💡YEET 2.5: How To YEET

Guest intro from MacroEdge, plus explaining the tools we use for reads and introducing you formally to Flow/Action Trading

Welcome to The Yeet, a weekly DD where we try to tilt the casino...

Hey! I’m @yourboymilt, and welcome to retail’s Sunday Paper.

I should probably let you know...This is not financial advice! We are here to entertain while giving you ideas, perspective, and angles. Do your own research, I prithee. And if you aren’t subscribed, join us here:

Creator/Editor:@YourBoyMilt // The GodFather: Abu // COOs: Nate Dawg and Cjo // Head of Haters Received: DTJ1948 // Head of Research & Plagiarism: Kenzo08 // Director of Futures Trading & Trickery:

EE’s /ES//Non-SPY Callout Coordinator: Plaggy // Elliot Dark Level Wicks Research: JBtrades // Director of Flow: Ace Ventura // Research Associates:B-Rad, Zik, El Mano Negro, Bean Man, Santo, Avine, Egyptaflip and All Flow Patrol

Pt. 1: Macro Edge piece, Pt. 2: Flow Action Picks, Pt. 3: YEET Plus Sunday Edition Pt. 4: TLDR

🌎 Pt. 1: CHOPPY WATERS IN FLORIDA

Contributor: Don Miami of Macro Edge

It’s been a busy weekend for us all… hopefully you had a chance to catch both the ‘Redeye’ and the first edition of the labor market report. Lots of important data to be discussed in the upcoming week - especially on the labor and inflation fronts (the two mandates the Fed is bound to fail at yet again this cycle). While much of our discussion over the past few months has focused around California, Nevada, New York, and other states facing employment pressures - I want to turn our attention this evening to Florida to cover some critical data on the real estate and employment fronts. Given the in-depth nature of the Friday and Saturday reports - I will keep tonight’s piece shorter to let Six, Greg, and Awsumb do most of the talking… Look forward to seeing you all on Friday evening again and make sure to hop into MacroEdge Ozone if you haven’t yet…

Employment Update

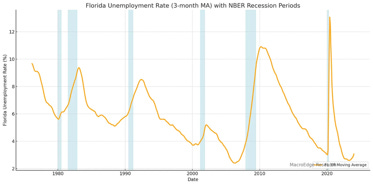

Employment in Florida remains robust - and unemployment remains low, for now. Unemployment is making an interesting turn upward using a 3-month smoothed average and looks set to go higher form here with national unemployment rising. If the broader labor market begins to cool further at the pace it has - we can expect unemployment to continue rising in Florida as well. Texas has been another interesting datapoint to watch as unemployment has seen a brief increase but now a pause in increasing. Tomorrow we get the latest unemployment figure from Florida and I will make sure to put something out on X to update my graph above.

Florida remains susceptible to a broader downturn once the brakes get pressed on RE and the service economy in the state. Even though there’s been a flood of finance into the state - there are a LOT of headwinds in Florida, just as there are in many other states at present. While the sunbelt remains ‘warm’ heading into Spring, we may get a bit of a winter solstice appear during the 2nd and 3rd quarters in the region that slows things down as national activity cools, as well.

Real Estate Update

Active housing inventory in Florida is nearing pre-lockdown levels (finally) - yes, the state added people since 2019 but it’s also the oldest state and there’s more supply on the way. The Southwestern portion of the state has seen inventory explode and we are also seeing inventory finally increase on the East Coast as well… Below: Miami-West Palm-Fort Lauderdale:

A deteriorating employment situation in the state will put huge pressure on the real estate market even with the large # of retirees that reside in Florida. While Florida has grown and diversified over the past few years - real estate remains a backbone of the boom/bust state.

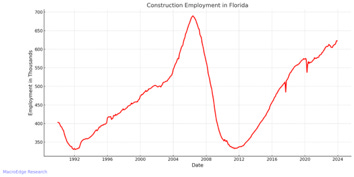

On the construction employment front, things have begun to slow down. Further headwinds will come about when the multifamily boom comes to a halt in the state:

🚨NOTE: YEET Free, YEET+ and MORE Education (don’t let me add any more features jfc.)

