🦄Trend Days and Unicorns: A New UW SPY Filter from the Magic Collection

🦄 SPY Unicorn: The Sleeker, Riskier Cousin of SPY Magic

A new filter. A new edge. A whole new beast.

For months, traders have trusted SPY Magic to deliver high-probability trades by parsing flow that consistently went in the money (ITM). But sometimes, the best trades aren’t the safest ones. They’re the most explosive—and that's where our new filter comes in.

🧪 Enter: SPY Unicorn

SPY Unicorn is a tweaked version of SPY Magic that aims to capture different order behavior: earlier signals, riskier entries, but with massively higher upside. Where SPY Magic plays it safe, Unicorn leans into momentum—using adjusted filters for premium behavior, strike progression, and pre-breakout flow footprints.

AS I WRITE THIS ON THE OPEN THE UNICORN HAS BROUGHT SPY TO 591.98— TWO CENTS LEFT TO VALIDATION YEET PLUS GANG

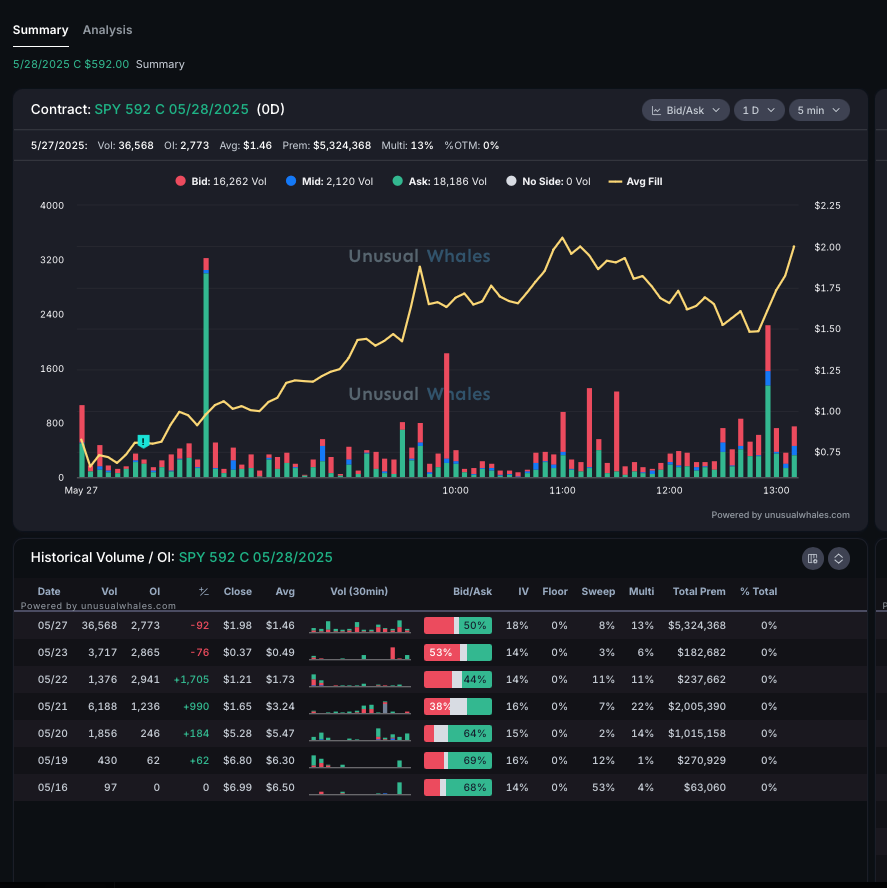

💥 Real-Time Example: 592C 5/28

Yesterday, SPY Unicorn caught a 592C call for 5/28 right at the start of the day. Price was hovering below $589. But the aggression on that fill, combined with the shape of the laddered flow beneath it, suggested strength—not just a scalp, but a position worth swinging.

🟢 Volume: 36,568

🟢 Premium: $5.32M

🟢 Avg Fill: $1.46 → over $2.00 into next day premarket

We trusted the filter, held it overnight, and hope to be as rewarded into this morning as we were doing the session. SPY pushed higher, validating the read and bringing us in the money.

The core insight: Unicorn flagged far OTM conviction where SPY Magic would've needed confirmation. That early edge made all the difference in our 0DTE plays printing in The YEET Discord.

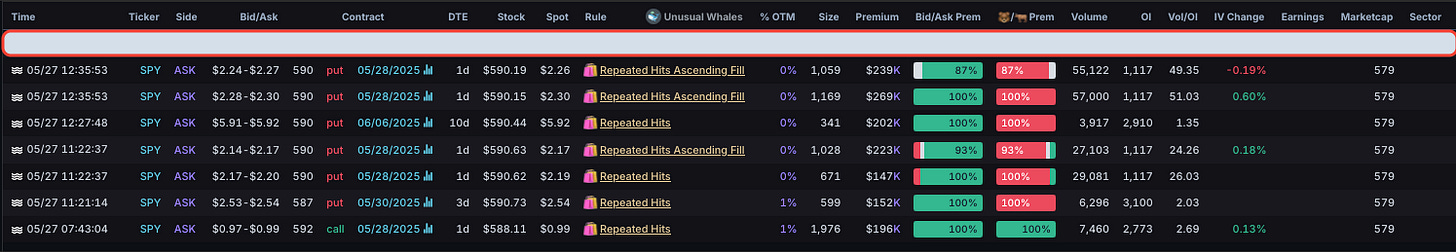

🔴 What We Ignored: 590P into EOD

As SPY dipped toward $590, flow started pouring into puts, especially 590P 5/28. But we stayed out.

Why?

Because—like we wrote last week—non-laddered reactive flow isn’t trustworthy. These orders:

Came after the drop had started.

Didn’t ladder progressively (i.e., no follow-through at 589P, 588P, etc.).

Were likely hedges or late chasers, not initiators.

Without laddered down progression, puts become suspect, even when they come with size.