💡Welcome to YEET Industries: Price Action Volatility Indicators, Whale Risk Indexes, Filters, and More

💡YEET Industries Tour: Your YEET Weapons in the Daily Retail War

This will be a little explainer of the some of the tools we’ve been using lately, and throughout the week I’ll be going in depth by recording live trading videos using them for Plus and in the Garden, but I’ll also drop some explainers for free gang after the plays so you can see them in action.

For more details on PARI, see the last YEET, titled Mid-Day Show.

🚀Welcome to the War Room

INDICES INCLUDING SPY, QQQ, IWM, AND ASSETS LIKE BTC WILL BE FREE.

At YEET Industries, we don't just trade—we engineer precision-guided financial warfare. Our arsenal of market tools is constantly evolving, and today, we’re unveiling the next generation of trading weaponry. This isn’t just about making money; it’s about dominating the market battlefield with tactical precision.

Daily PARI vs. Intraday PARI: The Iron Man HUD of Trading

Intraday Pari indicator is free on Trading View. Daily PARI Readings before close for YEET Plus will help inform swings.

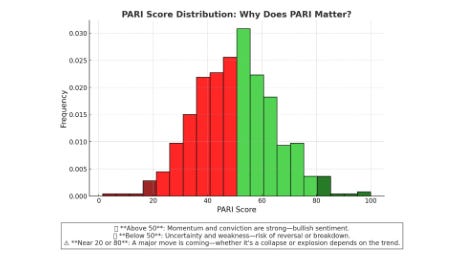

Before diving into the heavy artillery, let’s break down the core targeting system: PARI (Price Action Risk Indicator). Think of it as your J.A.R.V.I.S.—your market AI assistant providing real-time intel on risk and momentum.

Daily PARI: This gives us a bigger picture view—identifying key levels where the battle for price dominance is fought. It tells us where institutions are positioning, what risk levels matter, and where liquidity pockets will be defended.

NOTE: Daily PARI still registered low for Friday, at a 30, even though we had a ripper. This is a caution signal to not headfirst the dip.

Intraday PARI: This is where the precision strikes happen. It’s the heads-up display (HUD) that gives real-time risk readings, helping you catch reversals and high-probability moves within the day. Whether you’re sniping a scalp trade or positioning for overnight recon, Intraday PARI provides the dynamic intel needed for each mission.

Intraday PARI: This is where the precision strikes happen. It’s the heads-up display (HUD) that gives real-time risk readings, helping you catch reversals and high-probability moves within the day. Whether you’re sniping a scalp trade or positioning for overnight recon, Intraday PARI provides the dynamic intel needed for each mission. By analyzing shifts in risk appetite and liquidity at key intraday levels, traders can anticipate turning points before the broader market reacts. For instance, a sudden divergence between price action and Intraday PARI readings can signal an impending reversal, giving traders the chance to position ahead of momentum shifts. This makes it an essential tool for day traders looking for sniper entries and swing traders timing their entries with institutional moves.

It’s built with ONLY Price Action, gauges sentiment like the VIX, and is practically used like RSI.

TOMORROW WHEN THERE IS ACTION INTRADAY I WILL LIVE TRADE PARI FOR THE DISCORD AND THE VIDEOS WILL BE SENT TO PLUS.

ANNUAL MEMBERS: as a perk like the flow explainer videos I sent for those original filters, I’ll send some videos out using it and also let you do a couple requests for tickers to make a PARI for specifically.

🧨YEET Weapons Filter Showcase: Tools for Market Warfare

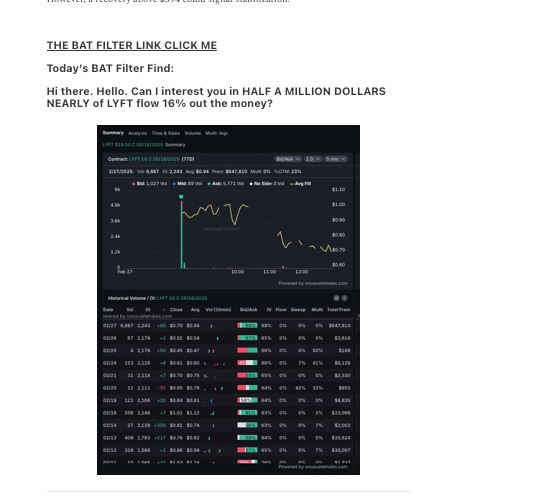

The BAT Filter: Tracking the Counter Trend Flow so you know what dips to buy, deflecting the trend noise like a shield

The BAT Filter is built for stealth and precision. It’s designed to catch major reversals before they happen, much like how the META AI flow signaled a massive bullish shift before their recent announcement—despite the day's price action suggesting otherwise. This kind of contrarian institutional flow is exactly what BAT was built to detect.

Use Case: Detecting institutional-level reversals early.

Best Timeframes: 5m, 15m, 1H for intraday positioning; Daily for swing confirmation.

Recent Example: LYFT ripped 4% to start Friday as the market tanked—it had unusual bullish flow detected in deep OTM calls, even as the stock traded lower, signaling an impending reversal we highlighted in YEET Plus.

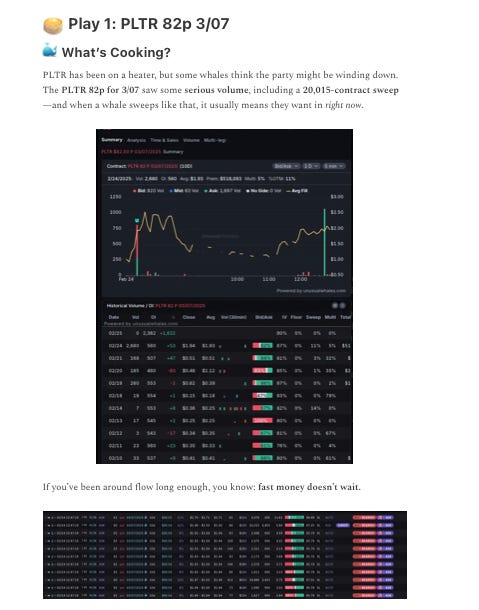

Intraday Sniper: The Quick-Strike Assassin

Not every battle needs a long-term strategy—sometimes, you need to get in, extract profits, and get out before the enemy even knows what happened. The Intraday Sniper was engineered for these missions.

Use Case: Catching rapid intraday moves and overnight holds before they explode.

Best Timeframes: 15m for quick scalps; 1H for overnight setups.

Recent Example: PLTR puts this week—Sniper Filter caught the short-term weakness EOD, allowing traders to capitalize on a sharp downside move overnight.

🚀 Suit Up—Your Next Mission Awaits

At YEET Industries, we don’t just react to the market—we engineer the tools to anticipate it. With these new weaponized filters, your trading arsenal is now more advanced than ever.

Whether you’re using BAT to catch reversals, Sniper for fast tactical strikes, or FARCRY for long-term warfare, you now have the firepower to dominate any market battlefield.