📺YEET: Saturday Morning Cartoons- How-To's on ✅SPY 225% // FLOW: ✅NVDA 70/100%+ on 2 plays, ✅FUTU Ripper,✅COIN blastoff, ❌CVNA /SPY Postmortem

Jam packed Saturday. Kick back, grab some cereal, and enjoy.

This week started off slow (❌CVNA bags, some mistimed ❌SPY) but ended with a bang as multiple SPY and flow plays came together for YEET Discord and YEET Plus including:

✅SPY 225%

✅CCJ 450% Signature Trade w/ 2 weeks left

✅NVDA 70%

✅NVDA 100%

✅FUTU 85% and counting

✅COIN 70% and counting

Here, entirely for free, are some of my favorite childhood cartoons explaining how this happened for your benefit (I started this in the morning, got busy, hence it’s Saturday MORNING Cartoons, lol).

🧠STRUCTURE BREAKS FRIDAY: A Quick Look at Thursday’s YEET, stating how we would know when to finally play a drop:

🐳 Maximizing Leveraged Price Action Opportunities with Flow*

Leveraged Price Action is unsustainable bullish rips that could topple at any moment—I say unsustained because they leave several GAPs in the index as they rise which could reverse to close at any moment. As a result its not usually safe to buy typical calls, but it’s also too early to get puts.

One of the ways you can protect your port when stocks are rising a bit too risk-on with a potential for downside is knowing what sectors 1) have the ability to move independently of the general market sentiment and 2) looking for intraday accumulative flow rather than large floor orders

1. Finding flow on Independent Moving Stocks

One obvious candidate for a safe-haven of reliable flow during an unsustainable rally is our friends to the East.

