🚨 YEET DD 12/18/25: Tension and Relief (Mid Day Special!!)

Where do we go now? Retail has questions--we have answers!

🧠 YEET DD: Tension and Relief

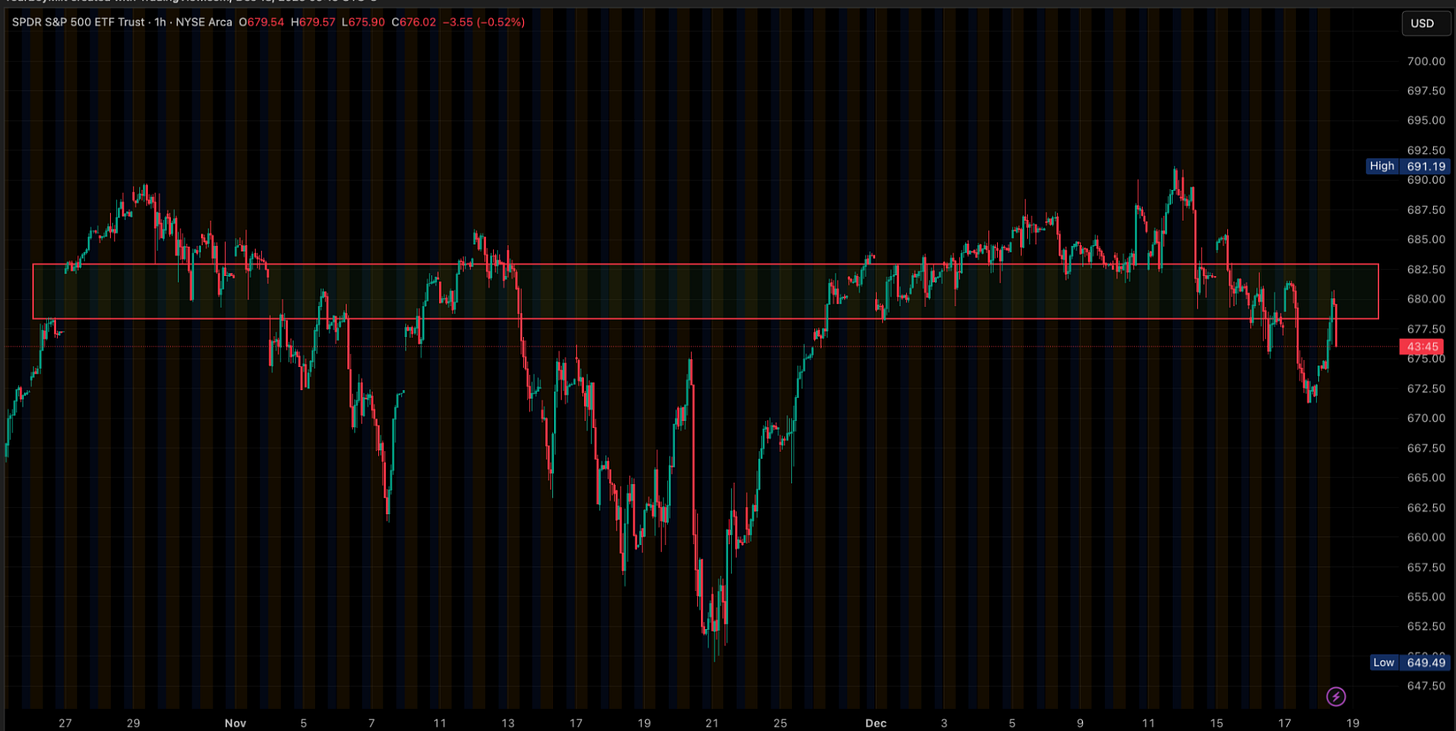

📦 The Range

That red box is the whole story right now.

