🌕 YOLO: Cat's Cradle / NightCrawlErS Preview

We have the tools. We have the training. We're built for this.

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Brought to you by: Your Boy Milt and His Sensei Abu OmegaTrigga

This week is the theme of YOLO: Trading Evolved. On Sundays we transition to a new theme for the week, with Expansion Packs and callouts in YEET Plus throughout the week based on that Price Action. YOLO-themed trades are currently 6-1

If you have been following along but are not understanding some of the stuff from previous issues or this one, or have other questions, I’ll be around the discord again starting tomorrow and can be good at answering questions in the main chat. Or just Twitter DM me if you’re YEET Plus on the Plus account and I’ll try my best to get to it same day.

When the Price Action tightens, and the expanse that once was freedom to profit from base to base unfettered vanishes, you’ve entered The Gauntlet. Welcome to…

When last we YEETed we focused on the basic concepts of Monthly and Weekly support and resistance, confirmation, and retests. In Price Action terms, we were in the position to fly using those simple concepts given the map we are currently on; recent all-time highs are a gold mine for Price Action trading. Allow me to explain…

At all time highs monthly and weekly levels have yet to be set, so there are few skirmishes to be had at levels—because there haven’t yet been any skirmishes at all. There hasn’t been time up here. Hardly any monthly closes have been had, so there are hardly any monthly levels. Hardly any weeks have closed–so there’s no weekly levels represented by a week’s highs and lows. There simply isn’t data as represented by buyers and sellers haggling over price. As a result? Candles rocket above or drop below, virtually uncontested by Price Action impediments, aka levels…for a time.

Put another way, space between monthly levels means open space without WEEKLY levels placed in between to impede your forward or backward progress, allowing you to accomplish our simple goal of getting the trade from one monthly to the next. A breakout to all-time highs is The Big Bang…the beginning of a new, open Price Action universe without levels dotting the expanse like aging stars.

