⚾️ YLB: YEET LEAGUE BASEBALL

We flip bats. We talk trash. We play loud. And most importantly—we win.

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Brought to you by: Your Boy Milt and His Sensei Abu OmegaTrigga

HALO—our last theme—is now retired after a blistering, record-setting run in what we can call…YEET 3.0. Our theme over the next month or so is shifting to THE WORLD OR SPORT—starting this week with YLB: YEET League Baseball.

Yeah, I hear ya, timing-wise NBA made more sense with the finals, but the Price Action of the week dictates an MLB analogy. We take the mound against Jerome Powell and The FED in a Wednesday showdown for the ages with FOMC/the presser—AND CPI—all on Wednesday, June 12th.

It’s all been leading to this; the YOLOs, the GUHs, the multi-baggers. The sweat in your palms from the entering of the order, mixing into the dirt on your jersey from trades passed. One throw on the mound. One chance to take these suits yard and send it soaring on Wednesday. In the quiet of the 9th inning when it’s to make the account blow up or the Lambo pull up…do we have what it takes to get the job done?

The Lineup:

Manager’s Card: ABU Explains the Market

Showtime: Milthani teaches You How to At-Bat SPY this week

Our Friends MacroEdge Stop by for The Market Report

Flamethrower: The Flow Section

So, you want to hear that hallowed and hollow pop of the bat followed by the soothing whistle of a squeeze candle ?

You’re in the right place, but you should know that it doesn’t happen that easily. First, take a listen to our Manager, ABU, who is going to set you straight on ES Outlook for the week.

⚾︎ MANAGER’S CARD: ABU BREAKS DOWN THE WEEK’S ES OUTLOOK

As we continue the teach you Price Action Fundamentals and how that applies to both indices and flow, it’s important to know who’s pitching against you, and what kind of hitting you need to utilise for maximum effect.

This week, we need to be prepared for a nasty curveball that breaks at the last minute on Wednesday. It’s CPI AND FOMC, and two things can happen leading into it:

1) They throw THE SINKER: flat into the big day then a nasty break in either direction that tests monthly levels

⚾️The Sinker: we trade flat into Wednesday and then the Price Action breaks directionally on the catalyst morning. The danger with that headed into the week is if you play the Price Action normally, going for big swings will lead to big misses because you ‘lol likely get chopped out and lose contract value to Theta. With such a monumental news day ahead, it’s logical to expect a lack of big movement

How do we respond?

