🗞Tuesday Tips: 315% ZM, 170% GME, 400% UPST, and RIVN News--what they all have in common.

It's all positive vibes right now in YEETland

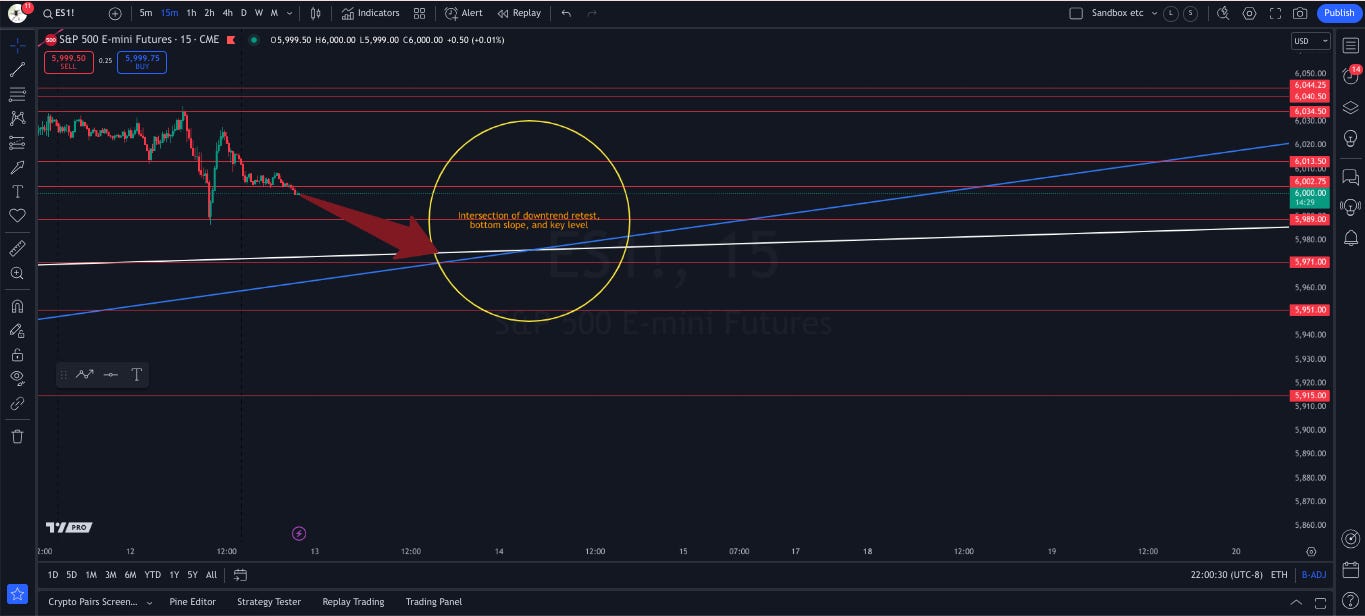

📈SPY/ES Update: The Imperial Bear Destoyer

Losing this level here on ES overnight means we’re almost certain to go down.

You’ll want to look for bounces at:

The Yellow circle which is the intersection of a long downtrend (retest), the wedge’s bottom slope, and a major level.

Another move that happens when a wedge looks like it’s giving out is that the next level below the slope becomes a mega bounce point that scoops it back into play

🌊 Common Denominator—In the past week YEET has found:

✅ UPST 400% // ✅ ZM 315% // ✅ GME 170% // ✅ FSLR: 146% // ✅ RKLB 160% // ✅ NVDA 140% // ✅ ELF ER Multi // ✅ SQ (that’s right) ER Sleeper Banger // ✅TOST ER Multi

