🎄 YEET 12 DAYS OF CHRISTMAS DAY 3: THE SWANDEX 🦢

What happens when we apply variance across sectors? Do we get tipped off?

🎄 YEET 12 DAYS OF CHRISTMAS DAY 3: THE SWANDEX

The lesson from Orange Swan has been clear: When flow diverges from price, pay attention.

We saw it with XLK (Tech) showing weakness while price held, and we saw it with China (Red Swan) showing massive strength while the index remained defensive. The biggest edge right now isn’t in following the herd—it’s in finding the Value in the Variance

When the Orange Swan reads “Caution” but a specific sector reads “Aggression,” that friction creates the trade.

🦢 INTRODUCING: THE SWANDEX

I created a more all-encompassing version of the Orange Swan called The SWANDEX.

Instead of just looking at the top-level index flow, the Swandex ingests major index tickers and key Sector ETFs (like SMH, XLF, XLE) simultaneously. Then, I run a Cerebro Scan across the entire dataset to see not just where the money is going, but what is getting hit the hardest relative to the baseline.

The Track Record:

This strategy previously worked on a localized basis to catch the massive runs in Semis/Chips.

It gave us the first real signs Yesterday that China was rotating into a “Red Swan” event.

But this morning, the Swandex spit out a reading I simply cannot ignore.

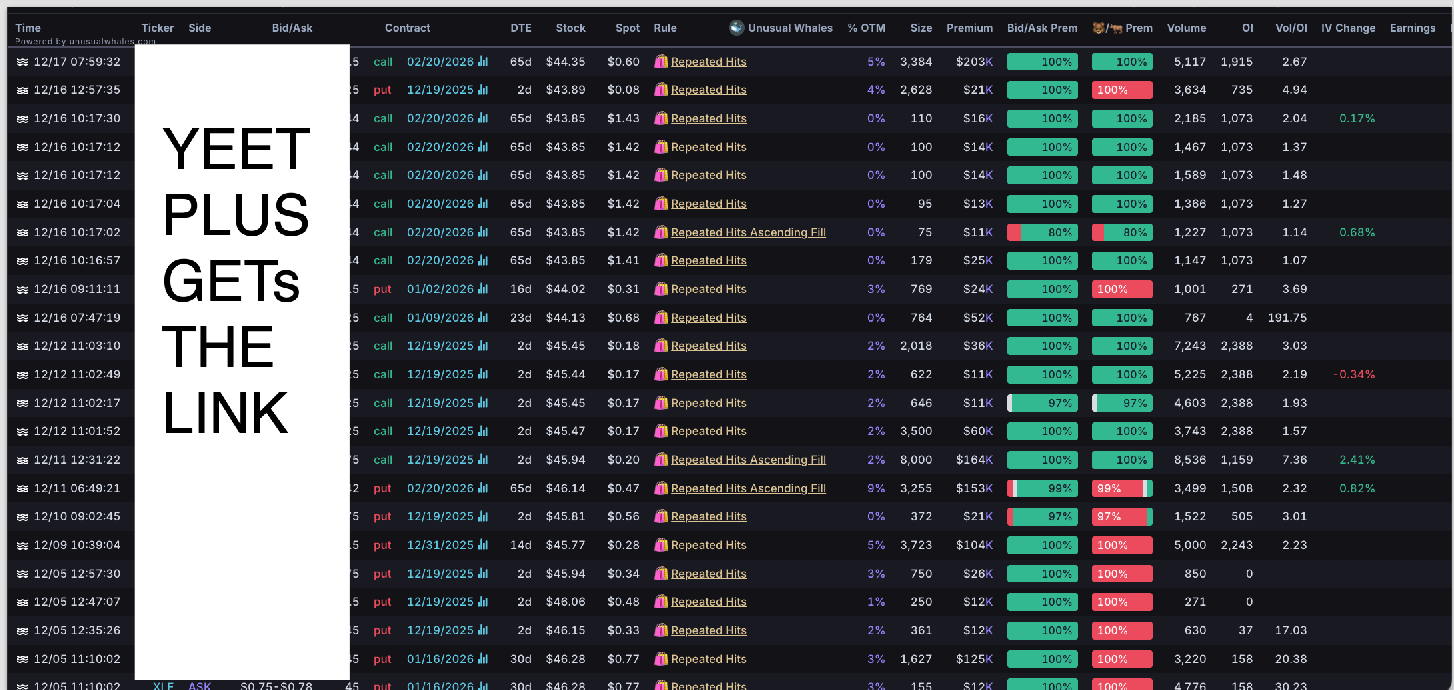

➕ YEET PLUS: THE SWANDEX SIGNAL

SWANDEX has caught a major upside mover into the beginning of the year.