🐳Two Ten Baggers, One Day: Analyzing Last Night's OKLO and WOLF Picks

Lessons learned, and our next bagger

🚨A Note About Flow and Being an Adult: REMINDER:There is no magic bullet to finding exorbitant money, in the stock market or anywhere else. If you want 10 bagger plays, you generally take ten bagger risks. Literally and metaphorically.

Please use judgment and common sense—if you’re risk averse, add time to your contacts and buy closer in the money, size smaller, etc. Flow is a really fun art form, it is a craft, and it is not a get rich quick scheme. Learn, grow, create, try, succeed, fail; but the options market is not your personal Welfare Office, and YEET is not your case manager.

🚨For the specific filter links used to find the trades, they’ll be provided in the weekend newsletter that’s specifically for Annual Subscribers as a perk

✅OKLO and WOLF in review

There are two things to learn from the filter that caught OKLO and WOLF

1. Urgency signals are one of the primary ways to catch big plays

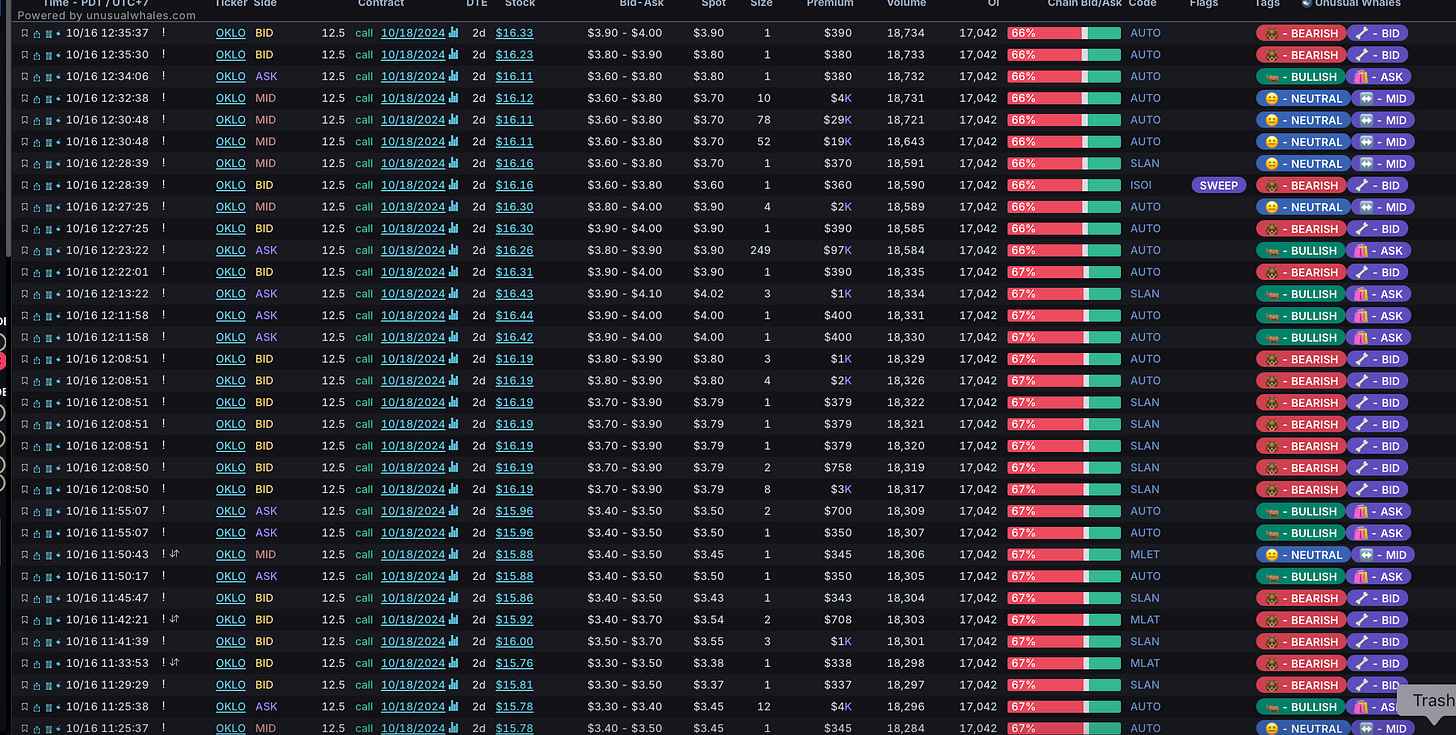

What was key bout OKLO in particular was the two primary urgency settings we always talk about

a. EXPIRY: Notice the expiration date on these contracts are THIS WEEK, bought on a Tuesday—and notice the premium

The name of the game in whale hunting is avoiding hedges—when I see something like that on a ticker that hasn’t seen much flow recently, I’m immediately noticing it’s more than a hedge.

