🚀YEET DD 9/11/25: SPY Levels, PARI (was right again), Flow Picks

Jam packed

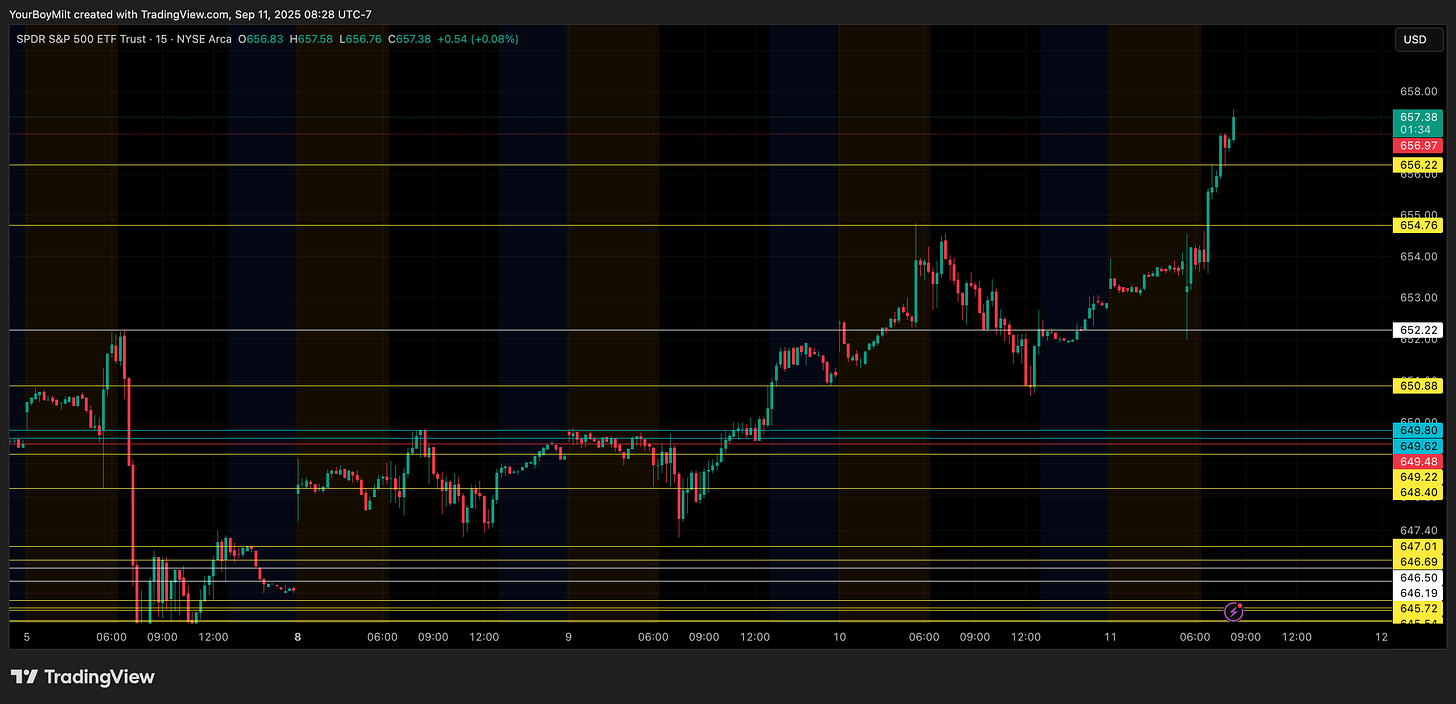

📏 SPY Levels Key

🔴 Monthly | ⚪ Weekly | 🔵 Gap | 🟡 Homemade

🔽 Levels Below (closest → furthest)