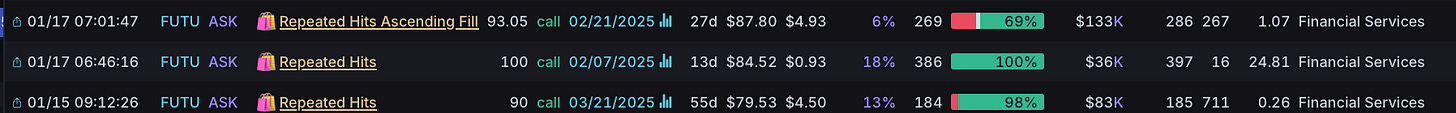

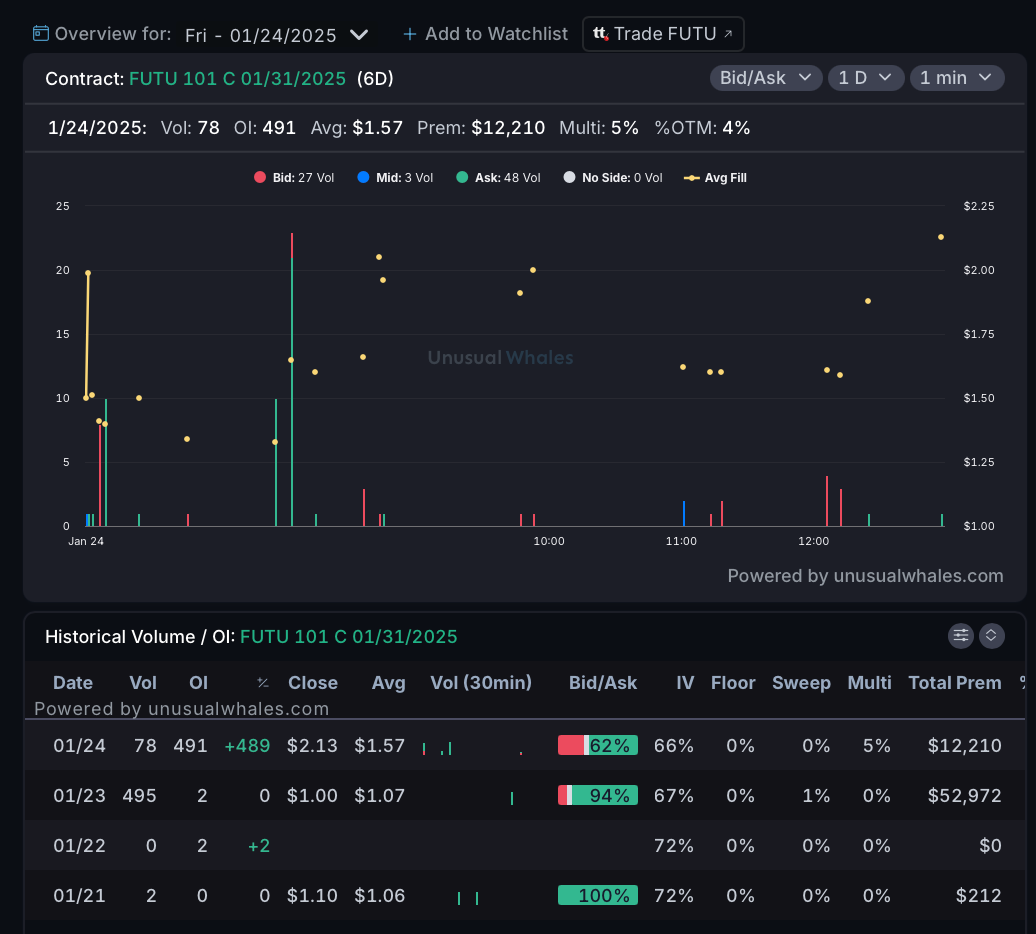

CHINA tends to move independently of the US market when its flow is heating up, so when we saw last week that FUTU calls had been building volume on multiple YEET Plus filters…

It was about waiting for a deep OTM order with a short expiration to confirm a sharp bullish sentiment. Thursday when we saw deep OTM, short-term expiration positions open up on the FUTU 101c 1/31 it not only seemed like FUTU would be a safe bet for bullishness continuing the trend, but it also had the relative independence to withstand a downturn—making it YOLO of the Day.

