🛩️ YEET D.D. 11/12/25 — The Flying V

Shoot and win!

🛩️ YEET D.D. 11/12/25 — The Flying V

We’ve been hammering this setup in YEETs for about five sessions straight now.

At this point it’s basically the Madden 2004 Michael Vick screen-pass spam of price action — the defense knows it’s coming, and it still works.

Today was a textbook version

📉 Step 1 — Identify the Overnight Downtrend

Start by mapping out what SPY and ES did overnight. The key is simple:

Three wick touches = an active downtrend. This gives you the “left wing” of the Flying V.

Once you’ve established the slope from premarket → open → early session, you know exactly what SPY has to break to flip the script.

🔮 Step 2 — Wait for Flow in the Opposite Direction

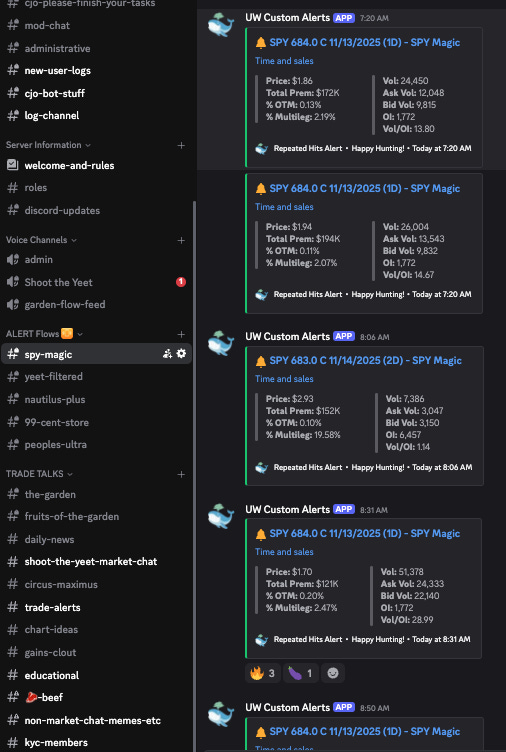

This is where you get the edge for more profits; instead of waiting for a textbook trendline retest, you let SPY Magic or your preferred index tracker tell you the reversal pressure is real.

A block, a ladder, or repeated hits in the opposite direction is your early alarm clock.

Flow confirms conviction → conviction gives you more room to profit → you get paid earlier than the chart alone would allow.

Today we had 685c, 684c, 683c all firing in a sequence right as the downtrend was losing steam and hitting support

This is Step 2 of the Flying V — flow turns a potential breakout into a high-probability pivot.

📈 Step 3 — Draw the Uptrend and Ride It

Once the breakout candle prints and flow confirms it, you draw the new trendline in your favor.

Preferably off 15-minute candles — an hour or more of clean structure gives you a far safer and smoother ride.

The right wing of the Flying V forms once the breakout confirms → retest holds → higher lows start stacking.

WE’RE FLYING

🚪 Exit Strategy

Two clean, simple options:

Option A — Highest Calls on SPY Magic

Once you see the peak contract in the ladder or repeated hits — that’s often where whales stop pressing.

Option B — Trendline Break

If your risk tolerance is lower, or if you’re holding 685c, you can exit the moment your trend breaks on the timeframe you’re using.

5-minute = more aggressive.

15-minute = more conservative.

Both valid — just know your style.

🚨YEET Plus: Orange Swan + Whale Selections Including a 2 Million Dollar Order On Something Relatively Obscure, Plus…

SPY Magic 90 % ITM System — the flagship auto-alert that’s caught almost every major intraday reversal this quarter.

Orange Swan Filter Link & Score in YEETs when applicable — macro flow sentiment meter that caught three major dumps.

People’s Screener ULTRA — real-time “public flow” radar built for retail-friendly whale detection.

Block Party Filter — smart-weighted positioning tracker for crypto-adjacent and speculative names.

Nautilus Megafilter Series — institutional flow stones (Casino Royale, Freelance Five, SPY Ballistic, etc.)

📈 What You Actually Get

Live Whale Flow Feed inside Discord, and access to four private alerts channel and Garden discussion Channel. As well as Fruits of the Garden for Milt plays.

Morning “Best of Flow” FULL summaries.

YEET D.D. deep dives, macro reads, and education built straight from live trades.

Access to every new filter drop the moment it’s released (no more waiting for previews)