📰YEET D.D. 11/6/25: Groundhog’s Bounce

Today's market explained through price action and flow, plus a signature trade

📰YEET D.D. 11/6/25: Groundhog’s Bounce

📑 Table of Contents

🎥 SPY Video Recap

📈 Price Action Explained

🐍 SPY Flow Explained

⭐️ YEET Plus: A Signature Trade!

🚨NOTE—SUCCESS: Automatic alerts are officially working for all intended filters. Plus Discord now gets automatic notifications for alerts from:

SPY Magic

Nautilus

People’s Screener Ultra

The Dollar Store (all contracts under 1.00)

Freelance Five Ultra

🎥 Today’s Market in 5 Minutes:

🧱 SPY Structure: What Really Happened

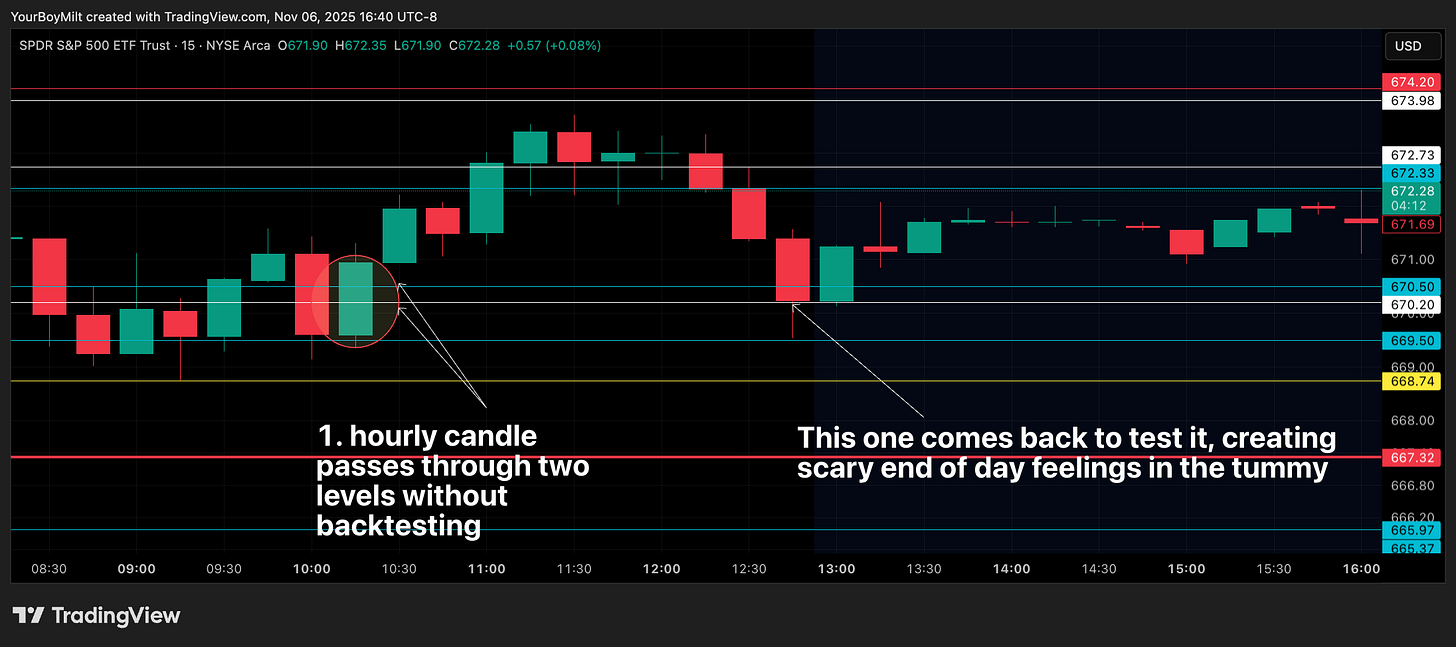

1️⃣ The “Random” Bounce That Wasn’t

So this looked like a messy day, but it really wasn’t. That bounce we got?

Not random — it hit a previous top perfectly, one of those 🟡 homemade levels.

When we’re in a wide, choppy move that’s drifting lower, the old peaks you see on the chart start acting like magnets. Old resistance turns into new support. That’s exactly what happened today.

We dumped right into a prior high and reversed to the cent. If you had that line drawn, you’d already know that was the level they wanted to test.

👉 Bottom line: The day’s low wasn’t luck — it was just a clean retest of an old top.