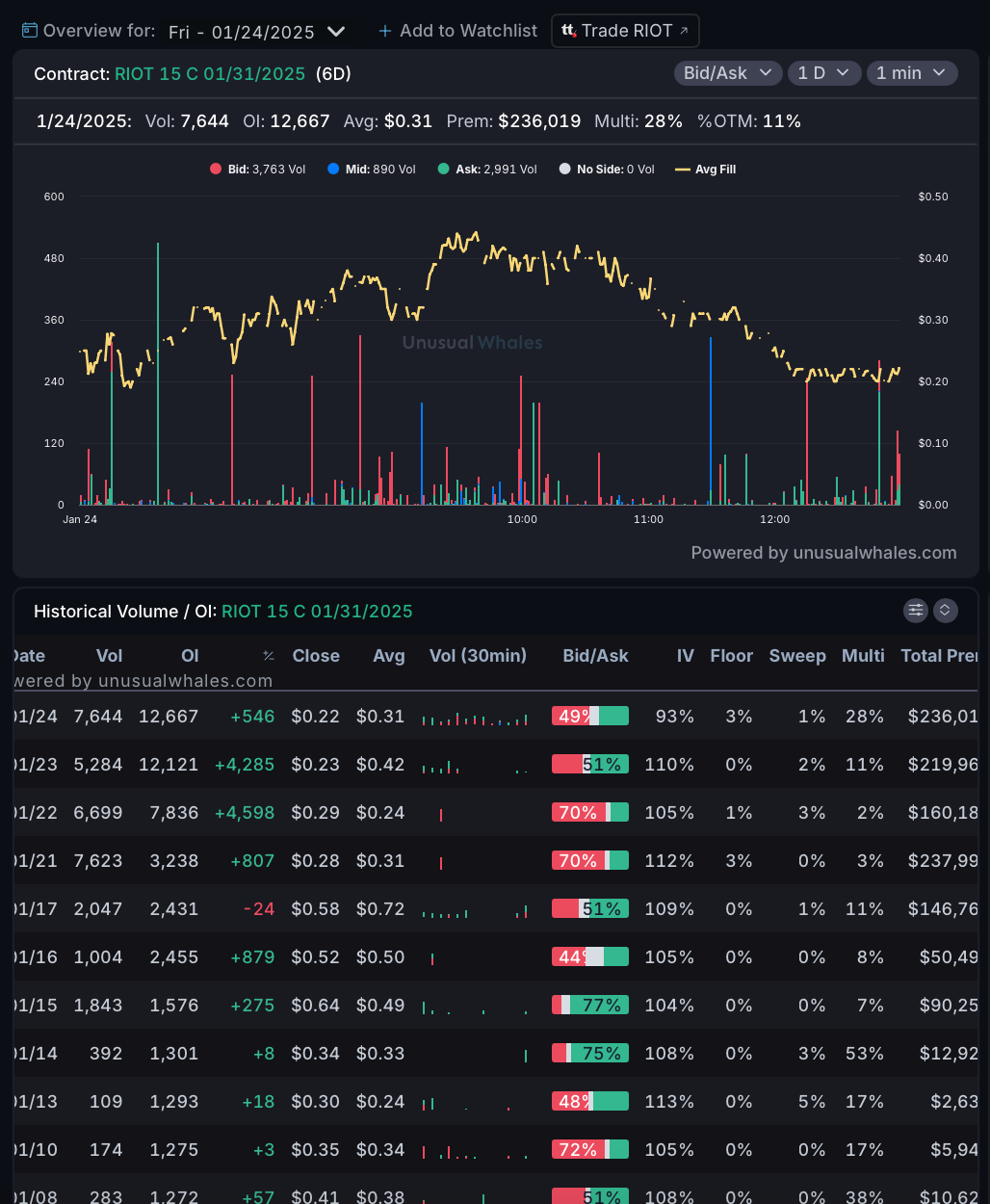

Another independent mover is Crypto, which is why COIN OTM calls were the YOLO of the Day late last week for YEET Plus, and why RIOT has long been a repeat choice including the Port 1 longterm allocations.

In addition to sticking with flow on sectors that tend to respect flow and price action movement independent of the market indices, there’s also—