🟡 656.22 🟡 654.76 ⚪ 652.22 🟡 650.88 🔵 649.80 🔴 649.62 🔴 649.48 🟡 649.22 🟡 648.40 🟡 647.01 🟡 646.69 🟡 646.50 🟡 646.19 🟡 645.72 🟡 645.54 🟡 645.49 🟡 645.44 🟡 645.21 🔵 644.28 🔵 643.92 🔵 643.72 🔵 642.87 🔵 642.82 🟡 642.18 🟡 642.15

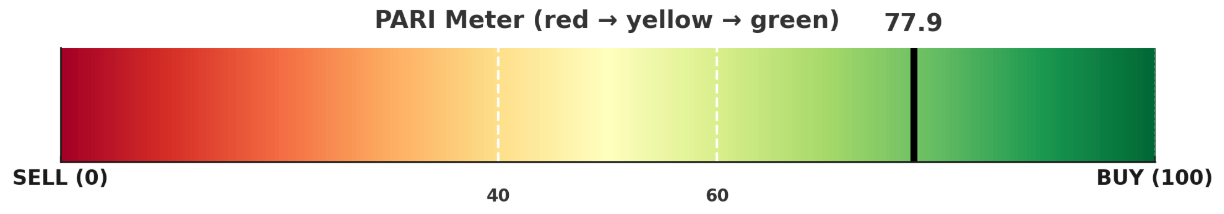

📈 PARI (Price-Action-Risk Indicator)

🚥 PARI Meter (red→yellow→green) — Current: 77.9

0 = SELL (danger) | 40/60 = chop guides | 100 = BUY (acceleration)

📍 Pointer in the green. Historically, bigger runs often cool closer to 80–85, so there’s still room but watch for heat there.

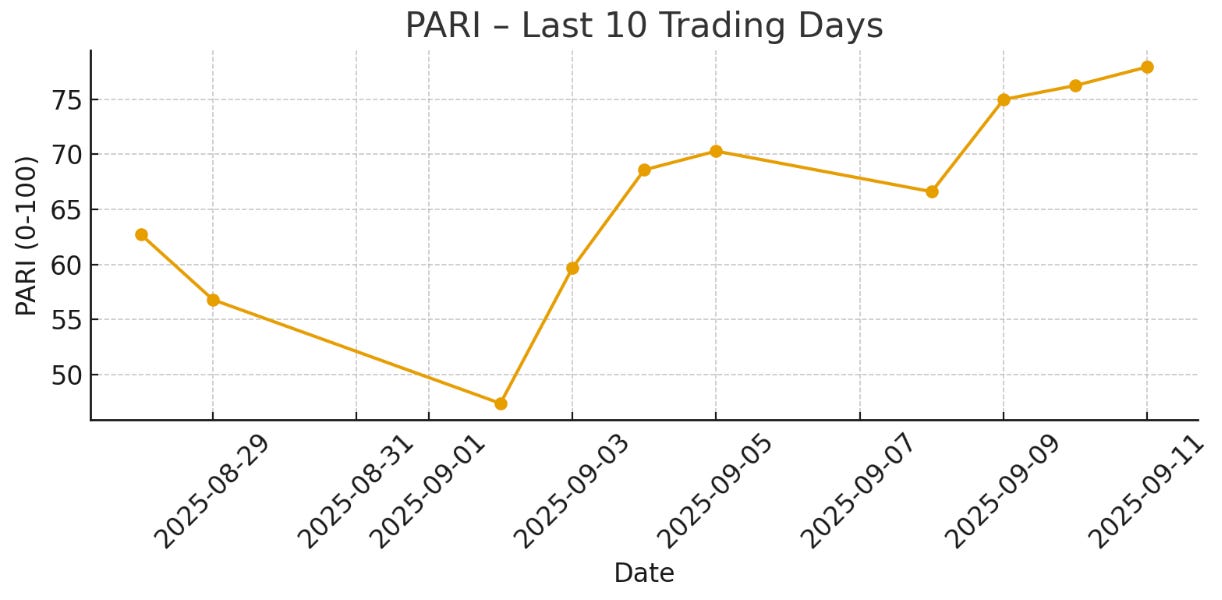

🔟 Last 10 Trading Days

📈 Trend: Climbing from high-50s to high-70s.