🧠BONUS BIG BRAIN MOVE: Search their competitors for flow to see if this is indeed unusual. There is a powerful, powerful free tool available on the internet—they call it Google:

A quick search gives me the competitors in their field, and a flow search of those competitors showed some minimal activity on related tickers.

b. Out-the-Money-ness: The second urgency signal is how far outside the money these contracts are-coming in at over 10% OTM. Let’s put on our thinking caps:

🤯A 10%+ OTM CONTRACT ON AN OBSCURE COMPANY EXPIRING IN LESS THAN A WEEK??

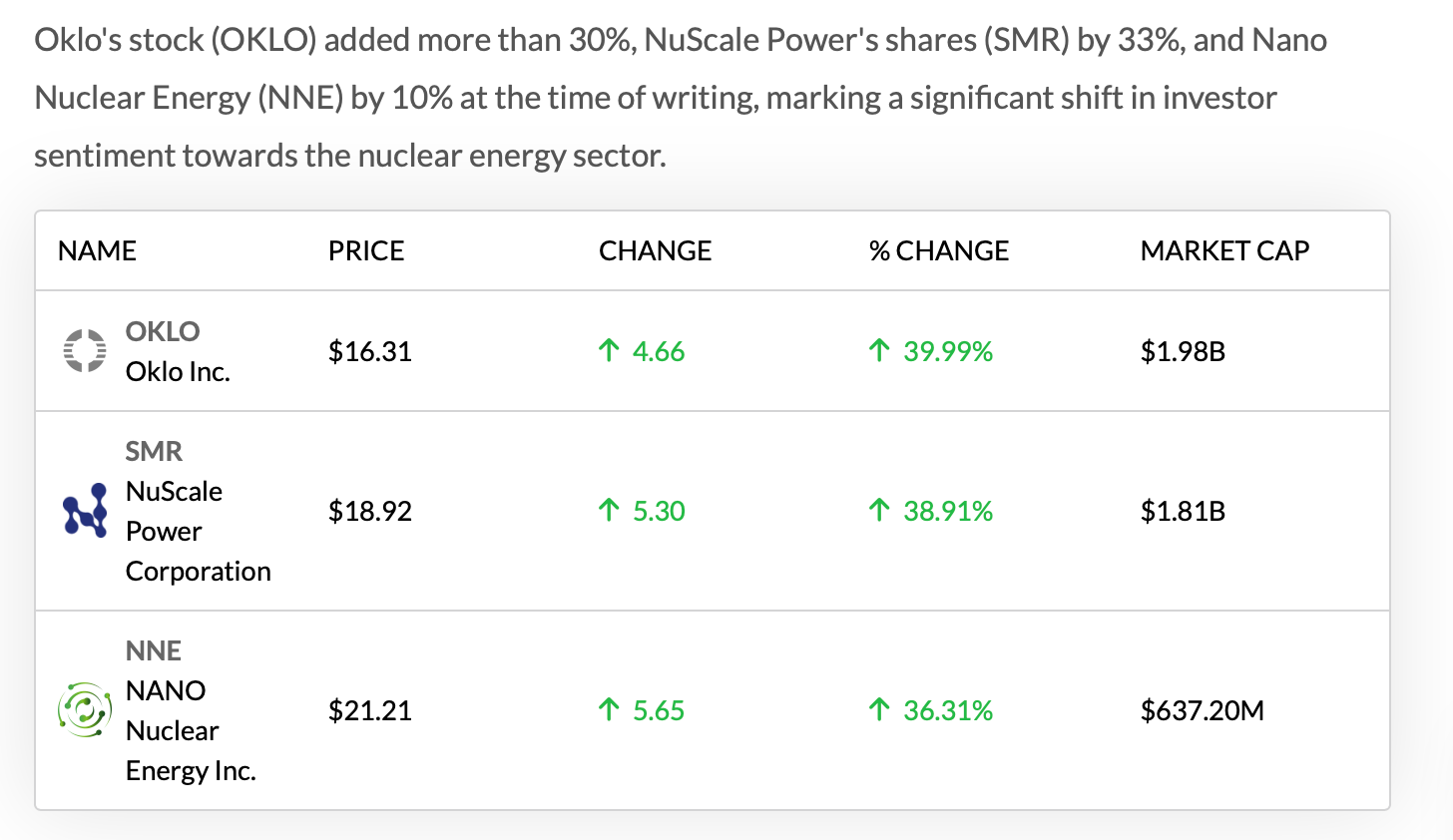

Absolutely reeks of big news. Then BAM:

So, in review: a confluence of urgency signals is how you separate the real from the fake in the flow game. The key Urgency Signals in this flow:

🐳EXPIRATION x OUT THE MONEY-NESS

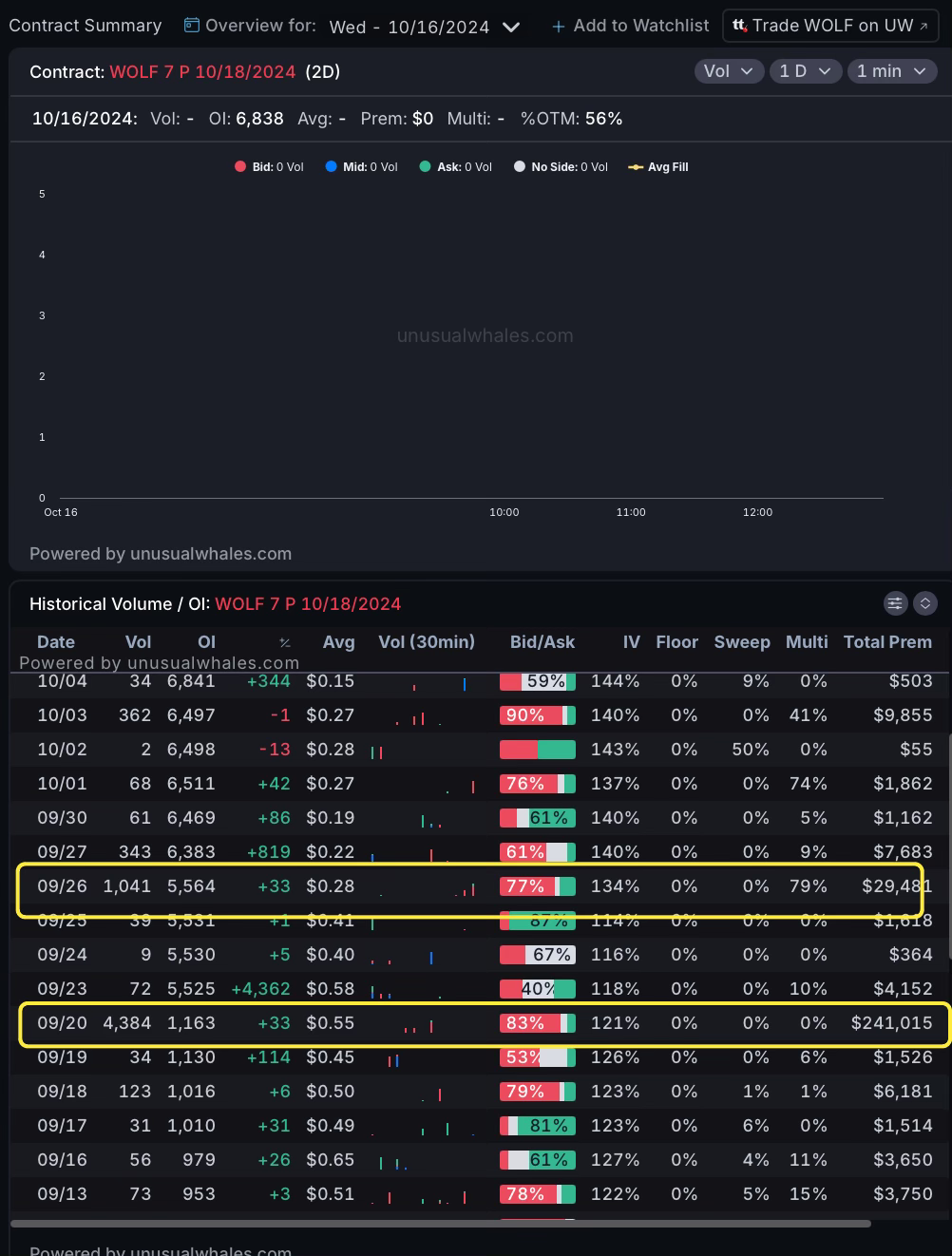

WOLF: Checking OI Chains

Just a tip on extra due diligence—checking OI chains is a way to see what previous activity there is on a ticker that can tip off if what you’re seeing is valid.

From our initial Primary Filter yesterday filter I do a sort of WOLF (YEET Plus Annual subs, you get the link this Friday):

Looks like way back on September 20th somebody sold a large amount of puts to open on WOLF expiring when…?

Gasp! 10/18—that’s this week! The same week as the news! dun. DUN. DUNN.

Although something like sold to open puts expiring the same week aren’t the end all be all, in a game where you’re looking for any sign of confluence to avoid hedges these things count.