Excuse her. There’s also…

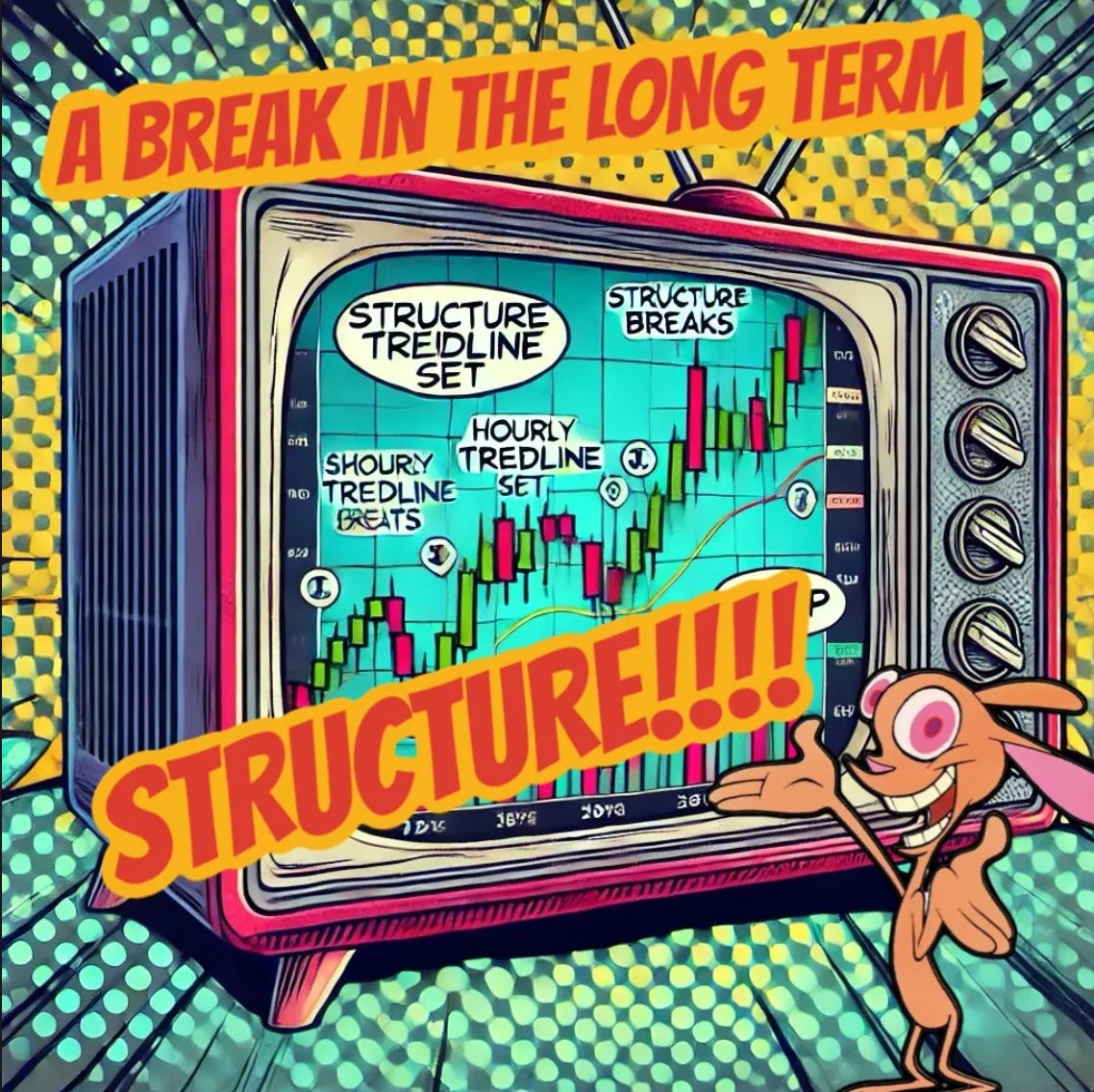

2. Playing the Long-Term Price Action Structure break with Short Term intraday flow

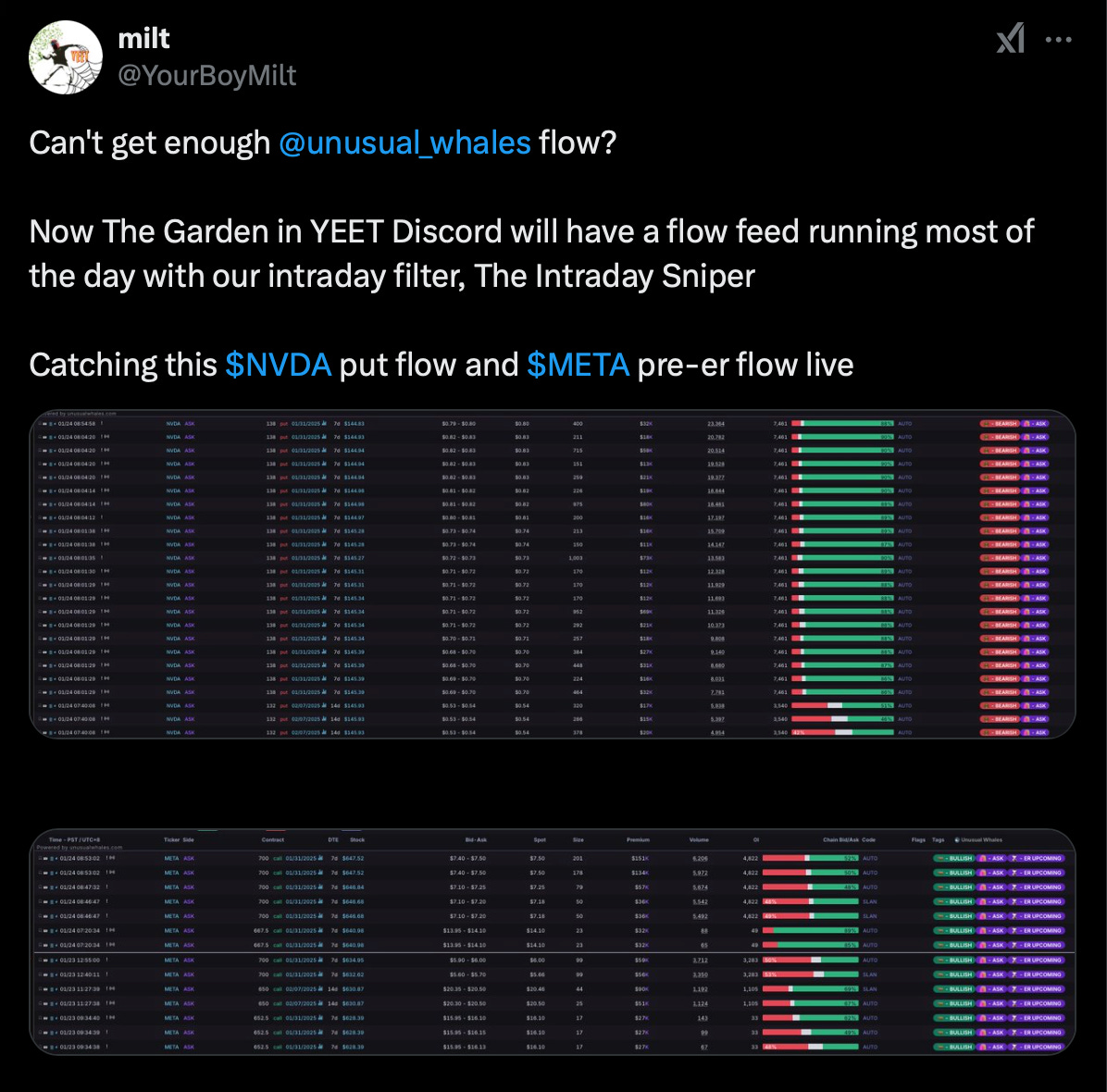

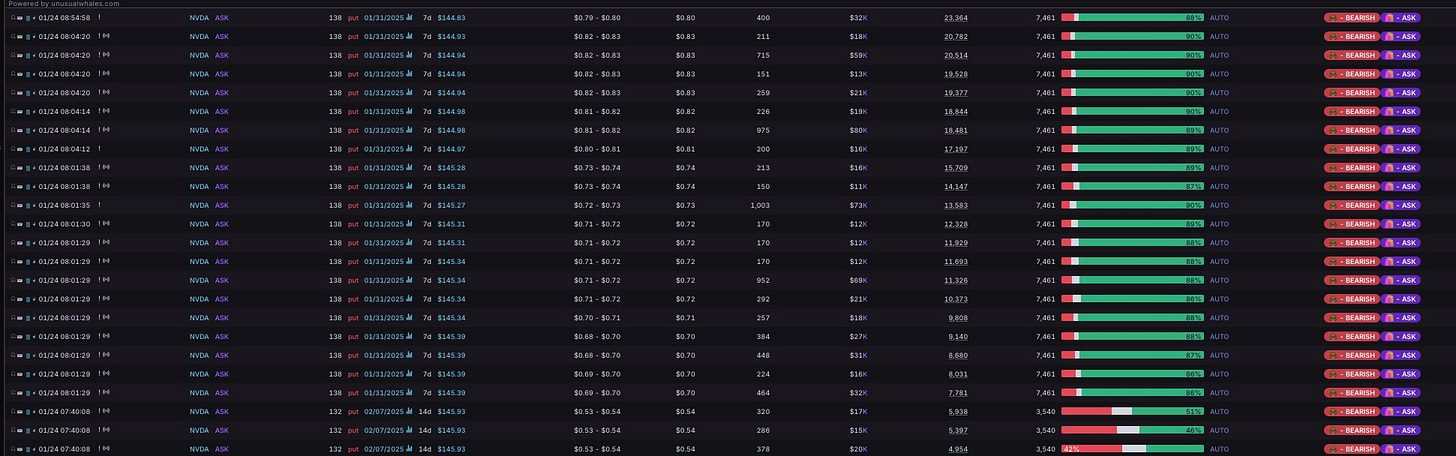

Now in The Garden in the YEET Discord we leave a stream running much of the day that shows Milt’s favorite filter: The Intraday Sniper. The Sniper is powerful because it focuses on small premiums, looking for ACCUMULATION rather than LARGE FLOOR ORDERS. Small accumulations are a better way to snag quick flow movement based on sentiment. This works well to catch quick countertrend bangers when you get confirmation that a rally is sputtering.

