🌗YEET 0 Days Til Extinction: TIME (Part 1)

Understanding how time is a constant factor in trading, and how we defeat it.

Hello! These will be getting out much faster—I’ve been under the weather (which will become clear in the videos), but I’m hoping to be on the upside by tomorrow morning.

This will be the first part of an exploration of how TIME factors into our trading. Enjoy!

When last we left the main story, DeGeneral Milt died in a fiery crash with 580 resistance which then became support…

⏱️ Prologue: Off to The Watchtower (it’s a flashback bro!)

In its simplest form the success of your trading day is based on being correct about only two things: 1) Price placement 2) Timing

Where many traders get it backwards, I feel, is that they approach with the logical framework of Placement as the priority, subsequently demoting Time to the status of “critical variable”. To succeed at trading options, however, that logic has to flip.

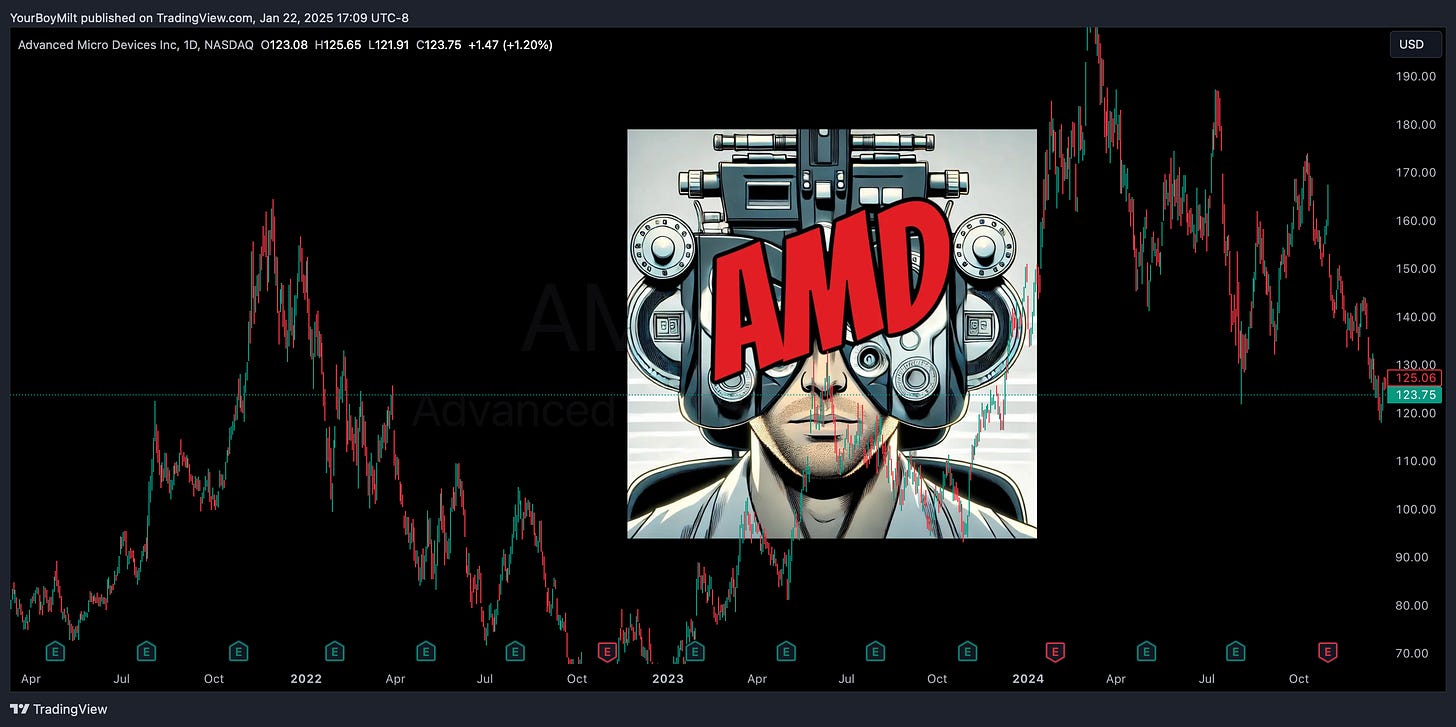

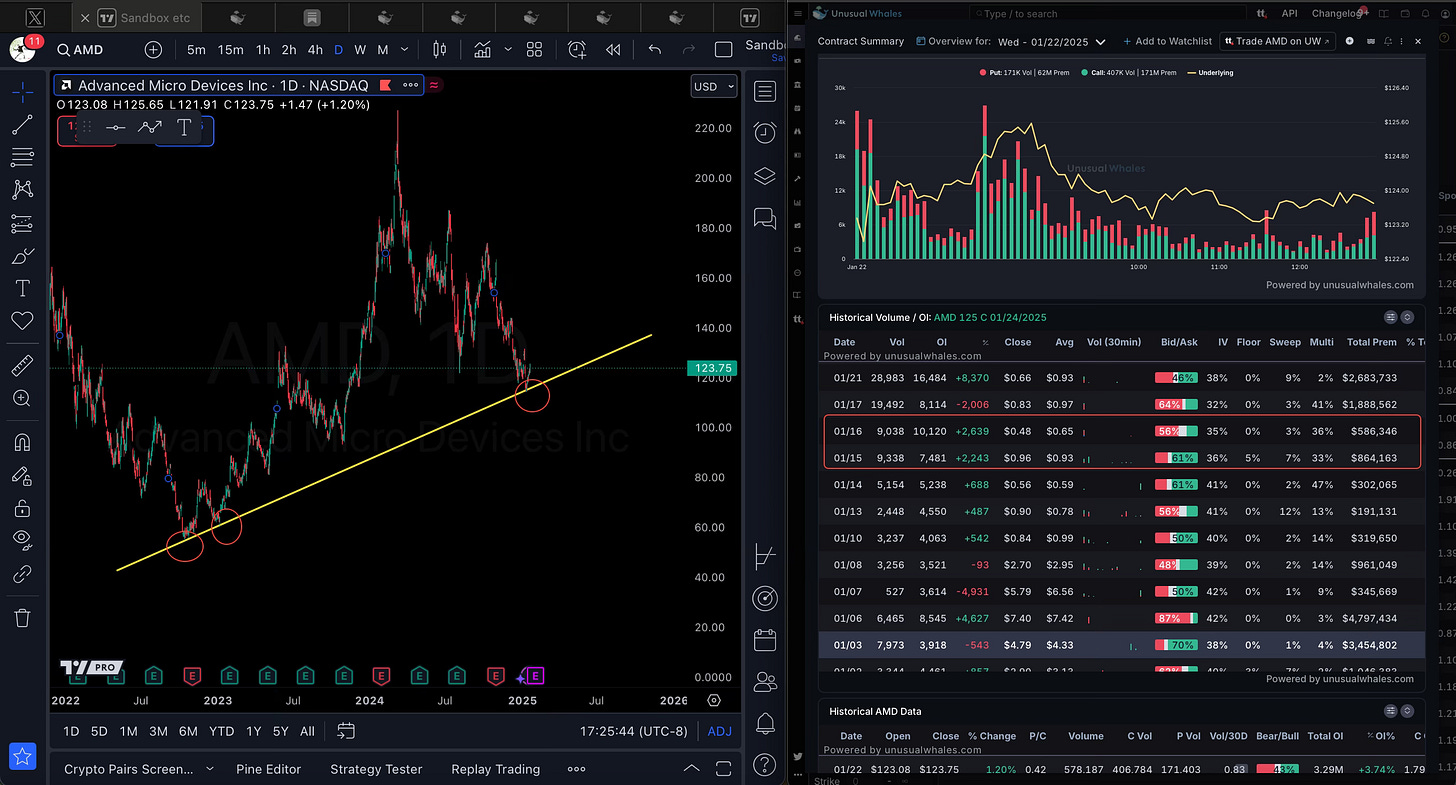

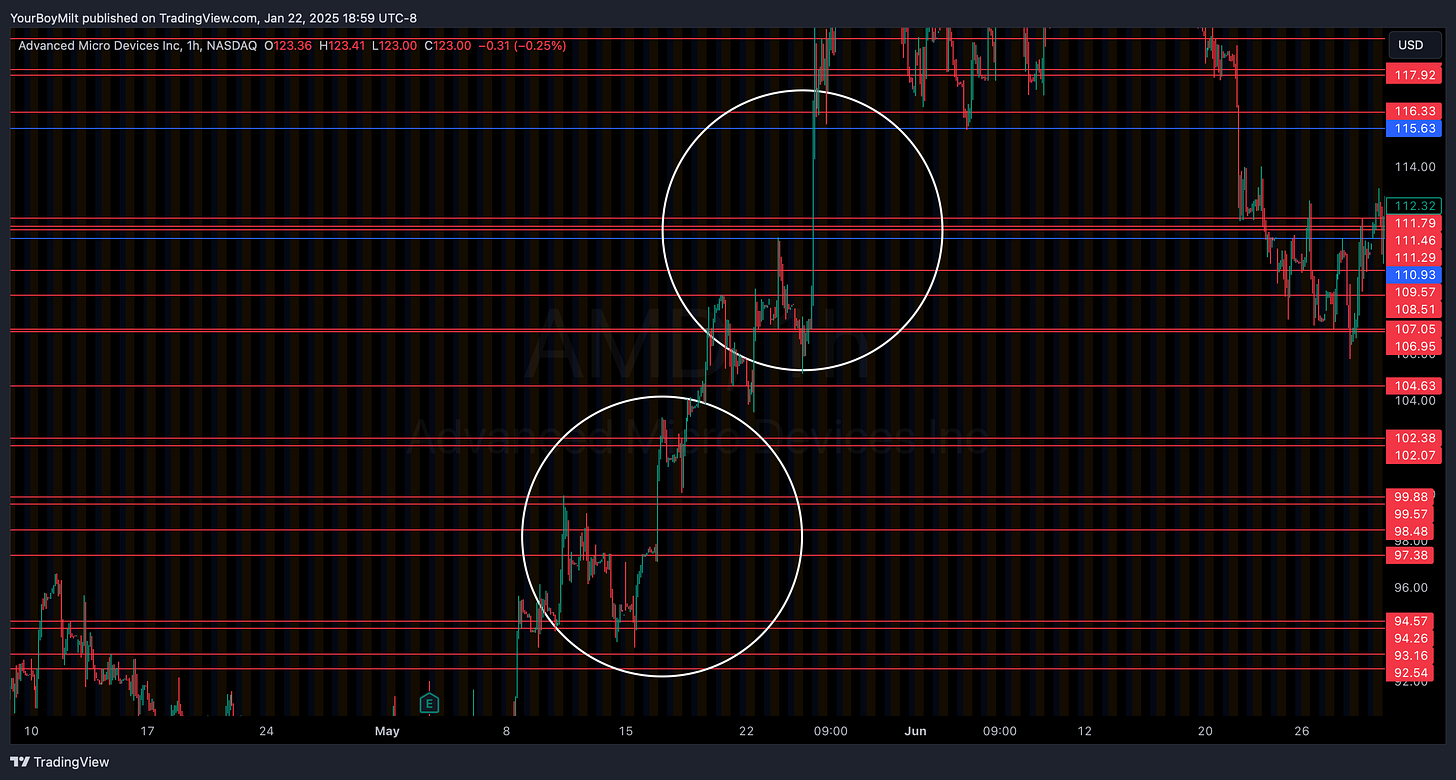

CHAD: AMD? Easy money. It held the trend line on the daily—bullish! Combine that with the 1/24 125c volume from the 15th and it’s easy to see that this thing is going up. I even put little circles on the trendlines and highlighted the volume increase on Flo’s report—just a few favors for an old man. Do you want to enter the order for calls—or should I?

Time works foremost like a Quarterback’s progressions when planning your trade. When doing a read you go through each of your timeframes progressions, but here’s the thing; not only on the ticker you’re interested in, but on the index itself.

