🔥 YEET 30 for 30: 5 Trades in November—The Simple Flow/Chart Tricks That Went 5 for 5 Today

Four day trades explained, then NVDA earnings call we got with flow

🔥 YEET 30 for 30: 5 Trades in November—5 Simple Flow/Chart Tricks That Went 5 for 5

🚨 NOTE: YES…WE GOT NVDA WITH FLOW!: the key to NVDA and Chip flow was all in our new Whales to Watch Sector Scoring: here were the scores published this weekend in The YEET so subscribers…you KNEW this was coming:

🔥 THIS PAST WEEKEND’S SECTOR HEATBOARD (5-Whale Scale)

(Ranked by same-direction, multi-contract alignment across all filters)

🐋🐋🐋🐋🐋 Semiconductors

🐋🐋🐋🐋🐋 Software Infra / AI Infra

🐋🐋🐋🐋 Healthcare / Pharma

🐋🐋🐋 Automotive / EV

🐋🐋 Industrials

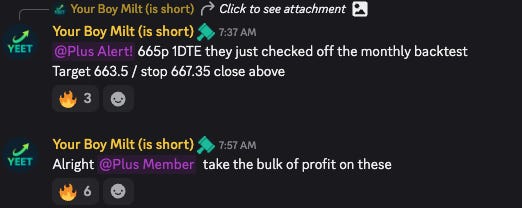

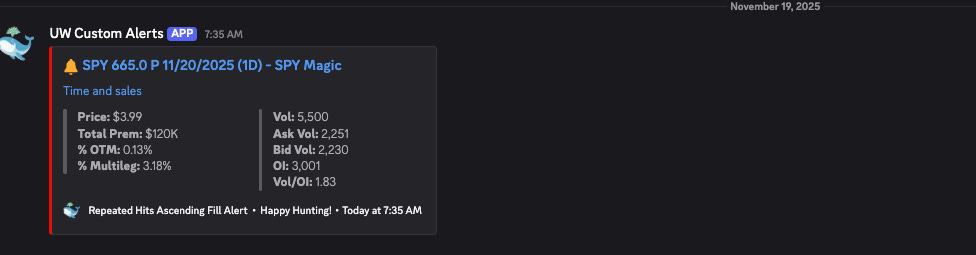

🏀 Game 1: SPY Puts on the Monthly Rejection w/ Magic Confiormation

We opened with a massive SPY candle that looked like it wanted to run — but SPY Magic instantly told us something different.

Only one bearish confirming order showed up, and nothing supported upside continuation.

Then SPY tapped a monthly level to the exact cent and rejected violently.

Easy Trick:

When a monthly level taps perfectly and rejects instantly, that’s The Dink — the cleanest sell signal in the game.

Result: textbook rejection → SPY puts print.

🔔 Tool Used: SPY Magic Alerts (YEET Plus)

This read relied on SPY Magic’s “no upside confirmation” signal — available with YEET Plus.

🏀 Game 2: Triple Weekly Support + Far OTM Magic Call

Price wicked right off a triple weekly cluster — weeklies, gap levels, and a homemade sitting right underneath.

Then SPY Magic dropped in a far OTM call that acted like a pressure valve, hinting that buyers were lurking.

Easy Trick:

When multiple levels are stacked together, they almost never break on the first attempt. Treat tight clusters like reinforced concrete.

Result: bounce off cluster → long wins.

🔔 Tool Used: SPY Magic Alerts (YEET Plus)

The far-OTM upside ping came directly from the Plus-only SPY Magic stream.

🏀 Game 3: ES Weekly Level Fail → Hidden Flag

SPY looked strong, but ES kept failing its weekly level — not once, not twice, but three times.

After the third fail, ES settled into a flag, revealing the real structure beneath the chaos.

Easy Trick:

When you’re unsure whether SPY is breaking out for real, switch to ES and check if you’re seeing a monthly or weekly level there even if not on SPY.ES exposes the truth every time.

Result: rejection → clean downside read.

(SPY Magic was informational here, but the read was primarily price-action + ES.)

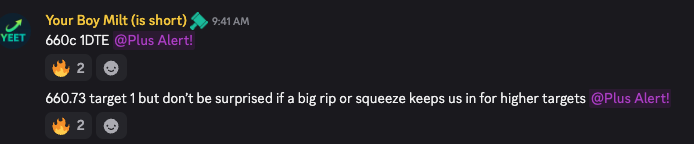

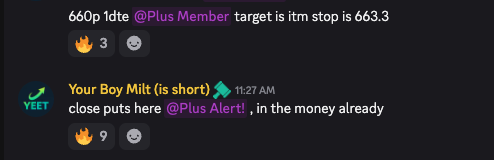

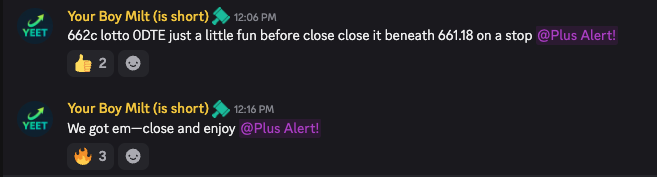

🏀 Game 4: The 662c 0DTE — “Fourth Quarter” Play

Clock ticking.

