📰YEET D.D. 11/5/25: The SPY Gap Shadow Whale Wars

The market moves of today and tomorrow made simple.

📰YEET D.D. 11/5/25: The SPY Gap Shadow Whale Wars

📑 Table of Contents

🎥 SPY Video Recap

📈 Price Action Explained

🐍 SPY Flow Explained

🐳 YEET Plus: Four Picks

🚨The new agenda in the SPY portion of The YEET is to explain daily market movement so you learn as we go, or maybe see things from a different perspective than news, which is almost always fake, made-up headlines that respond to price action rather than the other way around. This is because algos determine the market, the news just accelerates the mechanism. But that’s a longer story.

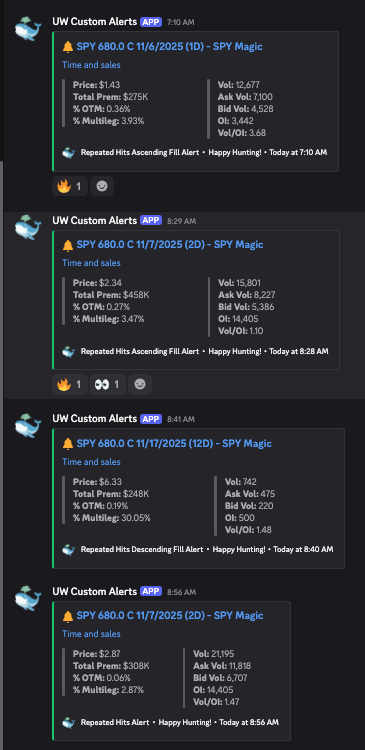

To show this isn’t hindsight trading or do as we say not as we do, here’s some of the work in THE GARDEN (private discord channel) today:

🎥 Today’s Market in 5 Minutes:

📝 Full Breakdown Below:

🌙 Last Night: The ES - SPY Gap Shadow War

To really get what happened today, you’ve gotta start overnight with ES.

While SPY was sleeping, ES was testing that monthly (🔴) level and passed it.

That move filled the leftover downside SPY gap, gave us the new trend channel, and basically wrote the blueprint for the day.

By the time we opened, those first three candles had already told the whole story:

✅ Monthly level tested

✅ Retest successful

✅ Clean trend locked in

So, going into the morning, the only real job was simple:

Buy calls and sell when a candle breaks the overnight trend.

🧠 The New Algo Seasonality

Now here’s what’s weird and may confuse some; we’re in a new algo season, and the rules have changed.

Normally, when you break a gap plane, it closes. Easy.

But lately?

1️⃣ They break it.

2️⃣ They stall.

3️⃣ They reverse and leave it open. Multiple times.

It’s like the algos refuse to finish the move, holding price right above the gap to bait shorts and fuel a push higher.

You can literally see it from this past month repeatedly; break, tease, reverse. Three times in a row.

That told us:

💡 Daytime algos are fighting to keep things going bullish.

The fills are happening only overnight, when a different algo set takes over.

☀️ The Open — Following the Blueprint

When we opened, SPY was already living inside that overnight roadmap.

The daytime algos (below algos) were locked on “up mode,” testing but refusing to close those gaps.

All you had to do was:

➡️ Follow the trend drawn by ES overnight.

➡️ Watch for a clean break below trend to sell.

You could’ve literally just said,

“I’m long until this breaks the overnight established trendline.”

🔮 The Confirmation — Filters Don’t Lie

Morning flow gave the warning signs early:

💫 SPY Magic: Showed continuation to 680 off the open in our Discord alerts, especially around the 686/681 range, but with some real divergence from flow.

🧡 Orange Swan: Caught a big wave of puts into the pump — not just hedges, actual bets.

And sure enough, after running up through 680s, we got the trend break at the end of the day — textbook exit.

You could’ve sold there and still been basically at the high.

💥 The Dump and the Catch

Once the break came, the move flushed right to the⚪ Weekly and 🔵 Gap levels — around 677.34 — and stopped cold.

That backtest was needed; they’d gone up all day without touching it, so the market had to come back down and check that box.

🧩 The Simple Way to See It

You can draw the whole day like this:

↘️ Downtrend → 🔄 Breakout → 🚀 Retest → 💎 Bounce → ❌ Break → Sell

That’s all it was — a clean, tradable structure.