🏊 YEET D.D.'s Algorithm Intensive pt. 2: The Drown Protocol (flow stuff too, ofc)

This YEET is crazy thicc.

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Brought to you by: Your Boy Milt and His Sensei Abu OmegaTrigga

So, picture for a minute you’re trying to drown someone.

And I don’t mean a smooth and shadowy assassin situation where you dispatch some unsuspecting fool in their bathtub. This is the real deal—you’re on a boat or some other slightly elevated surface with leverage, arms extended and elbows locked, triceps forcing some soul into a one way trip to Atlantis.

It’s slippery. You’re trying to get the job done, but this clown is flopping and flailing like LeBron trying to get the free throw line in the fourth. Sigh. You know how it goes—the thrashing and the gasping, “I have a family!”…so on and so forth.

Sometimes when SPY is beginning the descent of a significant backtest, it too will show similar fight against the inevitable drowning of the market. As SPY moves downward in a series of lower highs and lower lows—a hallmark of Price Action submission—it jolts in bullish bursts like random thrashes of fight. Green candles burst and wick above and below the downtrend, like the frenzied arms of our soon-to-be-dead friend clawing to get back on the boat.

These index movements aren’t sporadic though: what you are actually seeing is the accelerated closing of backtests, gaps and levels.

But for all the thrashing and all the backtests, one thing we can count on is that different types of people and stocks are going to drown similar in ways—patterns. The obese? Sink straight down in one plummet . Athletic people are volatile and tend to rise high and then drop many times. This is in stark contrast to children who are, obviously, pitiful performers in this exercise. Myself and other African Americans would be the high performing group , as you can’t drown someone standing in the shallow end with arm floaties.

When NVDA drowns it drags all of tech down with it.

And when SPY drowns…it does it on the four hour interval, and it sinks about 10-12 points.

I was looking at charts and rough pattern emerged which can be described as repeated double tops that led to relatively deep dips of the same distance.

This pattern covered the chart on our way up to all time highs, appearing about every six weeks. wanted to be sure of what I was seeing, so I went to another random point in SPY and analyzed it more closely.

I’ll spare you the boring part—figuring out the time frames that worked, cross-references with data drops, blah blah. The gist of it is when it’s time for SPY to drown, it doesn’t. It gives two large gasps at the surface, finds it’s footing at the price action level about 11 points beneath, then flies out on fire like a glorious, call-carrying Phoenix of a dolphin.

🏊 The Drown Protocol:

1) SPY almost unfailingly sees a drop of 10-12 points after double topping. The second top is between one and 3 trading days after the first.

2) Your signal that the second top is a double top is a rejection candle on 2 hour. If the 2 hour closes above wait for the 4 hour close—they tend to wick under

3) The bottom of the drop always is the same level as the initial support level where the run to the first top began.

4) SPY’s next move will be a run at least three points above the previous top before consolidating.

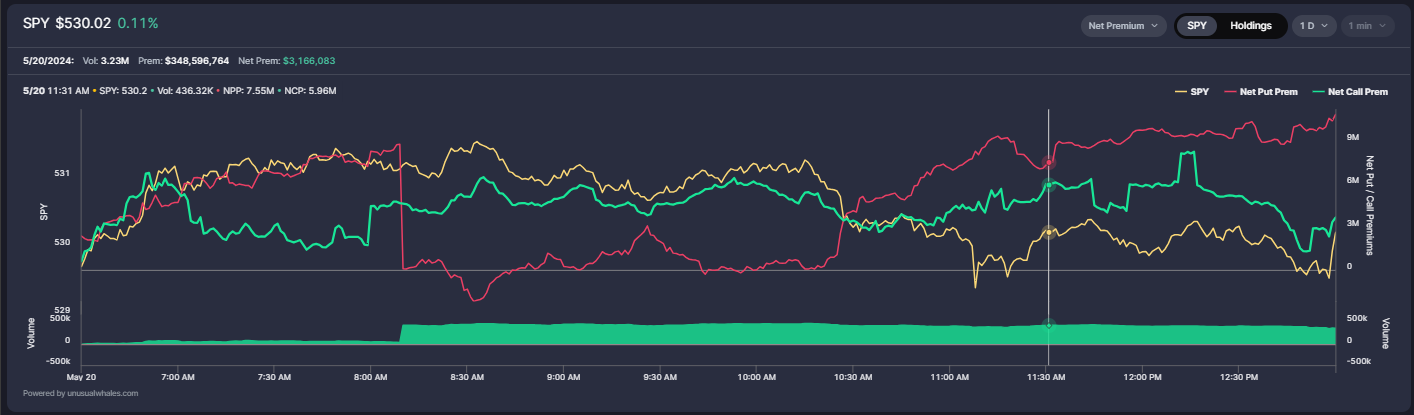

🕵️ Pt. 2: SPY Analysis Update Using The Drown Protocol

If our science is right and our aim is true, today SPY entered the drown protocol. YEET Plus got in a short position based on the research and other Price Action and Flow Signals.

🕵️ SPY Levels Analysis:

If the local top holds true, then we’re looking at a visit of the (red) 524.6 monthly level first—they’ve got to break this (white) weekly level that showed strength EOD. Between all time high and 524.5 we have a strong wick buy level and a gap level.