Before we get into some rigorous daily Flow and Price Action education/training so you can be as affective as your appetite to learn is, I realized it would be good to show you guys how you’re supposed to use our tool’s thus far for common ground.

Candidly, my mission has changed this year. 2024 was supposed to be a slog of proving to you all and myself I had the skills to go pro. I’m blessed that something between the ear clicked starting January 1st, I found my old form from 2021/2022, and I feel like from a public trading perspective I’ve “proven” all the things I needed to do, so now I can focus on doing the things I want to do; The YEET started as education wrapped in humor, and I’m determined we always teach as we go—even the losses.

With my personal trading goals have progressed ahead of schedule, my mentor/partner Abu I are going to dedicate ourselves to making a great trader out each daily subscriber.

What Abu taught me has changed my life, and whether you’re a seasoned pro or just starting out, I hope by the end of this year we change yours in some way.

If you don’t wanna learn, don’t sweat it—just take the trades and do you. And if you’re wanting to learn but are nervous you “can’t do it” blah blah, I say to you with all sincerity—I do not listen, I am lazy, I am (debatably clinically) insane, I cut every corner imaginable, I don’t retain numbers well, I have a whole career m a director in so I am too busy to be trading, and I’m a lush to boot. Everyone has excuses-if I can pick this stuff up, I swear to God you can and will just as fast if you want it bad enough. The only reason you and I are still trading and other people we know aren’t is because they quit and we didn’t.

BREAKDOWN, THINK OF IT LIKE THIS: THE PRIVATE TWITTER IS WHERE YOU WILL GET YOUR FREE BANGERS AND INFO—NO THOUGHT NEEDED JUST STRESS FREE ALPHA. THE DAILY NEWSLETTER/ VIDS IS WHERE YOU COME TO LEARN WHY, TO THINK, AND TO IMPROVE. (and more bangers).

TLDR: We are going to educate a LOT for all experience levels, and soon you will be able to make annoying shit like this pic below and send it to your friends while they’re trapped in some play because “anchored VWAP”. These screenshots have all been taken since YEET Plus started—still only ten bucks.

🌊 Pt. 2: How to Read The YEET

Pt.1: SPY

The results are in, and for the first 2 months of the year we are 80% on SPY accuracy in the day’s directionality based off the premarket read, 75%+ when providing a read at the end of the trading day, and 82% win percentage on SPY day trades.

Now we’re focused on general market directionality as it related to the Flow/Action plays that we are in. Here is a tour through the tools we are using.

🌊PT 1.: Net Premium Flow

You may have noticed your boy obsessing over Net Premium recently. I’d first like to note that this tool is never to be used on its own. There are a myriad of ways I use this tool, but primarily I am using it as:

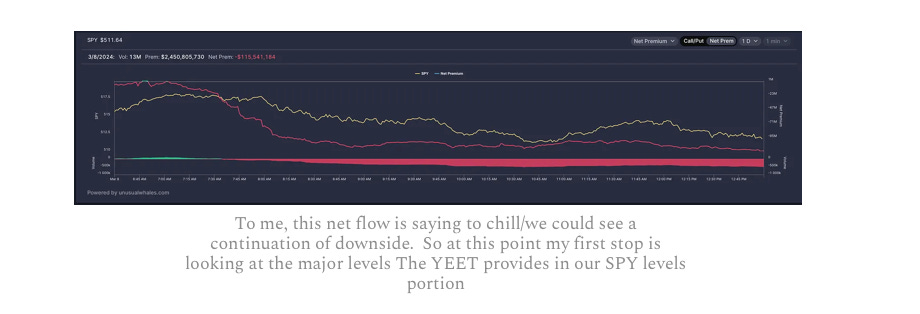

A) Caution on play entry: a good example of this was last week; the market saw two big green days while net flow continued to diverge, increasingly bearish. So on individual tickers I’m not buying pops, and instead waiting for key price action breaks to the downside on good opportunities.