45 minutes left.

SPY floating right under the trigger.

SPY Magic still had multiple calls open into the close, and price formed a Flying V — our intraday squeeze setup. We called the 662c with under an hour left, and SPY ran to 664+.

Easy Trick:

Flying V + upside calls still open = late-day squeeze potential.

Result: instant momentum → W #4.

🔔 Tool Used: SPY Magic Alerts (YEET Plus)

This play came directly from + the Flying V setup + open call structures visible on YEET Plus.

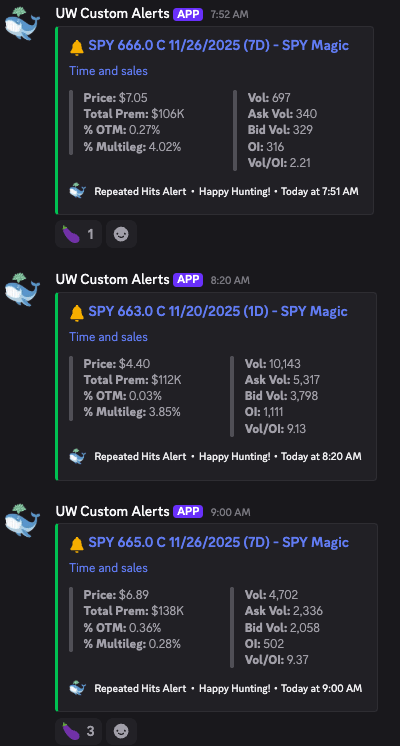

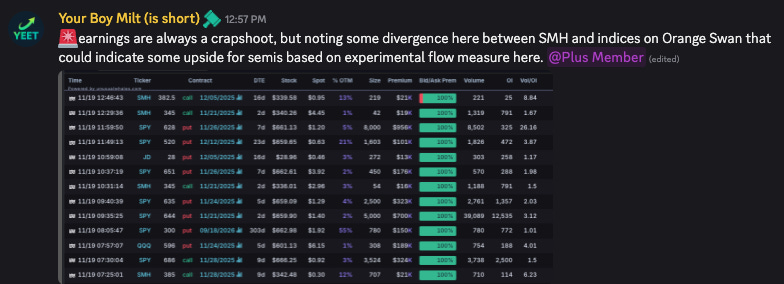

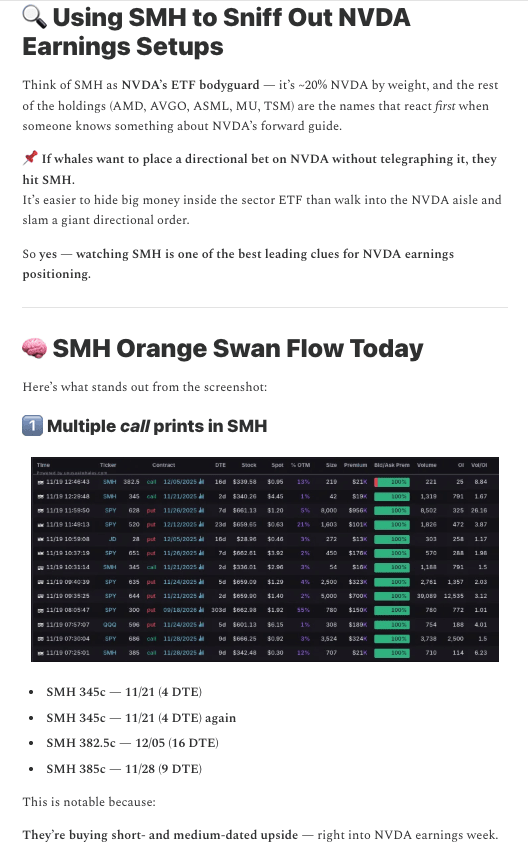

🏀 Game 5 (Overtime): NVDA Earnings Win

The finisher.

🍊We used the brand-new Orange Swan Divergence readings, and they started lighting up before the actual earnings:

Broad market flow = bearish

SMH flow = sneaky upside

NVDA appetite = hiding inside sector ETF calls

Divergence lines started tightening — a pre-earnings tell we’ve seen before

That divergence said:

“NVDA is going to be the outlier — don’t fade this one.”

Result: NVDA earnings reaction → Win #5.

🔒 Tool Used: Orange Swan Divergence (YEET Plus)

This read comes from the PLUS-only Orange Swan Divergence engine — not available publicly.