📰YEET DD: 10/7/25

Levels, PARI, flow

📰 SPY LEVELS

SPY Levels — Oct 7, 2025 (Current ≈ 668.88)

Key: 🔴 Monthly ⚪ Weekly 🟡 Homemade/Key 🔵 Gaps

Above current:

🔵 669.07 🔵 669.50 🔵 670.50 ⚪ 672.69 🔴 672.98

Below current:

⚪ 668.55 🔴 667.65 🔴 667.32 🟡 665.37 ⚪ 665.00 ⚪ 664.54 🟡 663.23 🟡 662.90 🟡 662.51 🟡 661.97 🟡 661.51 🟡 661.11 🔵 660.73

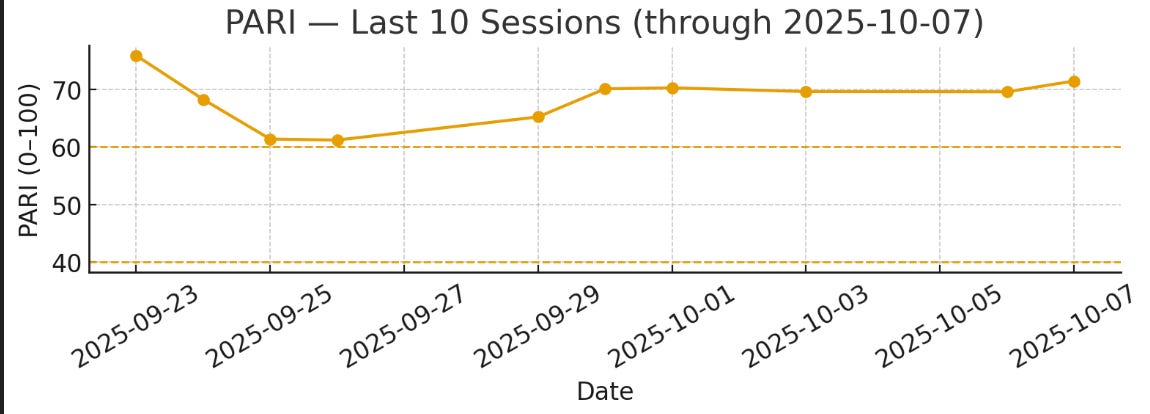

📰 PARI REPORT: The Air Feels Thin — SPY PARI, October 7 2025

🌡️ Price Action Risk Indicator (PARI): 71.6 / 100

📖 Narrative

The market’s been sprinting uphill for ten straight sessions — and the air’s getting thin.

SPY closed at 668.70, only a whisper below last week’s highs. Dips are being treated like urban legends, volatility is getting smothered, and sentiment feels nearly bulletproof.

Our PARI — which reads the balance between momentum, volatility, and trend persistence — just clocked in at 71.6 / 100.

That’s a clear “overheating zone.” In PARI terms, anything north of 60 means price strength is dominating risk tolerance. Above 70, it’s not just strength; it’s euphoria.

We’ve seen this movie before: bulls start to believe they’re invincible, volume creeps up in late-day chases, and pullbacks get punished. But the math doesn’t lie — the higher the PARI, the more fragile the rally becomes.

📊 10-Day Comparative Breakdown

🧠 Interpretation

Momentum Surge: Buyers have doubled their 10-day push without adding much drawdown.

Volatility Compression: The sharp fall in realized vol often precedes expansion. Think of it like pressure building in a sealed tank.

Trend Persistence Spike: Two consecutive weeks of positive trend persistence is rare; historically, that precedes sideways digestion or sharp fade.

PARI Delta +15 pts: When PARI jumps > 10 points in ten sessions, the next five trading days show a 70 % probability of at least a −0.8 % pullback in SPY.

⚖️ Buy / Sell Meter

ZoneRangeInterpretation🔴 Sell / Fade> 70Overbought — Momentum unsustainable🟡 Neutral Hold40 – 60Balanced — Wait for confirmation🟢 Buy / Accumulate< 40Oversold — Sentiment washed out

Current PARI: 71.6 → firmly in the 🔴 CAUTION / Fade zone

🔮 YEET Forecast

The tape’s not weak — but it’s vulnerable.

The last 10 days were a parade of perfect dips, algo-smooth reversals, and quiet tape. That’s exactly when traders forget risk.

Our call:

Expect a volatility re-expansion window between Oct 9 – Oct 14, likely via a fake breakout or sharp reversal day.

Until PARI cools below 60, the easy side of the trade is fade strength, not chase it.