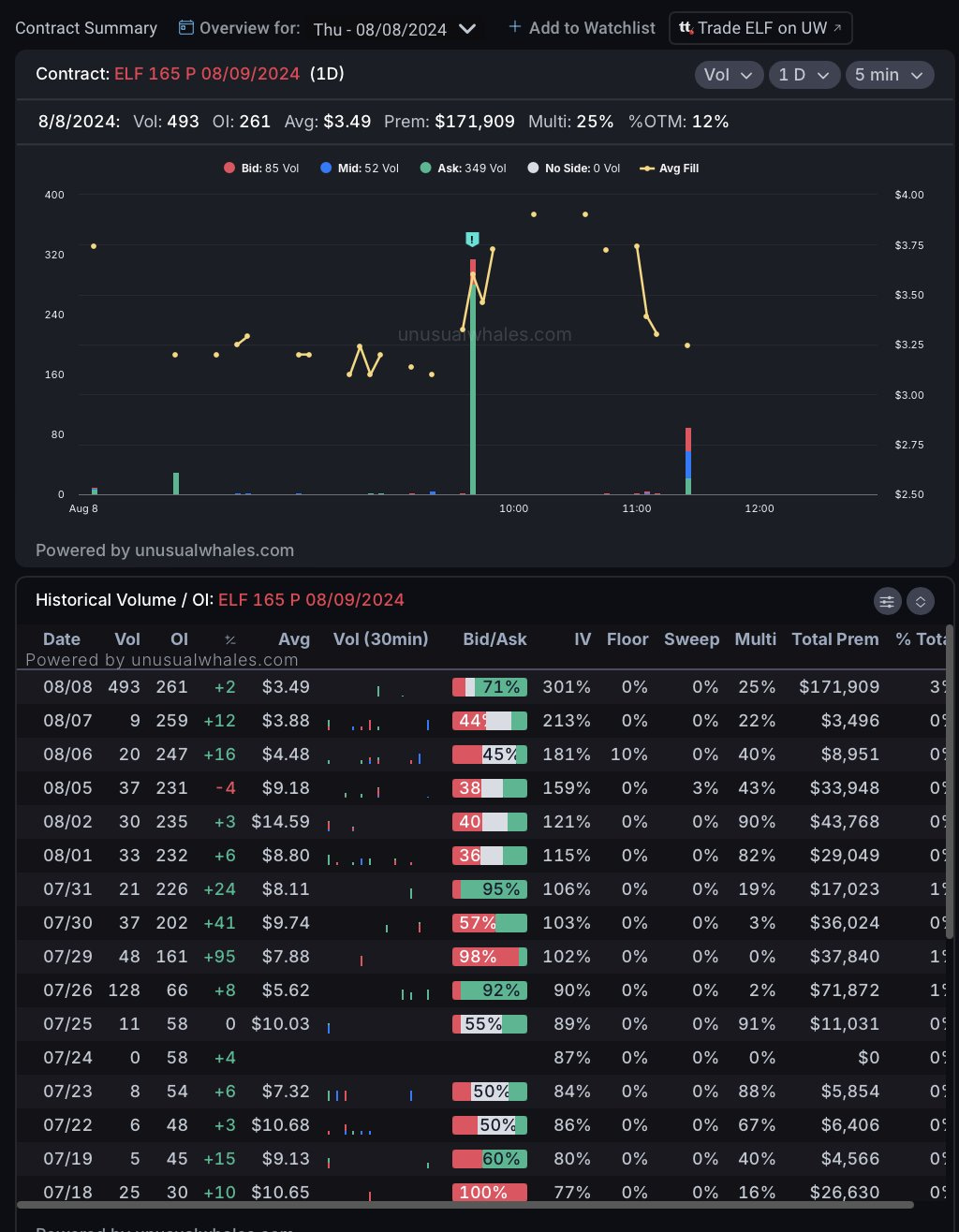

Today well take a look at the contract chosen as the YOLO of the Day on YEET Plus (initially didn’t know it was ER, then when we did liked it even more)/

There are two INTRODUCTORY parts to making an educated guess on Earnings YOLO (the rest will come as we explore this series more in-depth)

🏈The Distance to Expiration and the High OI Chains

1. The Distance: can your contract of interest go in the money?

Does the contract in question have a legitimate shot at going the distance? This is the most important question to answer in an ER Flow YOLO—going up or down isn’t good enough when you’re fighting IV…you need to be certain that the contract in question can go in the money.

Outside of the Implied Volatility, the key factor we can look at to determine this answer is gaps on the chart—it’s an easy way to determine where a reasonable place may be to aim for on your contract.

BUT REMEMBER—A SKIPPED BACKTEST HAS THE SAME PRICE ACTION FUNCTION AS A GAP ON THE CHART. I’LL EXPLAIN HERE:

2. The Formation: The High OI Chains

Although the volume on chains can trick you—the Open Interest chains can’t. By looking at what the high OI chains are you get a sense of where the money is heading into earnings.

Another look at the chains gives us a clue—most of the volume on these high OI bearish chains happened the past couple days, meaning the whisper network was active on shitty earnings for EL

📝 Pt. 2: Flow Playbook Update: Checking in on the Volume and Open Interest of Yesterday’s Pick

We found our deep touchdown bomb, in the following issues we’ll round out our playbook with some short-yardage gains (base hits, 20-40% inttraday scalps) and a couple first down pass plays (nice plays in the 50% to 100% range)