B) Taking profits: if the ride of the market starts to turn, I know to trust the first or second target I have a on a trade and get out before I’m fighting against the flow

So then, how am I interpreting it tonight?

📈 PT 2.: The Levels

The method to this madness is simple—these are you guides to SPY swings/day trades and scalps.

Use white (weekly) and red (monthly) as your swing guides. A bounce or reclaim off one likely leads to another within the span of a session or two.

The yellows are for the day traders. These levels provide resistance or support, but not at a make or break level for the overall Price Action. So if you get a squeeze candle or a huge drop through a yellow or two, you know not to push your luck and settle for that target.

📈 PT 3.: The Pertinent Chart

🗽 Part 3: Flow/Action Plays

💡Flow/Action is the trading style of Milt and his mentor Abu that combines market flow, individual ticker flow, market index price action, and individual ticker price action to to determine big movers AND just as importantly when to enter or exit.

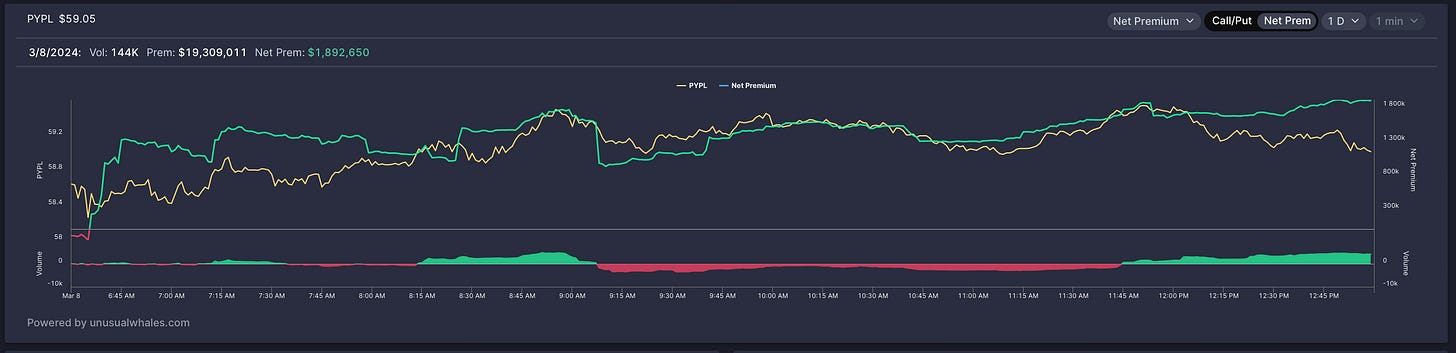

1. 👀 On Watch: PYPL// Eyeing 4/19 65c

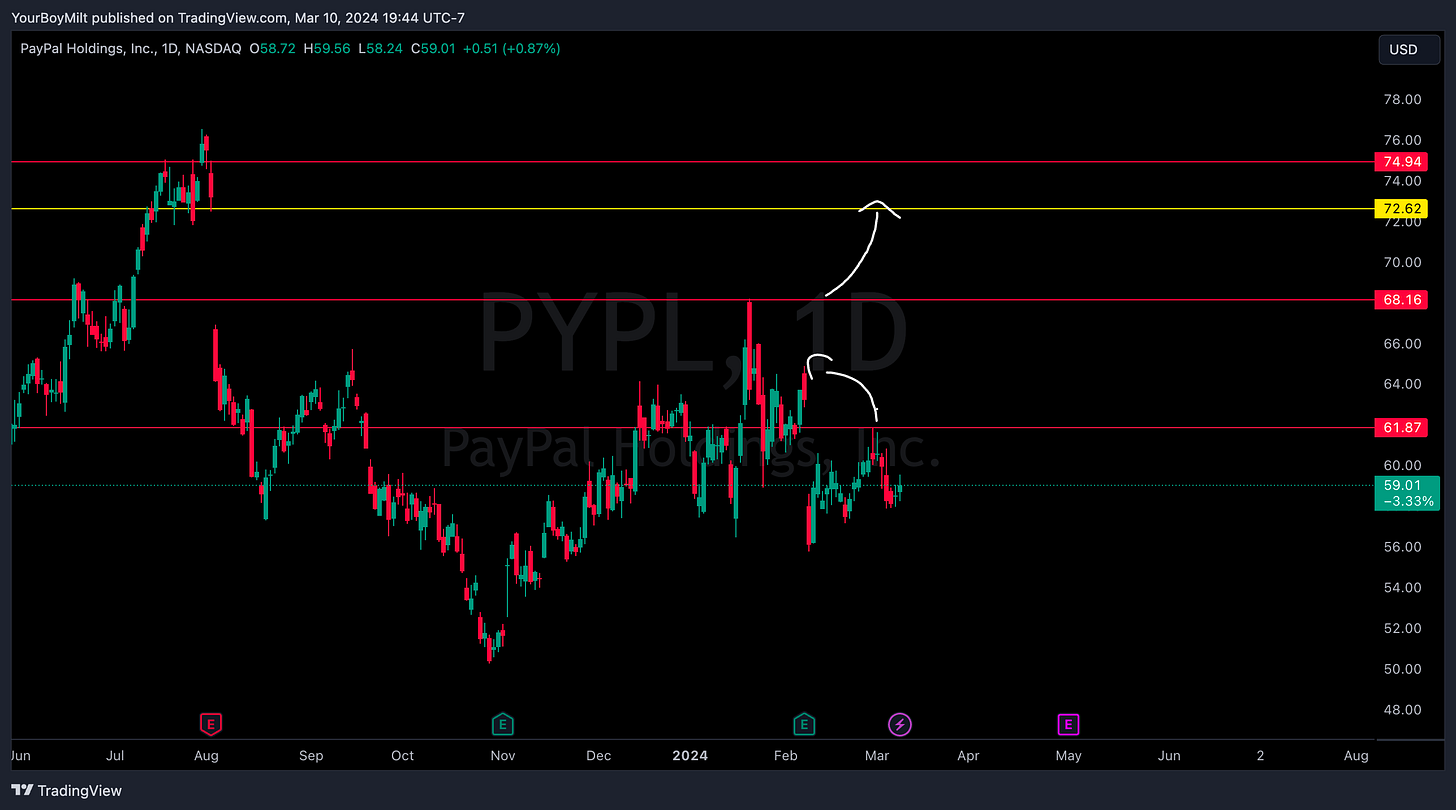

Nice play to track over time which gives us a chance to teach Flow/Action as we go, as well as establish patience and Prime Entry. PYPL has a very bullish chart—but some gaps to close to the downside. If our SPY Flow/Chart theory is generally correct, the buy level could come within the next week.

🚀YEET+ Subscribers: PYPL entry and exit—and key activity, will be tracked

🇺🇸YEET Free Subscribers: We will update this play for you in the coming Sunday Editions

Pt. 1: SPY has a very bullishly tantalizing chart, with a small gap fill to the upside followed by a major one!

