🧨YOLO SAGA: 600% NVDA Flow Play and 125% SPY Play Win the Trend Day

The Penultimate Issue in the YOLO Saga, with our friends from Pip Boy Explosives.

Hey! I’m @yourboymilt, and welcome to the Daily Newsletter! I should probably let you know...This is not financial advice!

Brought to you by: Your Boy Milt and His Sensei Abu OmegaTrigga

This week is the theme of YOLO: Trading Evolved. On Sundays we transition to a new theme for the week, with Expansion Packs and callouts in YEET Plus throughout the week based on that Price Action. YOLO-themed trades are currently 7-2

If you have been following along but are not understanding some of the stuff from previous issues or this one, or have other questions, I’ll be around the discord again tomorrow and can be good at answering questions in the main chat. Or just Twitter DM me if you’re YEET Plus on the Plus account and I’ll try my best to get to it same day.

When we last left off yesterday, we’d taken a rare Total Defeat and analyzed our miss. Our work paid off…

Today was fairly simple, we followed the principles of the trend day to affect (minus a 23% scrape late in the day trying to countertrend).

Here is the tutorial explaining how we played today for the big win:

Because we were correct about the market direction, our NVDA YOLO soared (with apologies for GRPN).

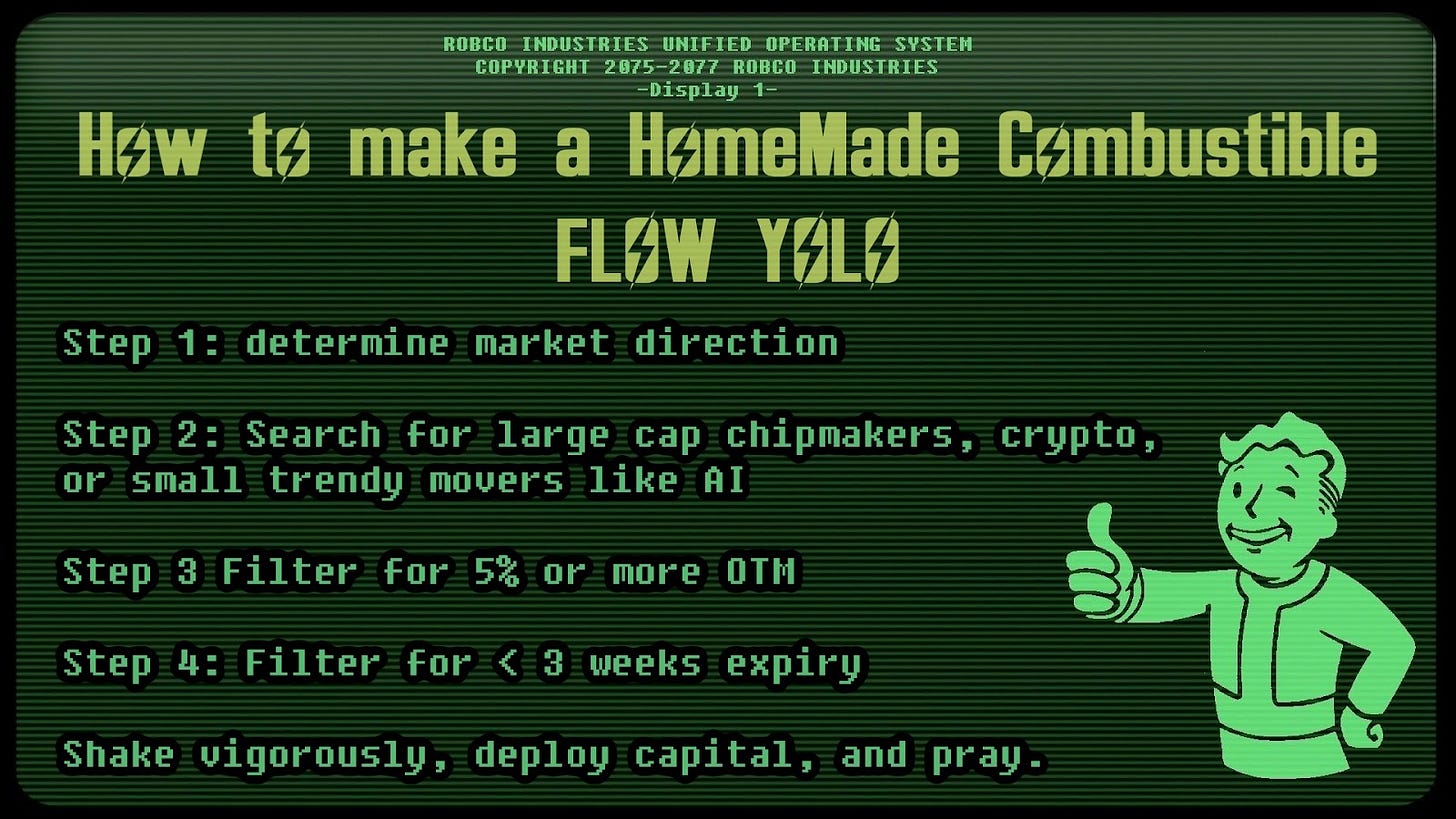

🧨 PIP BOY TNT CAMEO: 600% NVDA Flow Play Tip 🧨

Our friends from Pip Boy stopped by, and are going to show you how to make a homemade YOLO combustible on the fly, using particles we discussed yesterday in The YEET Plus section. These are the bare bones basics—when I do a YEET dedicated entirely to filters this weekend I’ll go into more depth.