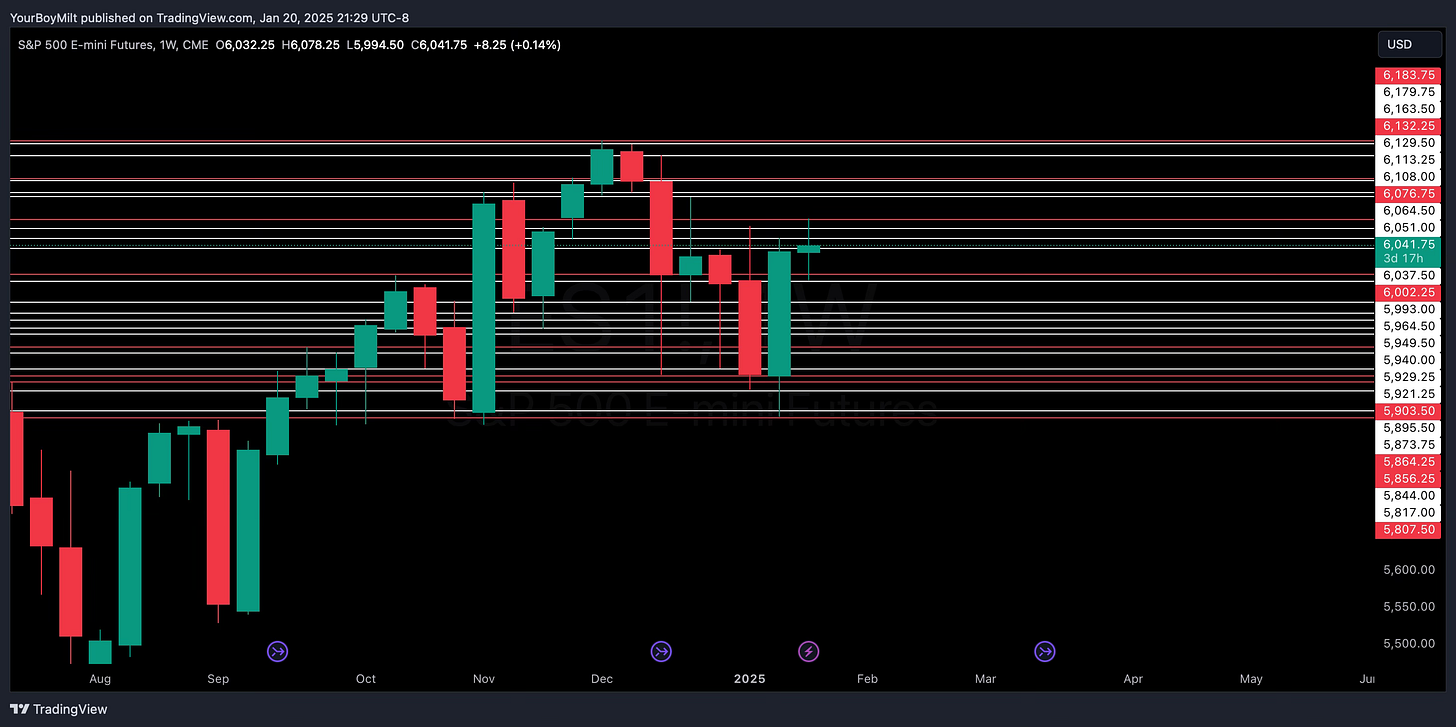

📈ES/SPY Outlook:

📈 Levels: The higher the timeframe, the stronger the level. On your index you want to have your monthly and weekly levels set near the current Price Action.

First your monthlies

Then your weeklies..

🏹 Trendlines: The higher the timeframe, the stronger the trend. For the way we trade, you're going to stick to hourlies when doing your planing. On ES you end up with something like this…

Patterns and Gaps: The higher the timeframe, the stronger the pattern or gap level.

Jarvis, distill the results into the resulting pattern and key support and resistance. Let’s see what we’re working with…

🍪AMD Read: The Right Way

Now knowing how to properly go through time progressions, give AMD one more try…

*Pro Tip: when there are considerable monthlies and gap levels, you don’t need to worry about weeklies until you’re in the trade/approaching targets, as your entries should always be only on monthlies and/or gap levels

The AMD setup mirrors..the index?! A rising wedge that just hit it’s break point as it rejected key resistance at a monthly backtest….

🧠CEREBRO Part 1: AMD Use Case // YEET Plus Preview

Once you’re enlisted in the Watchtower, FLOW will be moving fast and constant with their tool Cerebro. In fact, I’m going to give you a little gift: