⚡️ YEET DD 11/20/25: Volatility Inc

What makes price action go crazy--and how to play it.

⚡️ YEET DD 11/20/25: Volatility Inc

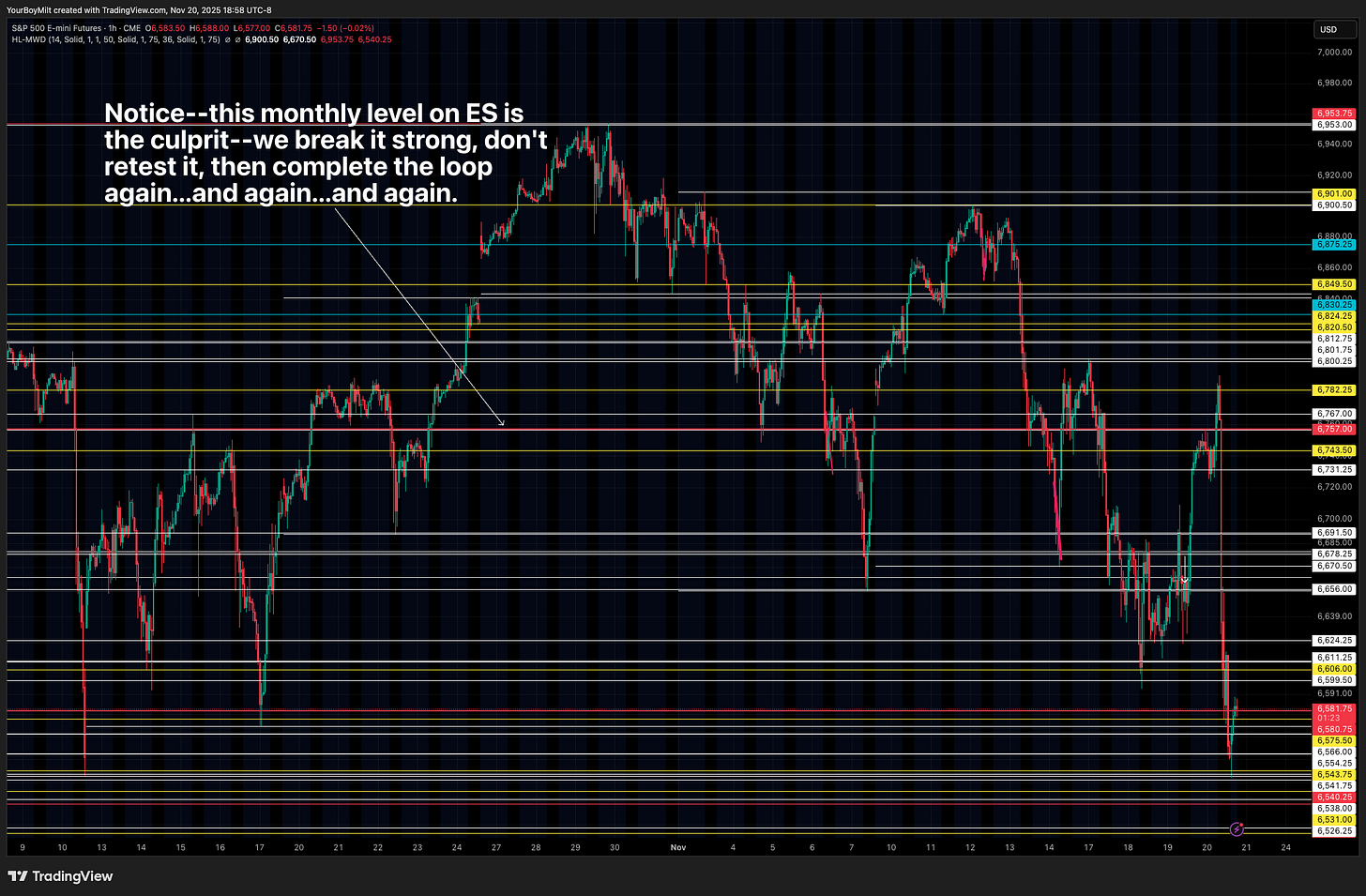

🎬 Volatility explained through simple Price Action

SPY LEVELS

Key: 🔴 Monthly ⚪ Weekly 🟡 Homemade 🔵 Gap

Levels Above (ascending)