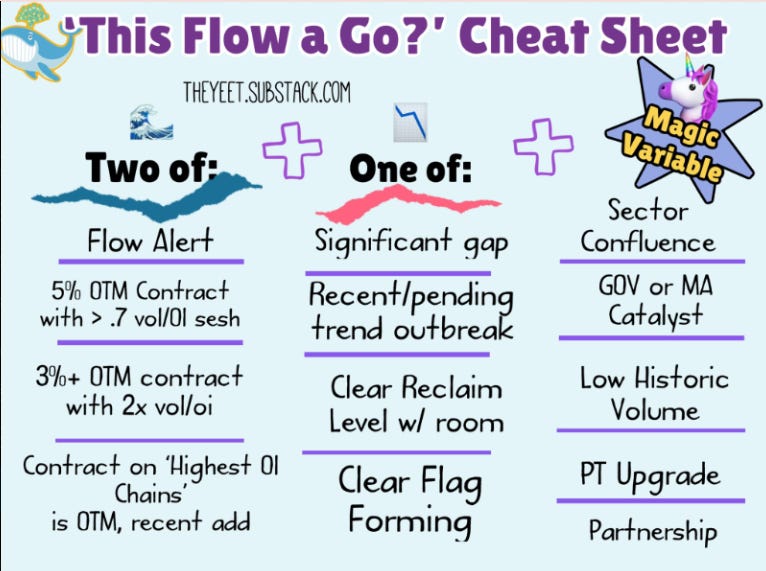

With this simple method:

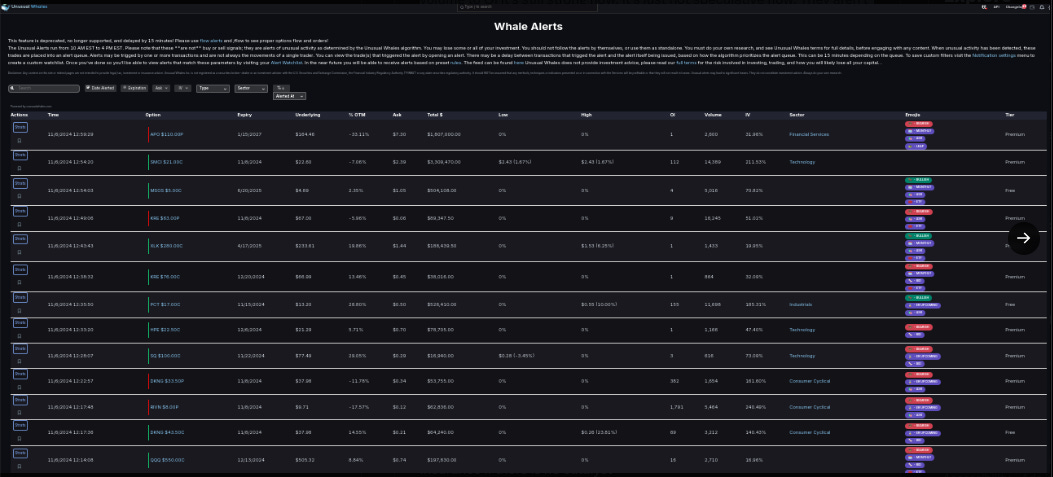

1⃣Part 1:Two Flow Data Points

This is the most important part of vetting--flow largely hedges, so you need more than one degree of certainty. Your options to match two of are:

Flow Alert: you can get the basic alert sent out, or use filters.

5% OTM contract w/ >.7 vol/OI ratio: volume needing to be greater than OI isn't true, so long as it's not your only metric. Significant inflow into an OTM contract is still a clue.

3% OTM contract with volume greater than OI: 90% of flow isn't blockbuster M/A--if something is reasonably OTM and has at least 2x volume to OI it's still strong flow, it's just not speculative flow. They aren't the same thing, and both matter.

Watch the High OI Chains: people ignore this gem. If you see flow you like, you should immediately check the High OI Chains to see if another contract recently got OTM attention. It means whales are building.

2⃣Must have ONE chart catalyst:

Try to find a Whale TA validation OR Insurance if there is no catalyst Most flow isn't news--it's explosive Price Action; your first exercise on the chart of the ticker of interest should be to pretend the whale is a chart nerd and validate their nerd ass thinking.

The bonus here is that if your flow is wrong, you know you have a valid play because you only entered a sound TA play. Is there a gap they're looking to fill? A flag forming? A trend breakout? If you can't find a reason on the chart, you're likely looking at hedge flow.

3⃣ The Magic Variable aka "Your Thesis"

One of the big mistakes people make is just wanting a good filter, thinking it will solve all (filter thread is next). I've had good filters for 2.5 years, but mostly lost money at first because what matters is WHAT you're looking for--not what the filter finds. Don't just search for crazy M/A news--it's often than not flow is:

a simple PT upgrade

Government or Corporate contract

Seasonal/Weather events

A stock that gets no attention tipping news because suddenly it's low historic volume floor is pumping

Someone leaving or joining the company

A partnership

Go through a few weeks of old Barron's and CNBC articles, and get a list in your head of what flow COULD be, not what you want it to be. Then you can have a thesis.