🐳 Whales to Watch

Some interesting flow.

🐋 Whales to Watch — October 14, 2025

Below are the four names that stood out in some flow screens — each carrying either unusually timed entries or concentrated volume that tells a bigger story.

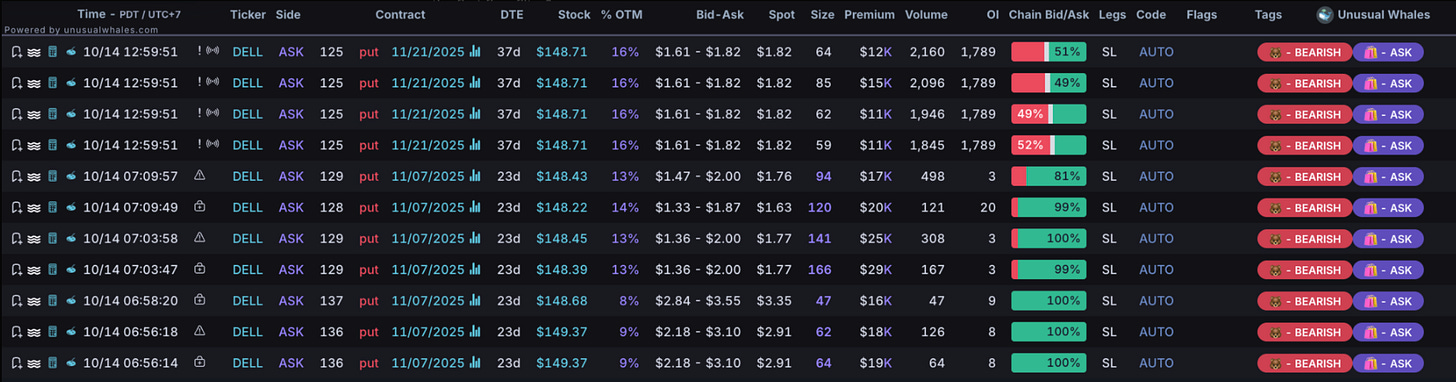

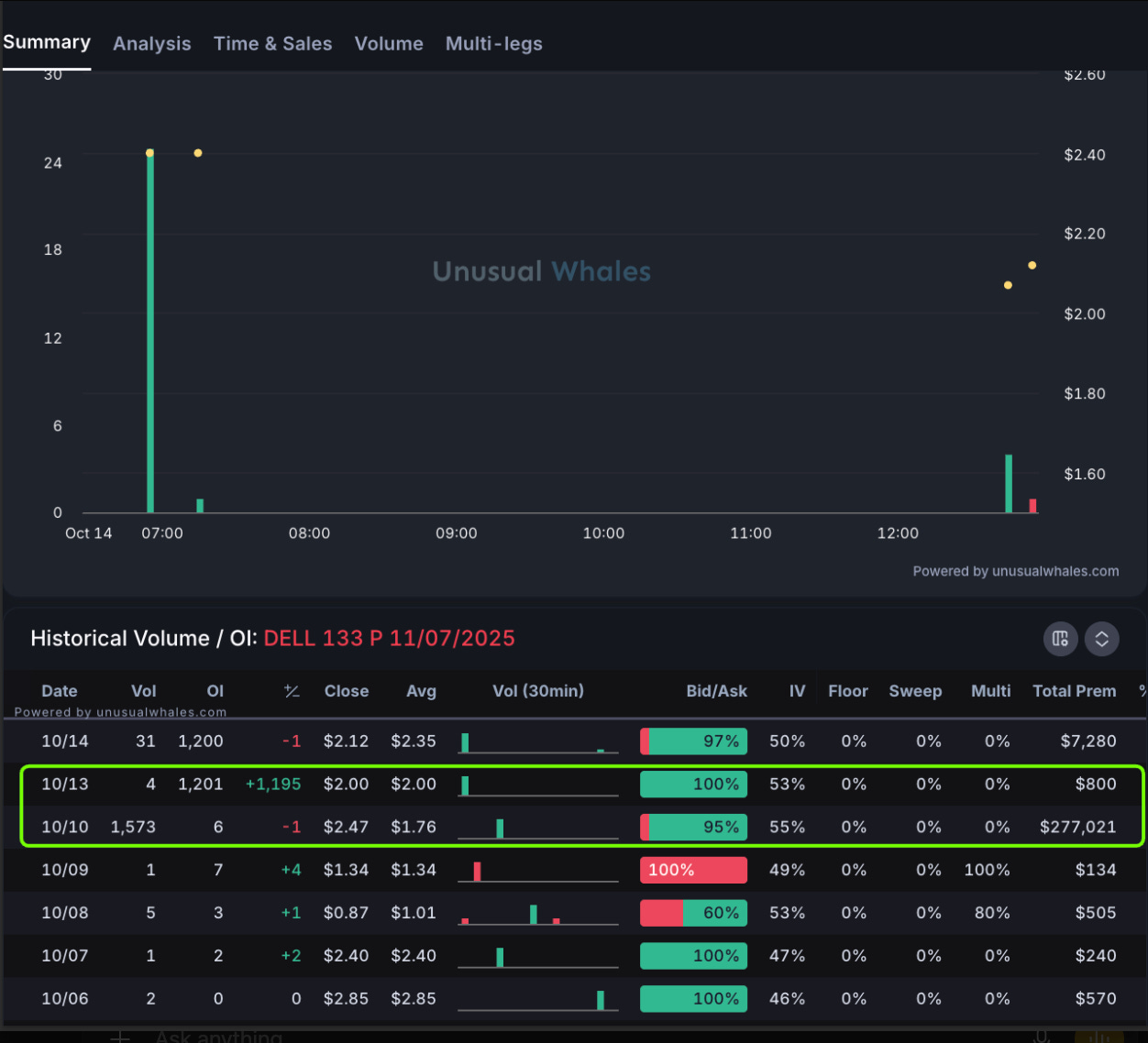

💻 DELL — Relentless Put Pressure

It’s not just today — DELL has seen persistent put buying all week, across multiple strikes and expirations.

Today’s notable hit came on the 11/21 $125P, stamped at 12:59 PM, the literal final minute of the session — a timing signal reserved for traders with confidence, not guesses.

This is now a five-day sequence of size rolling into the downside despite bounces in tech. The reasoning’s clear:

Hardware and legacy infrastructure names are facing margin compression.

Funds are hedging exposure as the AI-capex rotation continues to crowd out traditional OEM growth.

This isn’t panic — it’s calculated defensive flow from funds that expect volatility to bleed upward into earnings.

💻 DELL — Key Levels (1H)

🔴 Key Levels (Resistance / Structure)

153.06 151.63 149.77 149.59 147.09 145.59

⚪ Stop Level

⚪ 149.40 — If this breaks with confirmation, near-term structure likely invalidated.

🟡 Reasonable Target (Dashed Yellow)

143.56 — First realistic downside zone; aligns with prior consolidation shelf.

🟡 Home Run / Degen Target (Solid Yellow)

136.14 — Full extension level, coinciding with untested liquidity pocket from the last major breakout.