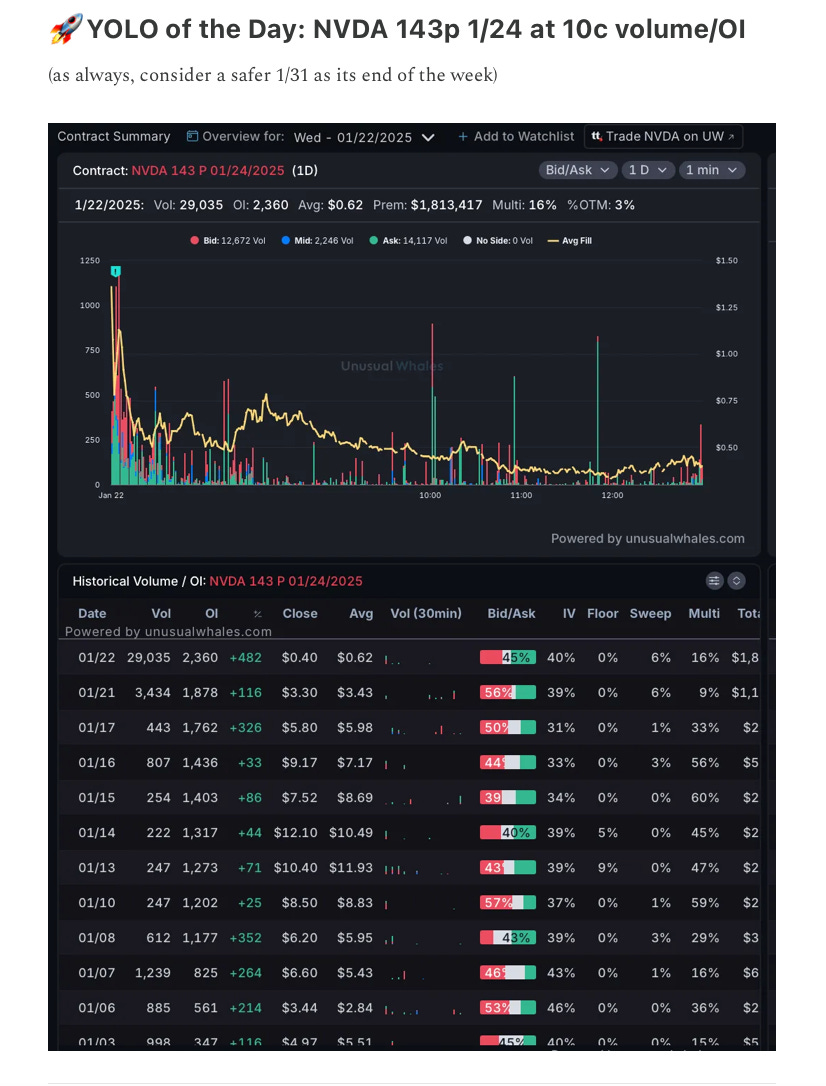

ANYWAY, for example, we posted on Twitter Friday about the NVDA 138p 1/31 that suddenly built an accumulation on the sniper, in ADDITION to making the NVDA 143p 1/24 the YOTD on Tuesday.

The YOLO of the Day Tuesday was because the volume to open interest was astronomical at over 10 volume/OI. Remember—2x volume/OI ratio is the threshold for what is generally considered Unusual Options Activity by technical standards. So each additional X adds a degree of confidence.

The Intraday Sniper catch is something you can easily do yourself doing by the eyeball test on small, counter-trend order buildup on the flow feed—if you see an accumulation of smaller orders that is in contrast with market sentiment and price direction, it’s more likely to not be a hedge. Why? Because you’re seeing a tide shift over time, rather than a large floor order which is likely to be a one-off protective action.

🧠Quick Postmortem Lesson: the importance of awaiting chart confirmation for interesting flow and respecting the invalidation

Ultimately, the difference between the end of the week and the successful flow plays was confirmation of trend breaks and other directional signals.

🚀YEET Plus:

🤔A directional YOLO that’s a bit ironic…

🎰And some EARNINGS spice for next week