There really isn’t that much more to it; once you have a stable of tickers you like for directionality, it’s a matter of just filtering them for deep OTM, close expirations. That’s because it shows urgency, a key factor in finding flow.

The other portion of this is the Degen’s Glass Technique—which explains the half bid/half-ask contract nature. I still need more data to present in a way that gives you the confidence you need, but it’ll be soon and it’ll be free—likely video format this Sunday edition.

But more than half the battle is knowing the direction of the market in the short-to-mid-term, which you can gather from the monthly levels. This is why Pip Boy always says:

IF YOU DON’T TAKE THE TIME TO LEARN PRICE ACTION YOU’RE F*CKED!

AND THAT’S A PIP PROMISE!

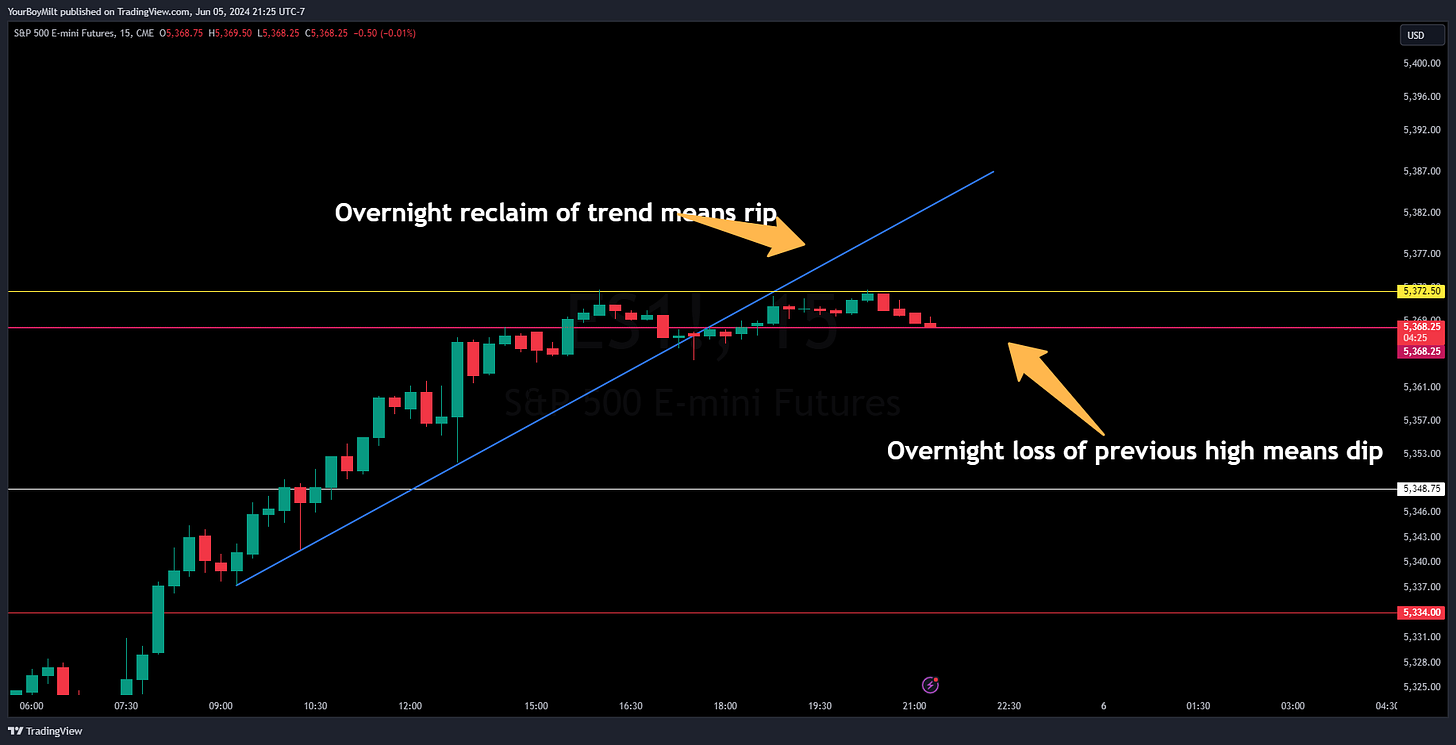

🌑How we are going to use ES to Play Tomorrow

We’re in a prime position with ES giving us the tip off—it’s just a matter of holding support, breaking trend, or neither. The play will reveal itself in the morning hours.