657.29 657.89 658.38 658.87 659.30 659.71 660.73 661.25 661.90 662.13

662.17 662.27 663.27 664.19 664.54 665.37 665.77 666.37 668.74

669.19 670.50 671.90 674.49 675.64 676.04 679.33

Levels Below (descending)

653.17 652.84 652.33 651.91 651.07 650.88 650.38 649.92 649.62

648.42 647.77 647.08 646.94 646.59 646.19 646.10 645.72 645.54

645.29 644.94

📈 SPY ANALYSIS – Volatility Inc.

🔥 Why Volatility Explodes

Volatility increases when the market skips several price levels in a single move. Each skipped level becomes unfinished business. These untested areas behave like magnets 🧲 that pull price back even if momentum is strong.

📊 The Skipped Level Chain Reaction

When ES or SPY skip levels in clusters, a predictable pattern follows:

A large candle pushes through several levels

The trend appears stronger than it really is

Price returns to test the skipped levels

The return move creates another outsized candle

This is why volatile markets feel like they whip back and forth. The structure underneath the chart is uneven and the market is trying to balance itself ⚖️.

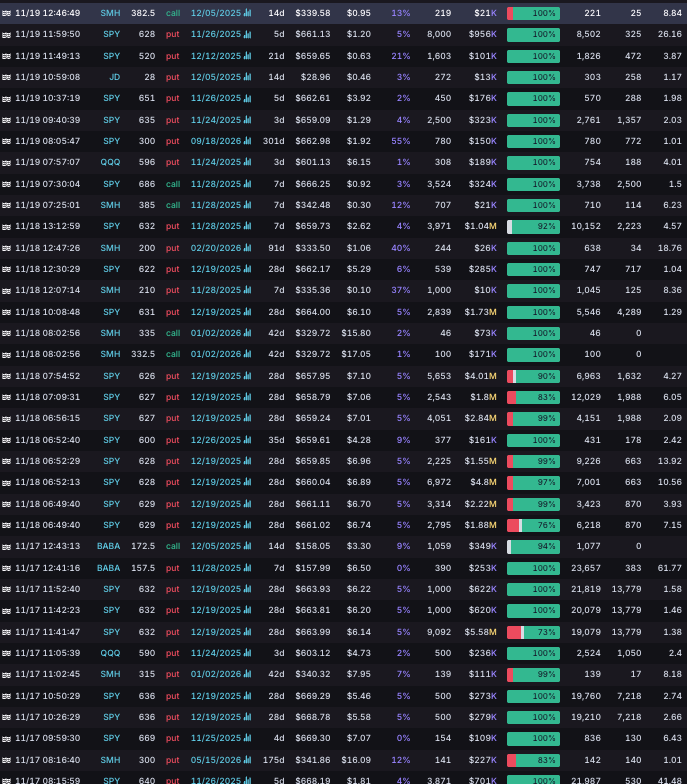

💥 Flow as Confirmation

Options flow during high volatility reflects traders reacting to the structural imbalance. You often see

Big prints after oversized candles

Flow leaning toward the idea of forced retests

Volume spikes that enhance each swing 🔊

Flow combined with skipped levels gives a reliable sense of whether volatility is likely to continue.

🔁 The Volatility Cycle

A monthly level gets cleared without testing. Price snaps back to touch it. Price then bursts toward the next skipped area. Price snaps back again.This creates a recognizable loop:

🚀 Overshoot

↩️ Retest

🚀 Overshoot

↩️ Retest

What looks like trend reversals is often just the market completing tests it avoided earlier.

🧩 What Ends the Cycle

The volatility cycle slows once the following conditions start appearing:

Skipped levels finally get retested in the same day

Monthly structure begins to hold

Candle size starts shrinking

Flow becomes less aggressive and more balanced

These signals normally lead into consolidation and a return to more normal market behavior