💸 YEET Friday Morning Briefing

A look at price action and flow into today

🐳 YEET Friday Morning Briefing

Good morning! Nagging illness hit a bit of an emergency yesterday, but we are all good now and back in the saddle thanks to what I’m pretty sure is what rappers call “Lean” my doctor prescribed lol. Here’s a look at what we’ll play today and why👌

📊 Yesterday’s Price Action (SPY)

The 682.11 area did exactly what 682.11 does.

As long as that level refused to break, every dip became fuel, not failure. The early sell pressure was a knee-jerk response to testing highs, and once it failed to follow through, buyers stepped back in aggressively.

📐 Structure Check (Hourly)

The hourly channel is now at a critical decision point going into the open.

Price is pressing against the lower boundary of—and now breaking— the channel, and the next few hours will determine whether this is:

continuation higher, or

a controlled pullback to reset

No middle ground here.

🎯 Key Level Ahead

690 (Monthly Level)

This is the line.

Above 690 with acceptance → momentum accelerates

Rejection at 690 → market stalls and grinds lower

Everything today runs through this level.

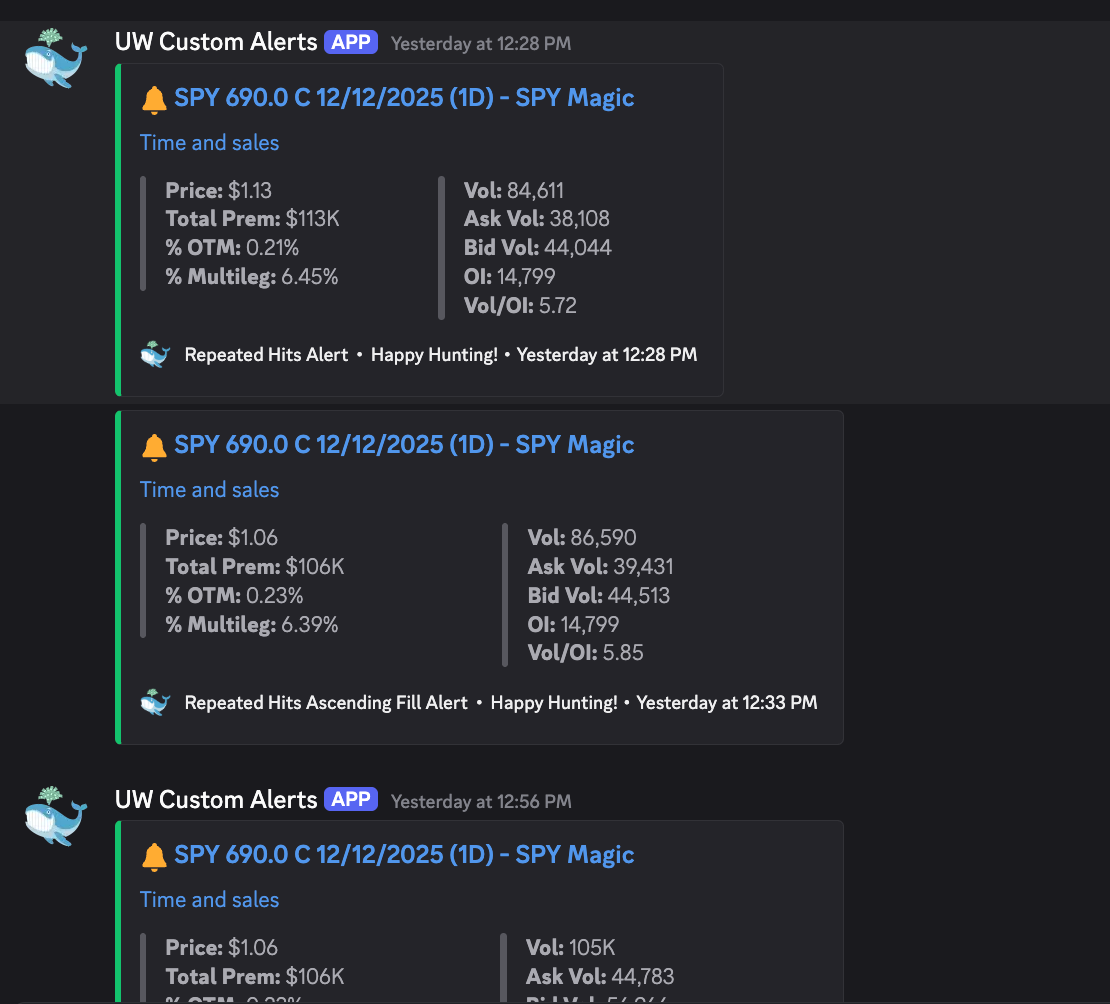

🧲 SPY Magic Recap (Yesterday)

On the way up, we saw mixed puts early as whales tested downside during the initial push. That hedging quickly got trapped as the reversal gained traction.

The tell was clear:

Massive 690c ordering

Concentrated and aggressive

Not hedges, but positioning

That flow is what powered the reversal.

🧠 Today’s Decision Tree

Bullish continuation likely if:

A) SPY holds the channel bottom off the open

B) SPY reclaims 690 with an hourly close

C) SPY Magic shows call flow extending above 690, confirming upside conviction

If those align, odds favor a mega green day.

If one or more fail, expect:

Chop

Failed pushes

A grind back toward 682.11 over the next couple sessions

🚀 YEET’s Play Today

Plan a: SPY 690c – 0DTE — on a close above 689 on the 15 minute

Trigger condition:

Enter only if the 689 is reclaimed with a 15 minute candle.

PLAN B: SPY 686p 0dte on a close beneath 687.39 on the hourly timeframe