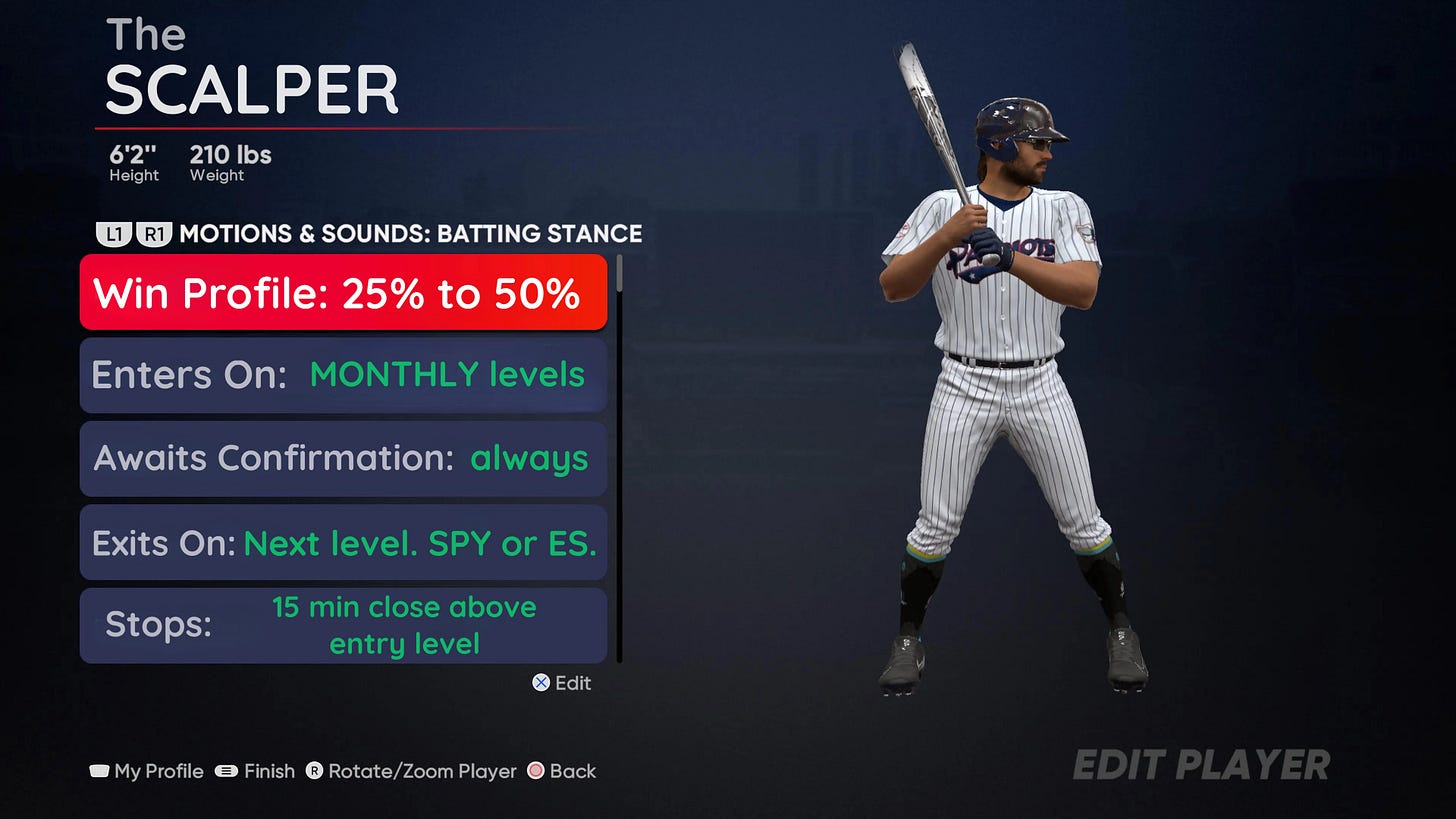

🏟️The SCALPER: We respond to this potentiality by following the basics of Price Action Principles with a conservative (yes, we do have that mode) approach.

Entries: Instead of taking entries on weekly levels, or using recall*, we are going to focus on MONTHLY entry at CONFIRMED levels ONLY—it means fewer plays, but playing the game the right way. Monday and Tuesday may be as boring as…well…baseball itself.

Exits: The next weekly—whether that be ES or SPY—is all we’re guaranteed. No holding out for monthlies. Typically I’ll use recall, patterns, or algorithmic circuits and logical closing loops to when I hit the big dingers. This week we’re only taking what we’re given, though.

Expiry: Anything after 9 am PST is a minimum 1DTE, and likely more. Trust me—Theta can get nasty.

🎯The Screwball: A Fastball Sailing Up on Monday and Tuesday that we swing hard at on Wednesday

The more I look at this action the ES chart, the more I can see a potential flush coming—I think they’ll pitch a srewball up to retest the top one more time—at 535 or 537—then drop it for the Almighty Backtesting. A confirmation of that would be the triple top rejection pattern was saw from “The Drown Protocol”.

Another way to view how this scenario is playing out is provided by our 7th inning stretch entertainment… The Channel of Destiny’s Child.

Refresher: we had an hourly SPY channel in March that was called the Channel of Destiny because it was so reliable—I later found a new channel that was an offshoot of that channel on a shorter timeframe—hence the name…The Channel of Destiny’s Child.)

THESIS SYNOPSIS ON THE MILTHANI VS POWELL SHOWDOWN

Stick with playing the Sinker if you’re risk-averse; going for Screwball (patience then a big put swing) this is more of a personal showdown we have based on my thesis and what they pitch. I’m kind of pumped, this feels like a legitimate pitchers duel.

If they throw me that high fastball to 535 or 537 and give me a rejection wick—I’m taking his ass yard with puts. I’ll know what contracts as we get closer, but IF I get my signals: 1DTE SPX puts on the close the day before CPI, and some deep OTM puts expiring next week.

🎙️ANNOUNCER BOOTH: Our Friends at MacroEdge Present The Labor Market Report

Good evening YEET community & friends,

Yesterday brought our monthly labor market report covering the labor data for May in the United States - covering a variety of public and private sector data sources to break down the entirety of the labor market picture and see what may lie ahead for the labor market through the summer and then into the second half of the year. As we’ve continued to state - May confirmed our analysis from months prior about a cooling labor market. Job growth has slowed broadly, unemployment is up nationally and in over 40 states, and job cuts as measured by the MacroEdge Job Cuts Tracker, our flagship labor market indicator, continues to point towards more coolness ahead.

Todat in the next Ozone weekly report - we’ll be laying out the new timeline for MacroEdge One - our global research and data line covering Canada, Europe, and Oceania - from a new MacroEdge contributor who will bring fresh perspectives to our broad array of perspectives and expertise. We’ll also have links to our new MacroEdge TV platforms - on Youtube, Spotify, and more - with our plans to launch broader content and coverage of data and stories at home and abroad. The tenth edition of MacroEdge Radio - covering the current state of CRE - will be available on YouTube tomorrow. We look forward to rolling out new services as we enact the plans laid out in our ‘2025 Vision’ earlier in the year and will have constant updates on new features in the months to come. Access Ozone for two weeks and experience the entire MacroEdge breadth of research and data:

We’re seeing some pockets of weakness appear in the Sunbelt states like Texas and Florida - and large layoffs have begun impacting Texas (such as Zachry Industrial laying off over 4,000 construction workers just last week). We will continue to ignore the fallacies seen in both media outlets and on social media platforms of (in or out thinking) where expecting continuing coolness in the labor markets equals building bomb shelters and hiding out on remote islands for some ‘apocalypse’. We’ll leave that to the billionaires. We will however continue to cover the data with an emphasis on accuracy through our driven-by-data approach, which allows us to be agnostic towards sides, and solely focused on the data.

The comparisons to 1995 (the ‘modern’ soft landing) are now lacking based on all of the data we have now, and the fact that the 1995 tightening period came during a period outside of maximum employment. It was still a period of labor market recovery following the 1991-92 recession. The next step in our process of analysis is seeing what the Fed’s response to the latest data is in the next meeting coming up. If they maintain a stance that the ‘labor market is falling into better balance’ but job growth remains strong, it’s likely they hold and continue weakening the labor market under currently restrictive policy.

Let’s dive into the data.

Breaking down the data in this MacroEdge Labor Market Report for the month of May:

Headline Unemployment Rate (U3)

MacroEdge Job Cuts Tracker

JOLTS / Indeed Job Openings Data

Initial Claims

Continuing Claims

Multiple Job Holders

Household Employment Total Employees

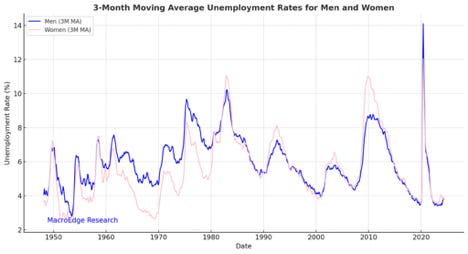

Unemployment by Gender

Total Unemployed Americans

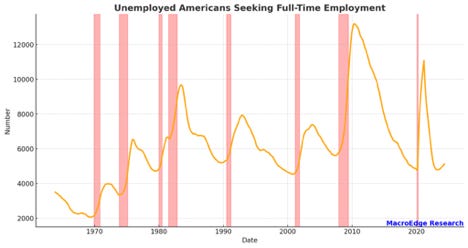

Unemployed Americans Seeking Full-Time Employment

Conclusions and Expectations

Headline Unemployment Rate (U3) and MacroEdge Unemployment Index

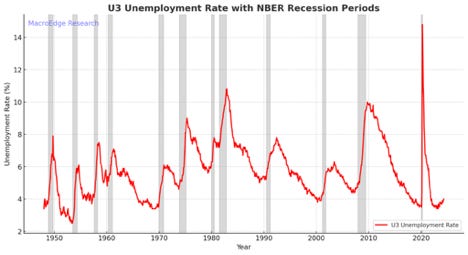

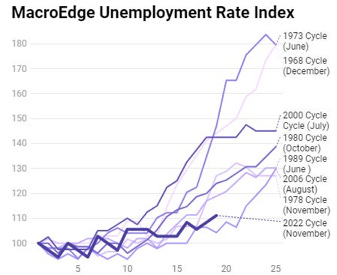

The U3 (headline) unemployment rate increased to 4%, as we anticipated, and we expect the risk remains to the upside for the second half of the year. The pathway currently being taken is most similarly echoing the cycles of 1980 and 2007:

MacroEdge Job Cuts Tracker

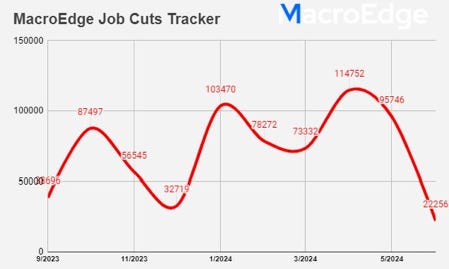

The MacroEdge Job Cuts Tracker shows June tracking similarly to May, in terms of job cuts. We expect the largest risks to job cuts to arrive in the Fall and Winter again, based on seasonality and past cycle analysis.

JOLTS/Indeed Job Openings Data

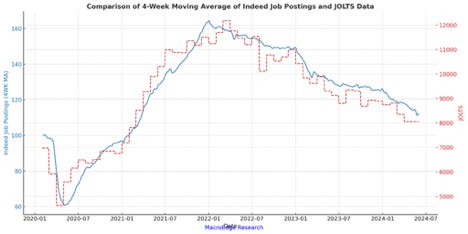

Job openings fell sharply in May and job postings stand just 12% higher than Feb-2020 levels. Notably with 20-30 million more people in the United States, this signals a labor market tighter now on the job openings side than it was at the beginning of 2020 before the pandemic.

Job postings will be below the Feb 2020 level Q3 or Q4 at the current pace which means JOLTS will follow.

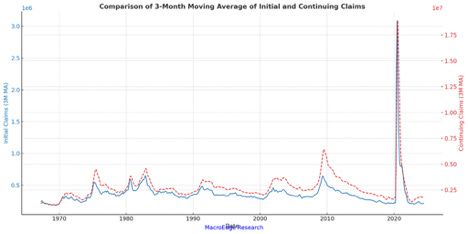

Initial Claims and Continuing Claims

Initial and continuing claims remain quite low relative to history and larger increases here will likely be seen after the Fed cuts rates. Continuing claims stand around 1.8mm and Initial Claims at 229,000/wk. We view Initial Claims as flawed viewed by itself due to the nature of the gig economy and insignificance of unemployment payments in most US states (way below poverty line).

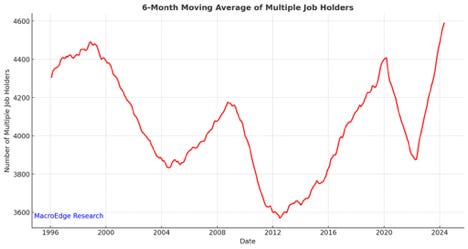

Multiple Job Holders

Full-time employees with a second part-time job usually peaks at/around the start of weaker labor markets. Currently, this figure hasn’t peaked using a 6mma smoothing, but has likely peaked for the cycle based on hiring data.

Household Employment - Total Employees

While the headline BLS survey continues to be the only outlier in the NBER 6 - with wild birth death adjustments - the Household Survey points to a sharp decrease in full-time employees. The economy has shed over 800,000 full-time jobs since the peak in November:

Unemployment by Gender

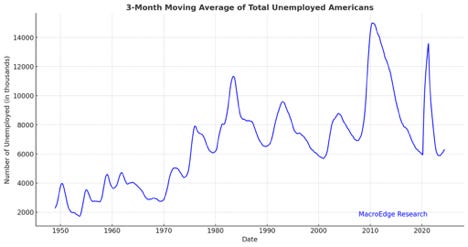

Total Unemployed Americans

Increased in May and is nearing 7 million:

Unemployed Americans Seeking Full-Time Employment:

A new cycle high of nearly 5.5 million Americans. This visual has a 12-month moving average smoothing applied to eliminate noise and highlight the cyclical nature of business cycles:

Conclusions and Expectations

In quick summary, the labor market continued to weaken in May and we anticipate broader weakness through the early summer.

We’ll be watching all of the signals as this continues to progress through June so stay tuned for more.

Have a great rest of the weekend,

- Don

☄️FLAMETHROWER: The FLOW Section (a flow/chart combo Milt likes. A lot.)

Focusing on quality and thesis this week—and the YOLOs will only be of the most tantalising variety. IT IS CPI/FOMC week—the first of its kind I think since I’ve been trading where it’s doubled up like that—and for the most part flow is just gambling unless you have a Price Action thesis that they match.