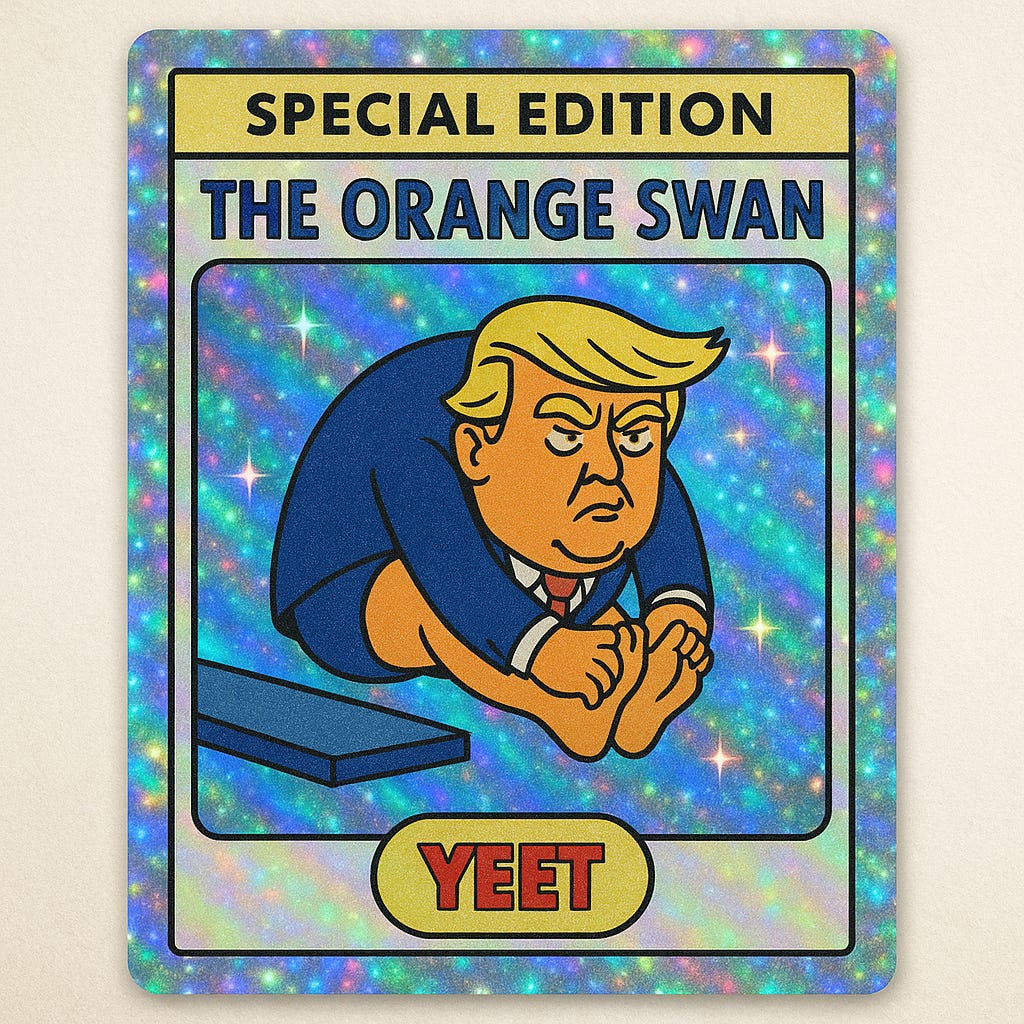

🚨 YEET SPECIAL ORANGE SWAN EMERGENCY BROADCAST

Do you believe the whales yet?

🚨 YEET SPECIAL ORANGE SWAN EMERGENCY BROADCAST

The “Pop = Backtest” Playbook Just Fired Again.

Orange Swan has been calling every dump these past couple weeks, and the reason we run it daily is simple: it tells you if we’re continuing down or finally reversing, so you know when to hold, when to go short, and when to buy the dip. If you want that day-to-day direction — the signals that keep you out of bad longs and get you into the right puts early — that’s exactly what YEET Plus is built for.

😇The Garden Private Discord Room is 7of the last 7 trades, and 11 of the last 13

1️⃣ The Message We’ve Been Repeating: Pops Are to Be Sold

All week, Orange Swan has been telling the same story:

“These pops are not reversals — they’re backtests.”

And day after day, the flow has backed that up:

Every green push this week → Swan stayed heavy

Every bounce → whales added more downside

Every attempt at upside momentum → model refused to soften

We’ve been calling this exact structure out for days:

👉 Whales are clear.

The underlying market structure is still down.

Strength is being used, not chased.

2️⃣ Yesterday’s NVDA Divergence Proved the Point

NVDA blew earnings out. Indexes ripped nearly +2%.

The entire market strutted like a new uptrend had begun.

But Orange Swan? Stayed divergent yesterday, showing sympathy SMH calls while still holding bearish flow

Price shows a face-melting rally — but Swan shows whales are selling that strength, not joining it.

3️⃣ Today: Market Floats, Swan Has a Telling Read

The follow-through today looked innocent:

early strength

algo drift

calm tape

But the model tightened further.

That’s the alarm.

Today’s reading confirms everything we’ve been saying in Orange Swan all week:

**Upside isn’t real.

Downside remains sponsored.

This is still a sell-the-pop environment.**

4️⃣ Why This Matters for the Broader Market

This isn’t a victory lap — it’s a directional read.

When Swan behaves like this:

Up moves fail to attract real buyers

Downside positioning accelerates on strength

Rallies become reset points

Momentum turns snap harder than expected

It’s classic “pop → stall → fade” conditions.

Not a crash forecast —

just a statement that the dominant trend is still down, and these green candles are cleanup, not construction.