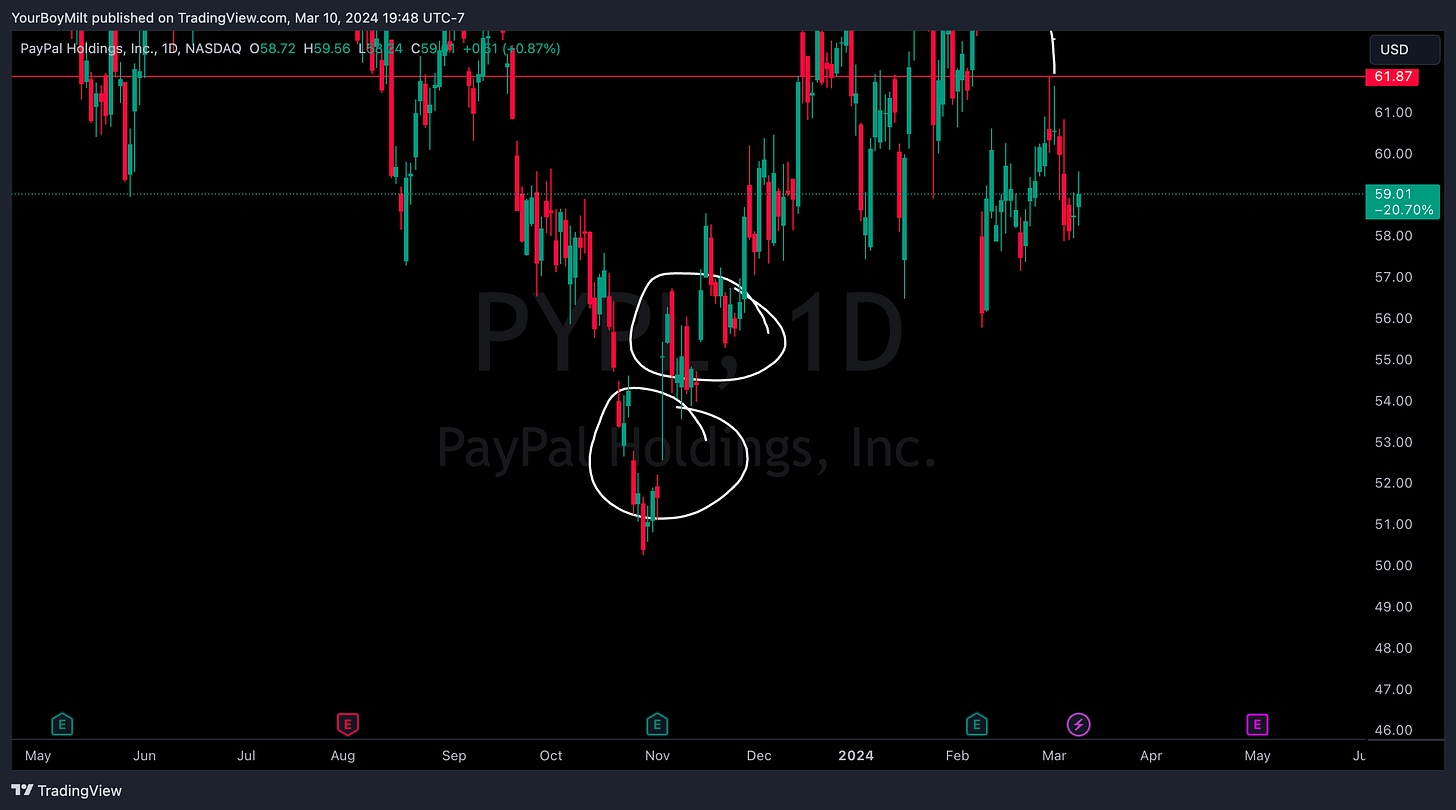

Pt. 2: Our trader, Joe-Don’t-Know-Flow, is all about it! But then he looks at the chart a little bit closer…

Pt. 3: He spots those two small gap fills down to 54.69 and 52.22. Defeated, Joe gives up on getting a good PYPL play and starts looking for shticoins to long.

…But Joe remembered he was a YEET+ Subscriber, and he saw his boy Milt breaking down that SPY bearish flow, calling for a relatively significant drop in levels

…and the Price Action chart had levels as well for if that does indeed occur.

He also did what Milt is always harping on and checked the net premium for PYPL and made a small note that the call buying sentiment greatly inverted SPY.

So, while everyone else will freak out if SPY does indeed drop next week, Joe actually already had a long that he loved and just needed a dip for—market flow combined with PYPL Price Action has given Joe an excellent play on the bounce. Yes! A YEET PRIME ENTRY! And if entry doesn’t come, there’s plenty of fish in the sea because he’s a YEET+ Subscriber and they’re just tossing out bangers left and right! He gets so many MFing emails and notis from Milt his friends think he’s popular!

🚀YEET Call: PYPL 4/19 65c // Prime Entry: 54.49 (fine), 52.22 (optimal)

😎 Next up…a spicy weekly