It is a tension zone where SPY repeatedly:

enters

chops

rejects

re-enters

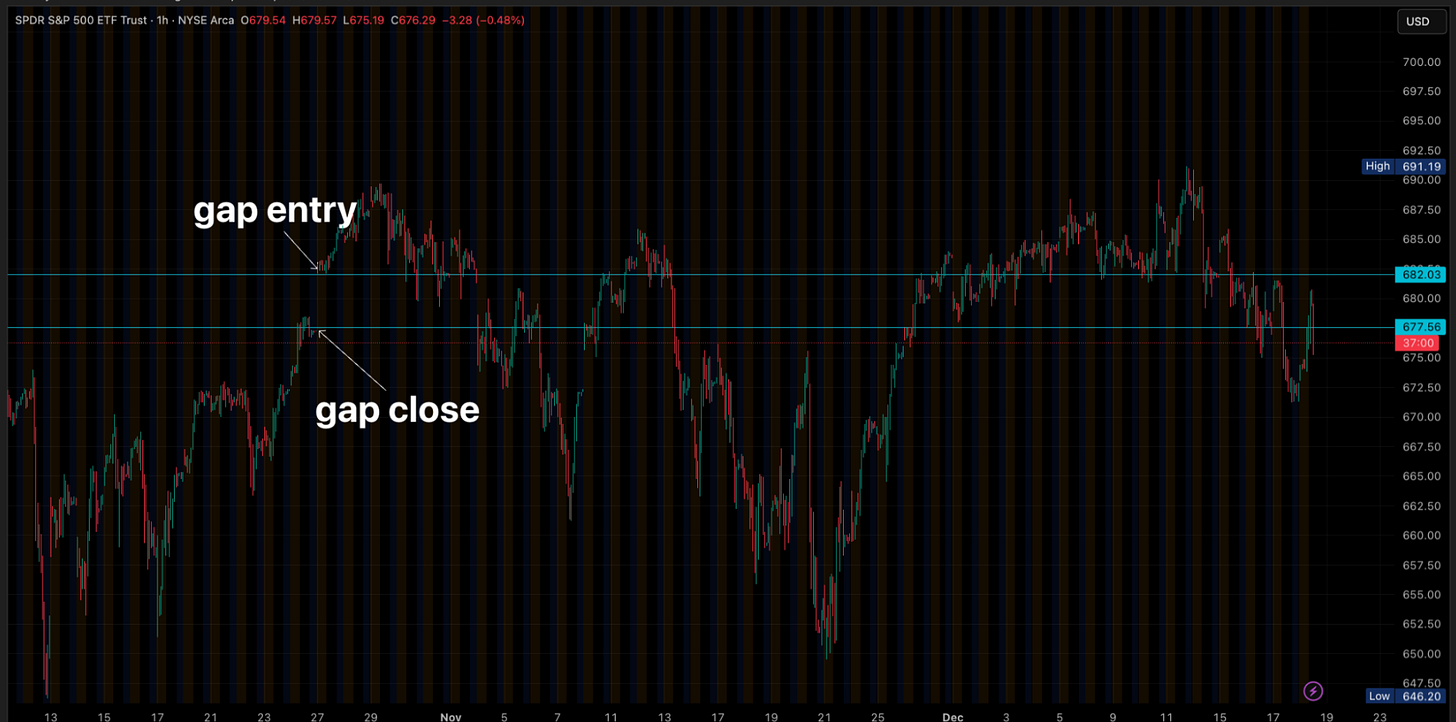

For the price action nerds, the boundaries of this box line up almost perfectly with a legacy gap from last month:

Gap entry near the top boundary

Gap close near the lower boundary

Market memory. Same levels. Same fight.

🔧 Structure: Why We Didn’t Long Yet

There are two clean ways out of a range like this.

1) ✅ Trend break + retest hold

break the downtrend

reclaim

retest

hold

We got the breakout candle, and now we’re watching the retest on the hourly. That’s the difference between “breakout” and “bait.”

So we waited.

2) 🧱 Range resolution

If structure is not clean, the market often resolves by:

sweeping one side of the box

snapping back through the middle

then trending

That’s where whales matter.

🐳 The Whale Angle: “When” Matters More Than “What”

I remembered how ballistic the downside signaling has been lately. FARCRY has been consistently flagging risk-off contracts showing up with persistence.

Then we saw a very specific pocket during the drop that did not feel like random fear buying. It felt like something “knew.”

So the key question became: