🧠 YEET Guide to FOMC 10/29

Updates, SPY Levels, Flow Signature Trade, so forth

🧠 YEET Guide to FOMC

🚨 System Update: Ultra Filter Automation

YEET Plus subscribers are about to get a serious edge — automated Ultra Filter AUTOMATED alerts are now rolling out in Discord.

That means you’ll get real-time, pre-filtered alerts from all the heavy hitters:

🐳 BAT Filter Ultra – contracts bought against trend.

🎯 Freelance Ultra – only high-risk, high-reward 5×+ setups.

🌊 Nautilus (NEW) – our sharpest tool yet, tuned to only catch super actionable flow.

The new system goes live within 24 hours. The infrastructure upgrade costs us, so if you’ve been thinking about Plus, jump in now — Substack grandfather pricing locks your rate forever.

If you want to join the FREE Discord, check out Shoot the YEET channel.

The Garden, Fruits of the Garden, Interesting Flow, and tomorrow the channels for Filter Automatic Alerts are with YEET Plus Subscription

HERE: https://discord.gg/E9HWsKVW

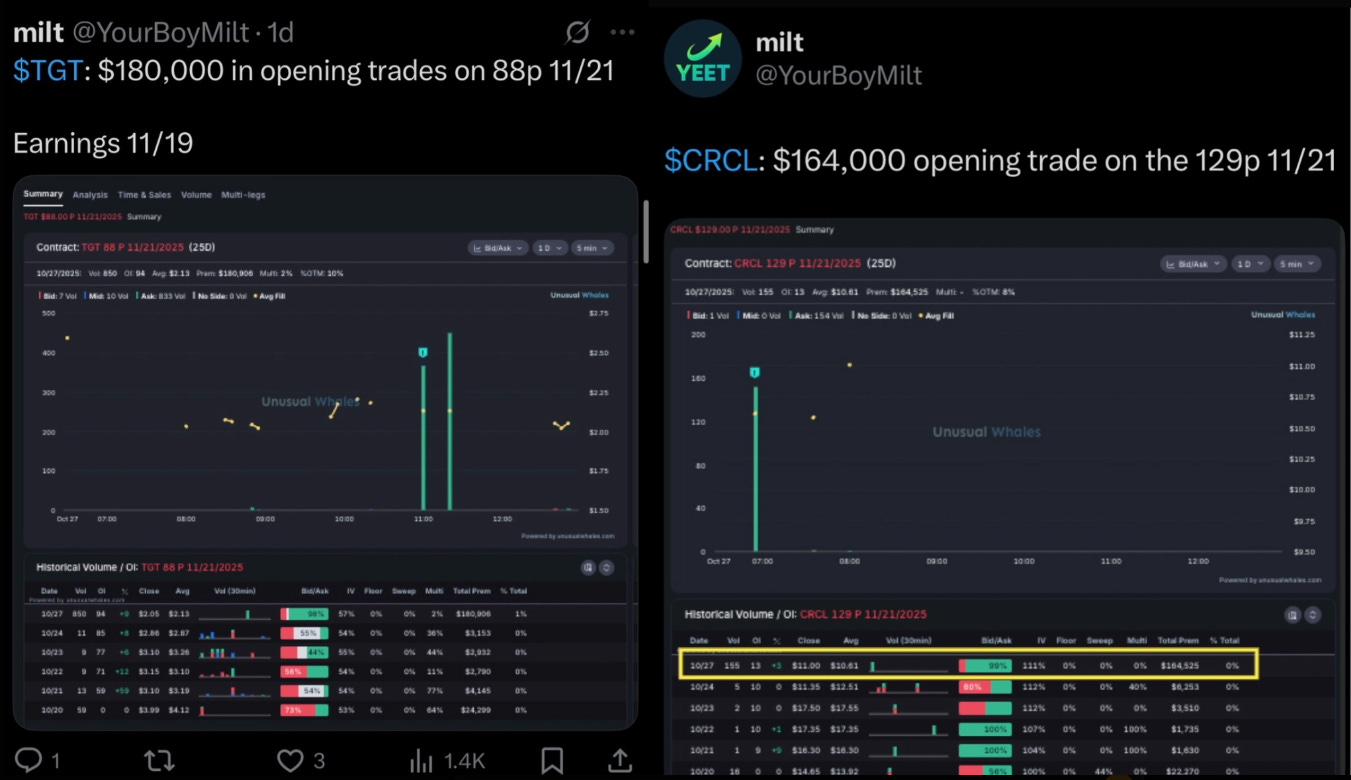

💡 Flow Lesson of the Day: Price-Flow Divergence

When flow and price split, that’s the tell.

Take a look at $TGT, $CRCL, and $WMT — all flagged on BAT Filter Ultra, meaning whales were buying puts against the trend while SPY was still ripping.

TGT: $180K on the 88p 11/21

CRCL: $164K on the 129p 11/21

WMT: Similar pattern — big put flow despite index strength

🐳 These weren’t random hedges. The key is context — price was muted when the orders came in.

If the index is strong and whales fade the move, that’s short positioning, not protection. When they flow with strength, it’s more likely hedging.

Divergence + price stagnation = real intent.

📊 SPY Levels — Oct 29, 2025

(Current ≈ 687.89)

Above Price →

🔴 689.70 | 🔴 687.91 | 🟡 687.39 | 🟡 687.24

Below Price →

🟡 686.03 | 🔵 685.51 | 🔵 685.36 | 🟡 683.26 | 🔵 682.11 | ⚪ 678.51 | 🔵 675.64 | 🔴 673.99

🕳 BIGLY GAP roughly between 683 → 678

🧭 SPY Word of Caution Heading Into FOMC

At best: Neutral.

At worst: a clean series of backtests on lower levels.

Notice how the blue gaps stack below current price — if we wick them up, fine, but the structure’s built for retests.

🚀YEET PLUS: SPY MAGIC INTO FOMC AND SIGNATURE FLOW TRADE

We are 5 for 5 for the last 5 signature trades, and an overall 80%+ in the money rate for target