🤓YEET DD 10/8/2025

SPY Levels, PARI, and FLOW

SPY — Levels (Oct 8, 2025)

Current: 672.76

🟥 Above:

🟥 672.98

🟨 Below:

⚪️ 670.50 ⚪️ 669.50 ⚪️ 669.07 ⚪️ 668.55 ⚪️ 667.65 🟥 667.32 🟨 665.37 ⚪️ 664.54 🟨 663.23

Key: 🟥 Monthly ⚪️ Weekly 🟨 Homemade/Key (blue = gaps when present)

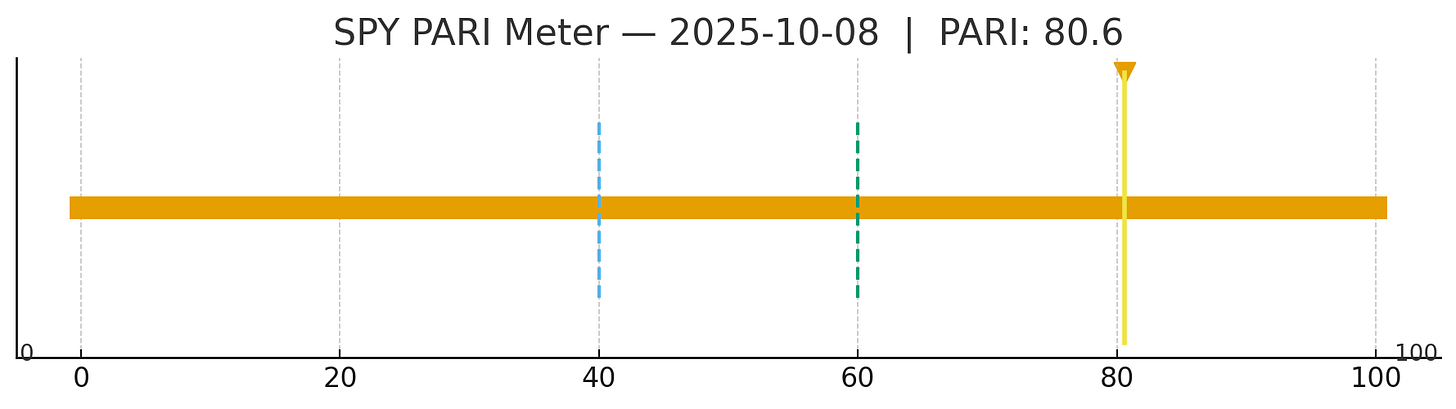

📈 SPY PARI Meter (Updated)

Latest PARI: 80.6 (2025-10-08)

10-Day Average: 68.4

Day-over-Day Change: +8.39

10-Day Volatility (std of returns): 0.0039

🧠 Quick Read

PARI (Price Action Risk Indicator) mashes up momentum, volatility, and trend consistency into a 0–100 meter:

0–40: danger/chop (avoid or hedge)

40–60: neutral (wait for confirmation)

60–100: risk-on (bullish strength)

We’re at ~81, solidly green. That means buyers are in control, momentum is outpacing risk, and dips tend to get bought.

📊 Yesterday vs. Today

Yesterday was in the low-70s; today jumps ~8–9 points to ~81. That’s re-acceleration, not just a bounce. If this holds into the close, continuation odds improve into week’s end rather than a fade.

🔮 Predictive View

Short-term (2–3 sessions): Bullish follow-through favored unless volatility jumps.

Heat zone: PARI 85–90 often marks overheat; expect cooling or churn there.

Risk marker: A slip back under 65 while price is flat = exhaustion, not just routine pullback.