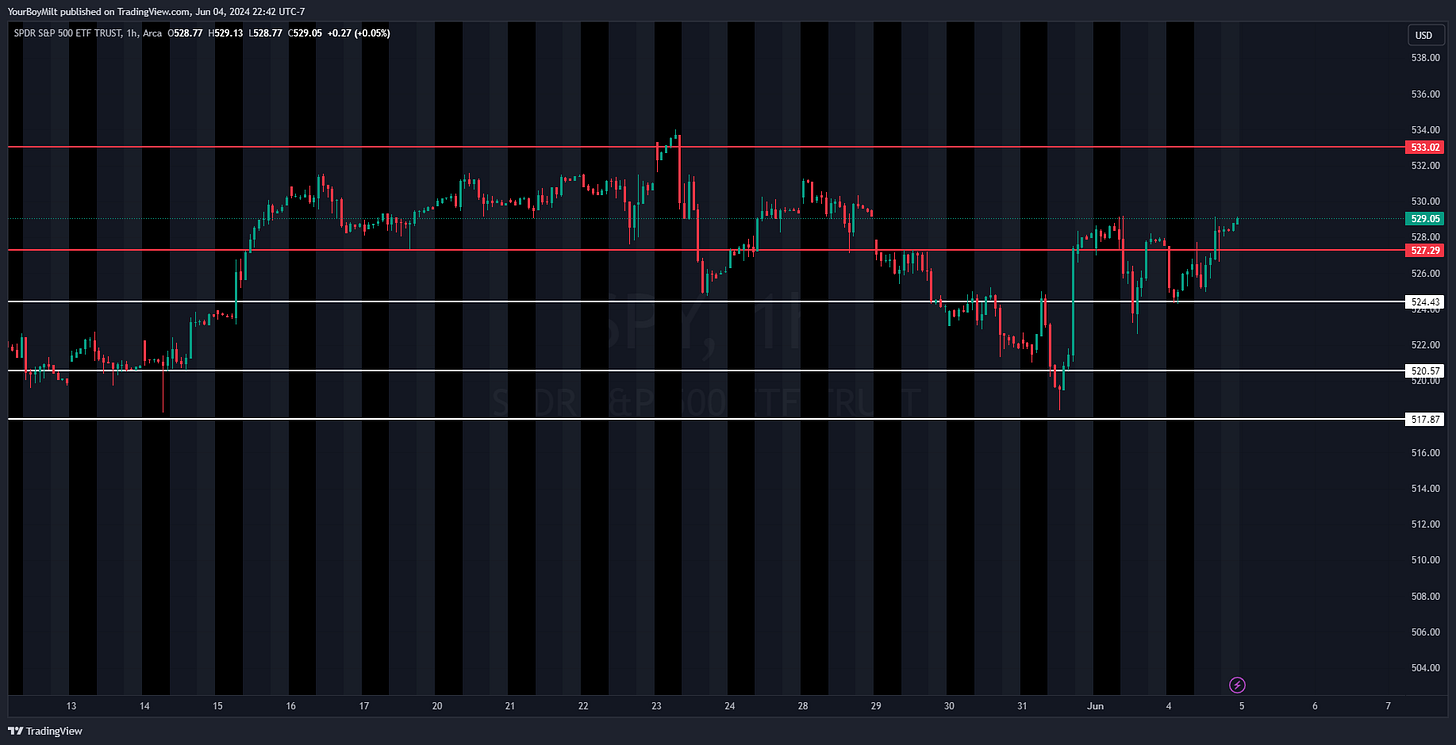

For example, a few months ago the support and resistance levels for the SPY galaxy above 515 looked something like this:

Then a couple months ago it looked something like this:

A month ago this:

And now this:

It’s getting TOIT.

When you’re initially rocketing from monthly to monthly with little resistance it can be easy to forget, like today, that eventually that coil tightens somehow; after all, new levels are set by new monthly and weekly highs and lows. If Price Action respects the existing weekly and monthly as religiously as we say, how do new levels get set on the SPY?

Suddenly, the expanse that was once a few weekly levels of resistance starts to get dotted with unseen levels that will knock you about even if you’re playing the Price Action correctly.

Take for example our play from today:

SPY 525p with a target at the monthly level of 524.72.

We were about .2 away from target, at about 50% profit, when suddenly the music stopped.

What is this? Did we not play it perfectly? Were the candles not in our favor? Is Price Action Method a sham? Is the YEET Prophet but a conman? Was it 19 wins, one loss, and one LIE??!

Settle down, sport. Two complicating factors hit today, one of which is going to explain to you how Price Action Charts goes from an empty Big Bang to a Weekly-Way Galaxy full of levels:

Look at this collection of weeklies and monthlies bunched up and how we slither above and below. The math on those get tricky, and sometimes it’s hard to parse through what’s the original test vs the retest vs the retest of the retest. Trying to eyeball what is the entry and what is the retest is probably hard as hell if you’re newer, or even experienced. But we actually got that right.

I summoned The NightCrawlErS a half measure when only a who will do.

You’re far enough along now in our journey for me to tell you about the myth of the NightCrawlers who lurk, trading the Futures. They play a chart called “ES”, which is directly correlated with SPY because ES and SPY are, for your purposes, the same instrument expressed in different numbers. ES is SPY futures traded all through the day, and all through the night.

Because ES trades during those extended hours, it will sometimes set levels that are nonexistent on your SPY chart; those levels will then often become the new SPY weekly levels and SPY monthly levels. They look like phantom bounces or rejections on your SPY chart, but if you’re watching ES they make sense. If you use a conversion tool, prices on ES directly correlate with SPY, and the monthly and weekly levels on SPY are most of the same as the Monthly and Weekly levels on ES.

So this morning in our trade, the Price Action on these candles told me (correctly) we were heading down based on a) the types of candles and b) I followed the rejection off the yellow line here on SPY, which is actually a weekly level on ES converted to its correlated level on SPY.

But if you are going to use ES as an entry point, you damn sure better use it as your exit point. The types of candles and the momentum said to me “they’re going to test the SPY monthly”. When the candle body went below the ES weekly level, i thought “they’re for sure going to test the SPY monthly level.”

Then they didn’t. Because the NightCrawlErS and their levels are powerful and trickery, and they don’t care what a candle looks like, or what the momentum says, or if the body goes beneath the level and fakes you out .2 away from the SPY target. They mock SPY, and they only care about what is promised based on their levels.

And that level was about 525 on SPY when using the ES weekly conversion. If you respect and use the ES entry level, you have to respect and use the ES target level. We will show you how.

YEET PLUS BONUSES: ES / SPY Interplay Video and Worksheet Tomorrow

Tomorrow morning YEET Plus will be receiving an Expansion Pack video, The NightCrawlErs, focusing on simple ways to incorporate ES levels and overnight action into your day trading. You will also get a worksheet on the concepts.

If you are truly interested in futures trading, check out our friend:

EE’s /ES —he’s taught me the vast majority of what I know about how SPY and ES intermix, and he’s a good dude. No promo or pay—he’s just one of the very few people I feel is doing things the right way.

💣 EXPLOSIVES: The Flow Section💣

Remember, the thing with Flow Plays is that once you have a clear sense of direction on Price Action between the monthlies these are your grenades—you’re looking for OTM contracts that are in your direction that meet our main flow criteria. Then you lob that thang.

We’re headed North. Let’s toss.