🔮 YEET DD: Sunday Service #1 — How We Win Next Week

All the tools you need to have a great week ahead...

🔮 YEET DD Sunday Service

Your weekly reset before the chaos starts

Welcome back. This one’s meant to get your head straight for the week — a quick rundown of the market’s risk tone, the cleanest flow + chart setups with real confluence behind them, and what to keep on your radar so you’re not walking into Monday blind. No noise, no hype — just the things that actually help you trade better out of the gate.

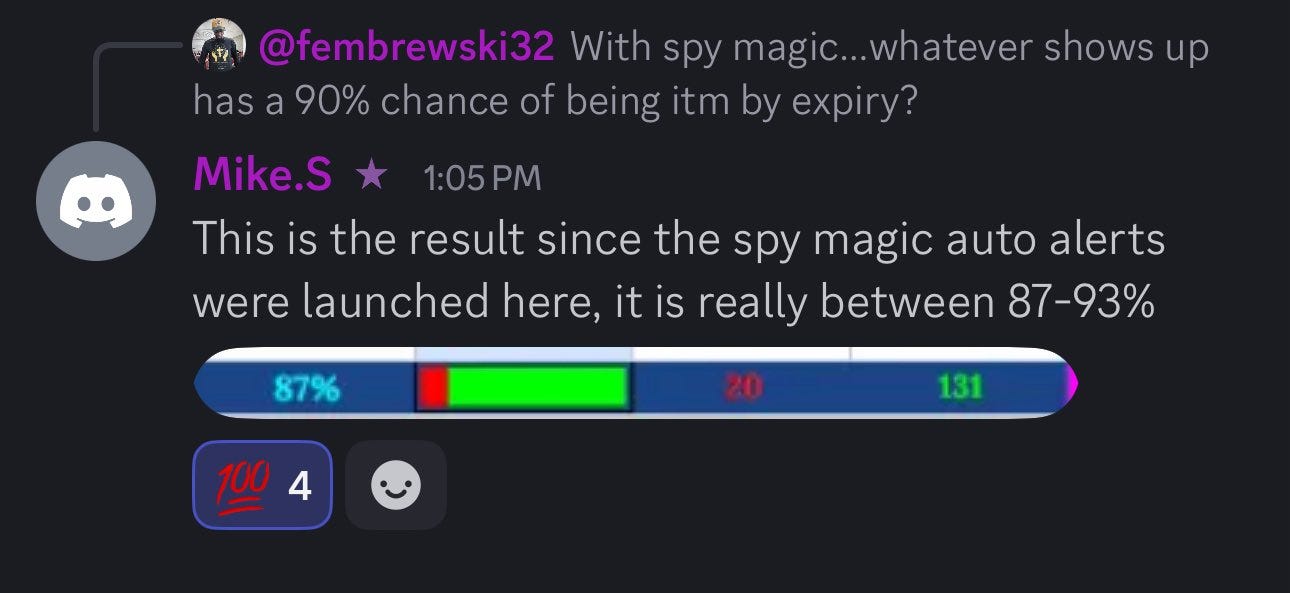

🚨Editor’s Note—Proof Pudding of 90% Filter

Many think when they hear our YEET Plus Filter SPY Magic has a backtested 90% in the money rate it’s a marketing gimmick. Well, Garden member Mike S. actually tracked the automatic alert performance—and the data is sound! Alerted automatically!

📹 Part 1 — SPY Video Analysis

Structural Key this week: If we reclaim it’s on, if we don’t she gone!

Pt. 2: SPY Levels

🔑 Key

🔴 Monthly ⚪ Weekly 🟡 Homemade 🔵 Gap

😇 Levels Above (ascending)

673.93, 675.64, 677.34, 678.55, 679.29, 679.95, 680.17, 681.25, 682.05, 683.26, 683.49, 684.00, 684.56, 684.96, 685.91

😈 Levels Below (descending)

672.90, 672.69, 672.33, 672.00, 671.49, 671.00, 670.50, 670.00, 669.50, 668.74, 668.40, 667.32, 666.00, 665.97, 665.08, 664.54, 664.19, 663.60, 663.23, 662.90, 662.73, 662.51, 661.80, 661.18, 660.99, 660.73

💎 What You Get With YEET Plus TODAY

🔍 PARI Reading

A daily look at where we are on our homemade risk indicator — what the reading means, how it fits the current cycle, and how to trade around it.

🔥 Top 3 Flow + Chart Setups

The three highest-conviction combos pulled from all filters:

multiple-contract confluence, one speculative OTM play, and clear trigger levels for both calls and puts.

💬 Other Plus-Only Benefits

Automatic Discord alerts from all premium filters and access to the YEET Plus Filter Suite of 10 filters and counting for different scenarios

Mid-day “Whales to Watch” updates on key contracts

Live callouts on actionable SPY 0DTE + 1DTE setups

Rapid updates when whales stack, flip, or ladder into major moves

🤓 Today’s PARI Reading: What is PARI

PARI is our homemade market risk gauge — a simple way to track how strong or weak the current momentum cycle is. It blends volatility, short-term trend behavior, and basic momentum into one number so you can instantly see whether the market is acting risk-off, neutral, or risk-on.