🧠 Read: Momentum improved quickly after a brief fade; buyers seized control.

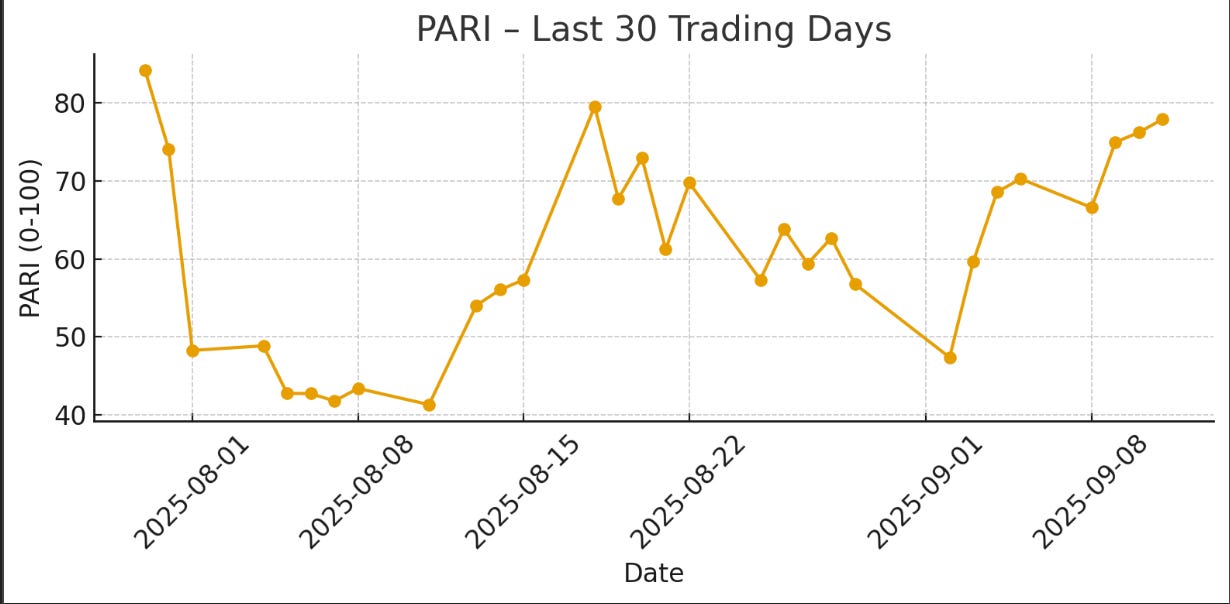

🗓️ Last 30 Trading Days

🧭 Path: Pullback → base in low-40s → steady march into 70s/80s.

🧠 Read: The up-cycle has multiple higher lows in PARI; thrusts have been sustained.

🧪 Layman’s Summary (no hedging)

🟢 Bias: Bullish. PARI is in a strong zone and rising.

🧲 What this usually means: Dips tend to get bought until PARI rolls over or price loses key support.

🧯 Where it can fail: A decisive PARI slip back under 60 or a price loss/reject below ⚪ 652.22 would cool the tape.

✅ What To Do (Trader Playbook)

Day/Swing Longs:

🟢 Favor buy-the-dip into reclaimed supports (656.22 → 654.76) with tight stops just below the level you’re using.

🎯 First upside management: trail into 80–85 PARI (heat zone) or use intraday structure.

Risk Guardrails:

🔻 If PARI closes <60 or price falls/holds below 652.22, shift to neutral/chop stance.

❌ If we also crack the red/blue cluster near 649.6–649.8, reduce risk—sellers taking control.

Positioning Notes:

For options, slightly OTM calls on dips to 656/655 supports; avoid chasing when PARI >82 without fresh consolidation.

If you must fade, wait for PARI roll + lower-high and rejection at a level (ideally near 80–85 PARI).