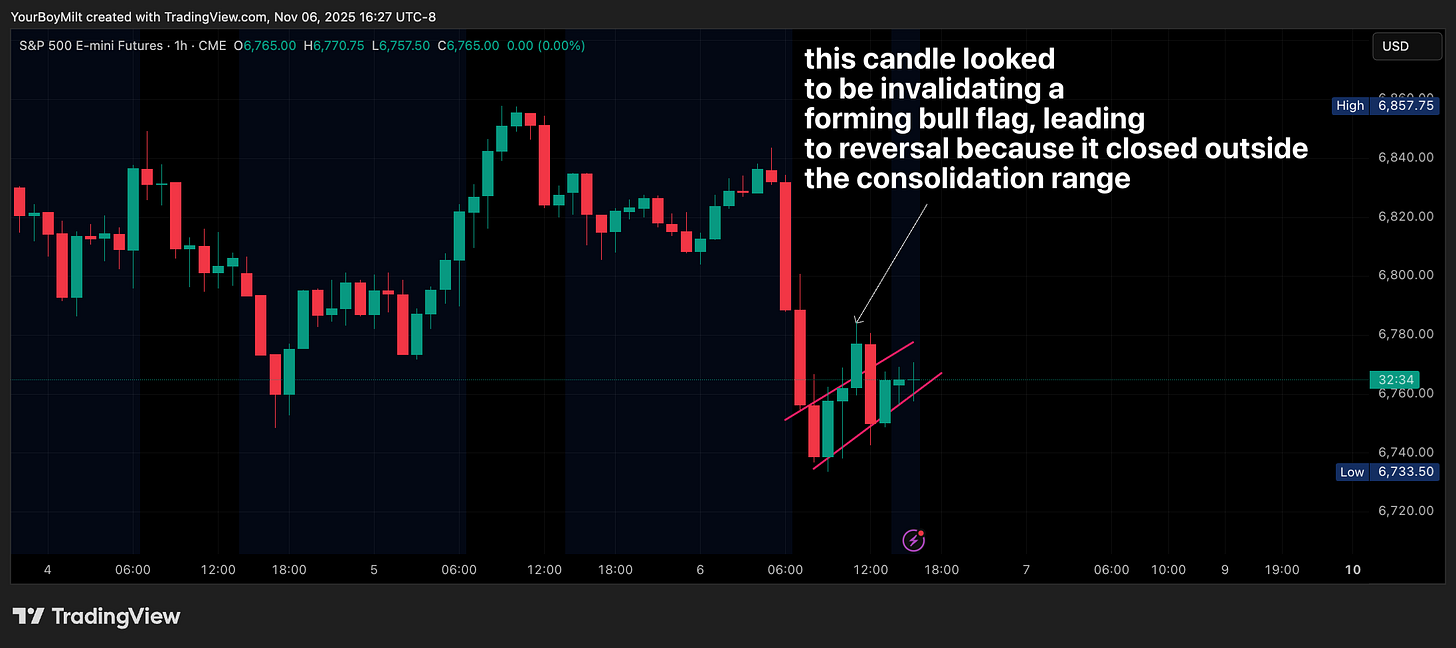

2️⃣ The Fake Flag That Fooled Everyone

Middle of the day it looked like we were breaking down from a bear flag, right?

Everyone and their cousin thought it was about to unravel — but that candle that “broke out” above the flag actually skipped a bunch of levels.

Here’s the trick:

If a move hops three levels (monthly, weekly, or whatever) in one hourly wick, it hasn’t really tested anything.

So what do they do next? Drop it back down, back-test all the skipped levels, shake some retail out, scoop cheap premium, and then continue higher.

👉 Bottom line: Don’t chase those one-wick breakouts.

If they skip the homework (no back-tests), it’s almost always coming back for a retest. That’s the patient entry.

💰 How To Trade It Today Made Simple

3️⃣ The Trend Break That Flipped the Whole Day

All morning the short trend was holding, clean and steady. Then you can see that 15-minute trendline finally gave out — closed right above it. That’s your long cue.

Once it closes outside the uptrend just like yesterday, that’s your signal the move flipped.

Same playbook every time:

“Short until the short trend breaks. Long until the trend breaks.”

That’s exactly what YEET Plus did: shorted the first leg, flipped long on the break, rode it up.

👉 Bottom line:

The structure looked wild, but it was simple — old top = new bottom, fake flag shakeout, then trend break reversal. Once you start spotting those three things in real time, these days stop feeling random.

🐳What the Flow Said

Today’s dump was easy to catch on the Orange Swan filter— once I saw several put orders come off the open we went with puts in the Garden. Days like this

⭐️YEET PLUS: Signature Trade

Signature Trades have a 80% rate of achieving 50% or more profits, 70% plus reach over 100% profits.